Think about: you’re the proprietor of a small however fast-growing enterprise. You might have simply launched a brand new product, and clients from all around the world have began shopping for it actively. However there’s an issue: a few of your clients need to pay with cryptocurrency.

You’ve heard of Bitcoin, Ethereum, and different digital property, however you’ve by no means skilled utilizing them earlier than. How do you settle for the fee? The place do you retailer these funds? And, most significantly, how do you do it safely and conveniently for your online business?

That is the place crypto wallets supply rescue. However how to decide on the appropriate pockets sort? In spite of everything, there are two fundamental varieties: custodial and non-custodial crypto wallets. Considered one of them is extra appropriate for newbies, and the opposite – for many who recognize full management over their property.

On this article, we’ll break down what a cryptocurrency pockets is and the way it works so you possibly can simply settle for, ship, and retailer cryptocurrency. We will even assist you perceive the most effective pockets to select from, whether or not it’s for private use or for enterprise.

By the tip of this text, you’ll have a transparent understanding of which choice is best for you and can have the ability to confidently combine cryptocurrency into your online business processes.

What’s a Non-Custodial Pockets?

Think about that you don’t hold your financial savings in a financial institution, however in your individual protected deposit field, to which solely you have got the personal key. Nobody however you possibly can entry your cash. That is precisely how a non-custodial pockets works. It’s a digital software that provides you full management over your crypto property.

How does it work?

A non-custodial crypto pockets doesn’t save your cash on exterior servers. Somewhat, it provides you a personal key and particular codes that allow you to management your property on the blockchain. You select the place to maintain these personal keys, find out how to use them, and when to make use of them.

Advantages of Non-Custodial Wallets

- Full management: You’re the sole proprietor of your funds. Nobody can block your pockets or limit entry to it.

- Elevated safety: Since your keys usually are not saved on third-party servers, the chance of hacking is drastically decreased.

- Anonymity: Your information and transactions stay personal as you don’t share them with third events.

Drawbacks of Custodial Wallets

- Safety legal responsibility: When you lose your personal key or seed phrase (restoration phrase), entry to your funds will likely be misplaced without end.

- Problem for newbies: Managing keys and transactions might be difficult for these new to crypto.

Examples of non-custodial wallets

- MetaMask: A preferred pockets for working with Ethereum and Ethereum-based tokens.

- Belief Pockets: Common cellular pockets with assist for a number of cryptocurrencies.

- Ledger Nano S/X: {Hardware} wallets that present most safety by storing keys offline.

What’s a Custodial Pockets?

You go on a visit and resolve to not carry all of your money with you, however go away it within the lodge protected. The important thing to the protected is held by the workers and also you belief them to maintain your cash protected. A custodian pockets works roughly the identical means.

It is a sort of pockets the place a 3rd get together, similar to a crypto service or Alternate, shops your personal keys and manages your funds in your behalf.

How Does It Work?

In a custodial pockets, you don’t have direct entry to your personal key. Somewhat, the service supplier retains them protected and takes care of all of the technical points of managing your crypto property.

You entry your funds via a handy interface, similar to an app or web site, and the supplier handles all the things else. Use a custodial pockets for those who favor comfort and belief a 3rd get together.

Advantages of Custodial Wallets

- Ease of Use: Excellent for newbies who need a easy and simple strategy to handle their crypto.

- Restoration Choices: When you neglect your password, the supplier will assist you get well entry to your account.

- Extra Options: Many custodial wallets additionally supply built-in providers similar to buying and selling, betting, and lending, making them a one-use answer for crypto customers.

Drawbacks of Custodial Wallets

- Safety Dangers: Because the supplier holds your personal key, your funds are susceptible to hacks or mismanagement.

- Lack of Management: You depend on the supplier’s coverage, which can embody freezing your accounts or limiting withdrawals.

Examples of Custodial Wallets:

- Coinbase: A preferred custodial pockets supplier with a usable interface.

- Binance: Identified for its wide selection of providers, amongst them a custodial pockets for buying and selling and storing crypto.

- Kraken: One other trusted platform that gives custodial pockets providers together with superior commerce options.

What’s The Distinction Between Custodial And Non-Custodial Wallets?

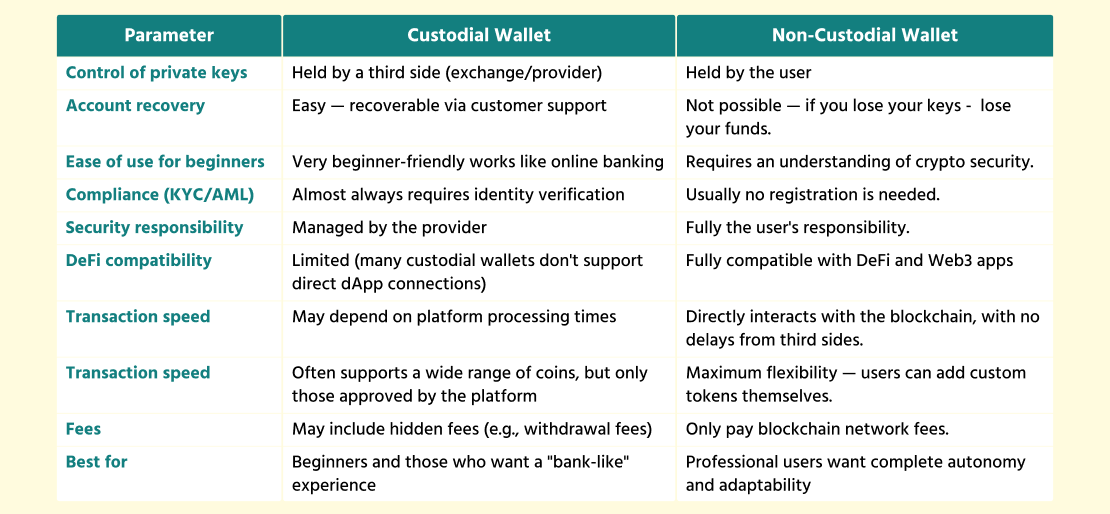

That will help you higher perceive the distinction between non-custodial and custodial wallets, we’ve ready a transparent comparability desk.

This side-by-side overview highlights who controls your funds, how safe every choice is, how straightforward they’re to make use of, and which sort of pockets is likely to be the most effective match relying in your wants — irrespective of for those who’re searching for the most effective pockets for private use or a pockets for enterprise.

Here’s a detailed comparability of key options and capabilities:

Custodial vs Non-Custodial Pockets

Cryptocurrency Pockets Improvement Companies

If you wish to create your individual cryptocurrency pockets, growth providers will help you make this concept a actuality. Whether or not you want a easy custodial crypto pockets for comfort or a non-custodial pockets for full management over your property, skilled builders will supply an answer to fit your wants.

What’s normally included in such wallets?

- Help for common cryptocurrencies similar to Bitcoin, Ethereum, and ERC-20 tokens.

- Integration with blockchain networks and DeFi platforms for superior options.

- Strong safety: two-factor authentication (2FA), encryption, and different safety measures.

- Consumer-friendly interface that works for each cellular gadgets and computer systems.

Crypto exchanges growth

Crypto exchanges are the guts of the crypto financial system, the place the place customers purchase, promote, and alternate digital property. If you’re planning to create your individual alternate, growth providers will help you understand this mission.

What’s necessary when creating an alternate?

- Buying and selling engine: A quick and dependable system that may deal with hundreds of transactions per second.

- Liquidity: Integration with giant liquidity swimming pools so customers can commerce with out delays.

- Safety: Chilly storage of funds, safety from hacker assaults, and KYC/AML compliance.

- Comfort: Easy and clear interface that may swimsuit each newbies and skilled merchants.

Exchanges are available in two varieties: centralized (CEX) and decentralized (DEX). Centralized exchanges are handy for newbies and supply excessive liquidity, whereas decentralized exchanges give extra freedom and management over their property.

Ending Ideas

The selection between a custodial or non-custodial pockets is dependent upon whether or not you’re a common consumer, a crypto investor, or a enterprise searching for a dependable software for working with digital property.

When you want a crypto pockets for enterprise, particularly if the corporate operates in a closely regulated jurisdiction, it’s higher to have a look at custodial options or wallets as a service.

These are turnkey platforms with KYC/AML assist, built-in fiat gateways, and the flexibility so as to add enterprise options starting from multi-user administration to computerized reporting to tax authorities.

In case your aim is private use, most freedom, and entry to decentralized providers, then self-custodial wallets are your alternative. Such wallets give full management over funds and personal keys, will let you work instantly with DeFi protocols, hook up with Web3 functions, and add any tokens manually. Everybody will discover their professionals and cons.

To summarize:

- A crypto pockets for companies or wallets as a service with a give attention to comfort, safety, and compliance.

- For private use and energetic crypto-enthusiasts – self-custodial wallets with full management and most freedom.

- For newbies and those that need simplicity and assist – custodial wallets from main exchanges.

Every answer is appropriate for its personal duties, and the primary factor is to know what priorities are extra necessary to you: management or comfort, freedom or error safety, autonomy, or ready-made infrastructure.

Often Requested Questions

Is it potential to switch funds from a custodial pockets to a non-custodial pockets?

Sure, it’s potential. You may withdraw your funds from a custodial pockets to a non-custodial pockets by coming into the deal with of your non-custodial pockets.

How do non-custodial wallets present serverless safety?

Non-custodial wallets use cryptography to guard personal keys. These keys are solely saved in your system, eliminating the chance of servers being compromised. Utilizing non-custodial wallets require extra accountability from the consumer as you handle and safe your personal keys your self.

Can I take advantage of a non-custodial pockets for staking or decentralized finance (DeFi)?

Sure, many non-custodial wallets similar to MetaMask or Belief Pockets assist staking and integration with DeFi platforms.

Can I get again right into a non-custodial pockets with out a seed phrase?

No, the seed phrase is the one strategy to regain entry to a non-custodial pockets. Must you lose it, the cash will likely be inaccessible.

What’s a crypto pockets and the way does it work?

A crypto pockets is a tool for storing, sending, and receiving cryptocurrencies. It really works by managing personal and public keys: the personal key provides full entry to your funds, and the general public key’s the pockets deal with the place you possibly can obtain transfers. Some wallets (custodial) retailer the keys for you, whereas others (non-custodial) put management completely in your arms.

Custodial vs Non-Custodial Wallets. How do you select between them?

The professionals, in addition to cons of every choice, are necessary to bear in mind in relation to selecting a saved or non-stored pockets. Non-cascading wallets will let you absolutely management your crypto property, however entail higher accountability. Castile wallets, quite the opposite, supply comfort and assist however require belief within the digital pockets supplier.