While some experts predict the fleeting nature of brokerages, others envision a future where decentralized banks and AI-driven CEOs allocate tasks to brokers and individuals alike. While our team believes that this knowledge holds significant promise, companies considering the implementation of brokers must also acknowledge the existing limitations.

So, what are brokers? In conceptualising and observing, what can they accomplish together remains limitless. Will potential stakeholders’ varying levels of understanding and buy-in impact project timelines and overall success? Can we proactively address resistance to change and ensure a cohesive roll-out strategy? How will we measure the effectiveness of the solution, and what metrics will be most relevant in evaluating its value proposition?

What’s an AI agent?

The global market for autonomous systems and autonomous agents is experiencing rapid growth. The global market for artificial intelligence in the healthcare industry was valued at $19.7 billion in 2023 and is forecasted to surge to $28.5 billion by 2028, with a compound annual growth rate (CAGR) of 43% over that period.

Brokers facilitate transactions between buyers and sellers by providing a platform for trading securities, commodities, or other financial instruments. They act as intermediaries, connecting clients with market participants to execute trades, manage risk, and optimize investment returns.

AI agent definition

An intelligent software program, also known as an agent, is a sophisticated piece of code that interacts seamlessly with its environment, performing specific tasks by simulating human-like behavior. As a result, the intelligent system effectively assimilates information, makes decisions independently, takes actions without human intervention, learns from past occurrences, and adjusts its behaviors in a manner that evolves over time.

Brokers can operate physically, functioning as a sophisticated thermostat, or they can exist digitally, akin to a personal virtual assistant embedded within an enterprise resource planning (ERP) system.

As knowledge has evolved since the advent of OpenAI’s ChatGPT, enabling computer programs to comprehend human language and collaborate seamlessly with individuals. Generative AI can efficiently process enormous amounts of data and provide insights significantly faster than traditional methods. Not every agent needs to be rooted in General. It will likely function superbly when operating independently, leveraging its autonomy and scope of responsibilities.

Discover the nuanced differences between various applied sciences in our latest article.

AI-powered trading platforms differentiate themselves from traditional software applications by leveraging machine learning algorithms to execute trades and manage portfolios more efficiently. While standard software programs rely on predetermined rules or manual intervention, AI brokers utilize complex analytical models to analyze market trends, identify profitable opportunities, and make split-second decisions to optimize returns.

What sets brokers apart from others is their commitment to making logical decisions. Decisions are made primarily through a combination of gathered data and interactions with the environment. People will respond differently to the same situation, influenced by their unique environment and circumstances. Customers don’t need to perpetually supply prompts, akin to those used in ChatGPT, to effectively activate the conversational flow of a virtual assistant. To effectively realize its objectives, the system must have the capacity to autonomously select options and take provisional measures in order to ultimately accomplish the desired outcome.

Brokered chatbots are designed to collaborate seamlessly with humans, while autonomous brokers operate independently, directly engaging end-users to provide conclusive responses or escalate tasks when insufficient information hinders their ability to complete them.

Key traits of AI brokers

You can distinguish brokers from different software programs by their distinct features:

- Brokers could operate autonomously, making decisions without requiring human oversight or intervention.

- Brokers can respond reactively to external stimuli or proactively drive progress towards their desired outcomes by taking the lead and steering their interactions accordingly. Brokers will operate effectively in both static environments with set rules and guidelines, as well as in dynamic settings where they must continuously learn and adapt to shifting circumstances?

- They leverage machine learning algorithms to continually improve performance, learn from past experiences, and adapt to changing environmental conditions.

- Brokers are programmed to achieve specific objectives. They possess the tools to make informed decisions, set priorities, and adjust their strategy to effectively pursue their ultimate goal.

Forms of AI brokers

brokers come in numerous varieties. Discovering the fundamental principles of every concept defined with a concrete example.

Easy-reflex brokers

Their response to stimuli is often driven by predetermined protocols that ignore the risk of unforeseen consequences and past experiences. If their environment undergoes significant changes, simplistic reflexive agents are incapable of adapting unless someone adjusts the fundamental principles governing their behavior? One might characterise these brokers as having limited cognitive capabilities, yet they excel in stable settings where tasks are straightforward and purely reliant on current knowledge.

One example of a simple reflex agent is a basic thermostat without self-learning capabilities. With autonomous functionality, this device leverages a temperature sensor to maintain precise control over room temperature, ensuring optimal comfort and stability. As the temperature drops below a certain threshold, the agent automatically activates the heating system. Once the temperature reaches the predetermined level, the agent automatically shuts down the heater. It habitually operates reactively, relying on conditional rules.

Mannequin-based reflex brokers

Experts aggregate data on the global environment, utilizing a simulated figure to extrapolate information that is not directly provided. Unlike their predecessor models, model-based reflex agents respond to stimuli by considering past experiences and potential consequences. Brokers capable of operating in dynamic environments will adapt and modify their inherent models according to changes on the ground.

Consider a cutting-edge vacuum cleaner as a prime exemplar of a model-based reflex agent. The robotic system effectively maps and sanitizes residential spaces by leveraging an internal prototype that simulates its environment. The agent continuously receives input from sensors that detect obstacles, dirt, and varying terrain types. Using internal mapping technology, the device optimizes the most eco-friendly cleaning approach by dynamically adjusting suction power for various surface types.

Aim-based brokers

These brokers exhibit exceptional cognitive abilities, surpassing their predecessors in terms of logical and analytical prowess. They will scrutinize various routes leading to the ultimate goal and identify the most eco-friendly option. Brokers utilizing an aim-based approach can develop a comprehensive list of specific, measurable sub-goals to monitor and track progress towards achieving their objectives. They will accept any motion as long as it brings them closer to their desired outcome.

A chess participant models a goal-oriented agent by actively seeking victory through deliberate and thoughtful strategizing. The system utilizes a comprehensive model of the chessboard and adheres to the fundamental principles of the game to assess potential moves. The primary goal of this chess agent is to achieve a checkmate against its opponent while simultaneously protecting and preserving its own pieces from potential threats. The AI system strives to predict its adversary’s attacks and evaluates the consequences of various techniques employed.

Utility-based brokers

Brokerages operating under a utility-based framework employ distinct strategies to navigate the most effective route towards achieving their ultimate goal, leveraging choice principles. When employing a utility-based agent to plan a trip to a desired vacation destination, users have the flexibility to select their preferred approach: opting for the quickest route possible or seeking the most cost-effective option.

Assuming that a good thermostat operates in a utility-based mode where the choice is energy efficiency? The thermostat leverages advanced sensors to monitor current temperature and humidity levels, while also taking into account energy costs. During peak energy usage periods, the system minimizes temperature fluctuations while ensuring a comfortable and fully occupied space.

Studying AI brokers

Brokers can draw upon their surroundings and professional knowledge to enhance their understanding. As they begin with limited data, their understanding expands with the completion of each subsequent task. Brokers tailored to dynamic environments seamlessly adapt and evolve without requiring manual intervention or rule reprogramming.

A personal AI assistant is an instance of a learning agent, as it continually refines its suggestions by studying individual habits and preferences. The algorithm initially suggests content based on its fundamental popularity. As the individual engages with the platform, browsing exhibits and films, rating content and exploring diverse genres, the agent amasses and interprets this data to grasp the user’s preferences and formulate personalized content recommendations.

Hierarchical brokers

Brokers are structured in a hierarchical system where senior brokers break down complex processes into smaller tasks, subsequently delegating them to junior brokers. Lower-level brokers perform these tasks and submit their findings to their supervisors.

A self-driving automobile can serve as a paradigmatic illustration of hierarchical brokerage in action, showcasing the complexities of decentralized decision-making and autonomous navigation. A sophisticated navigation system calculates the most efficient route to the desired destination, taking into account prevailing traffic conditions and applicable regulations. The system assigns specific responsibilities to intermediate agents, focusing on skills such as highway travel, urban orientation, and vehicle parking. These instructions, in turn, direct lower-level managers to execute precise actions akin to navigating, speeding up, and slowing down.

The key components of AI brokers include: algorithms for predicting market trends; robust data analysis capabilities to process vast amounts of financial information; ability to execute trades swiftly and accurately; integration with existing trading platforms or systems; capacity to learn from market fluctuations and adapt strategies accordingly; advanced risk management tools to minimize losses; user-friendly interfaces for seamless interactions; scalability to accommodate increasing demand; and transparent reporting mechanisms to ensure trustworthiness.

A typical agent has six essential components:

- The securities market is the arena where stockbrokers operate. A dwelling may be either physical or virtual.

- Enable brokers to collect information from their environment. This is typically a basic information compilation device, akin to a thermometer or an interface for gathering text or audio input.

- Can a software program convert an agent’s output into bodily actions in the real world? Examples include robotic arms that strike inventory and software programs that create data or send emails.

- The power of a dollar is the equal of a well-informed and clever mind. This unit processes vast amounts of data generated by sensors and enables brokers to make informed decisions about their next course of action. This mechanism typically employs a rule-based framework or another decision-making approach to facilitate determinations.

- As a result, A-permits brokers are able to learn from past experiences with their environment and refine their approach for greater effectiveness over time. This type of machine learning model employs techniques similar to those used in supervised, unsupervised, and self-supervised approaches.

- Are a compilation of rules and specifications that brokerages employ to inform their decision-making processes. As brokers continue to study and learn, their information foundation continually grows and evolves over time.

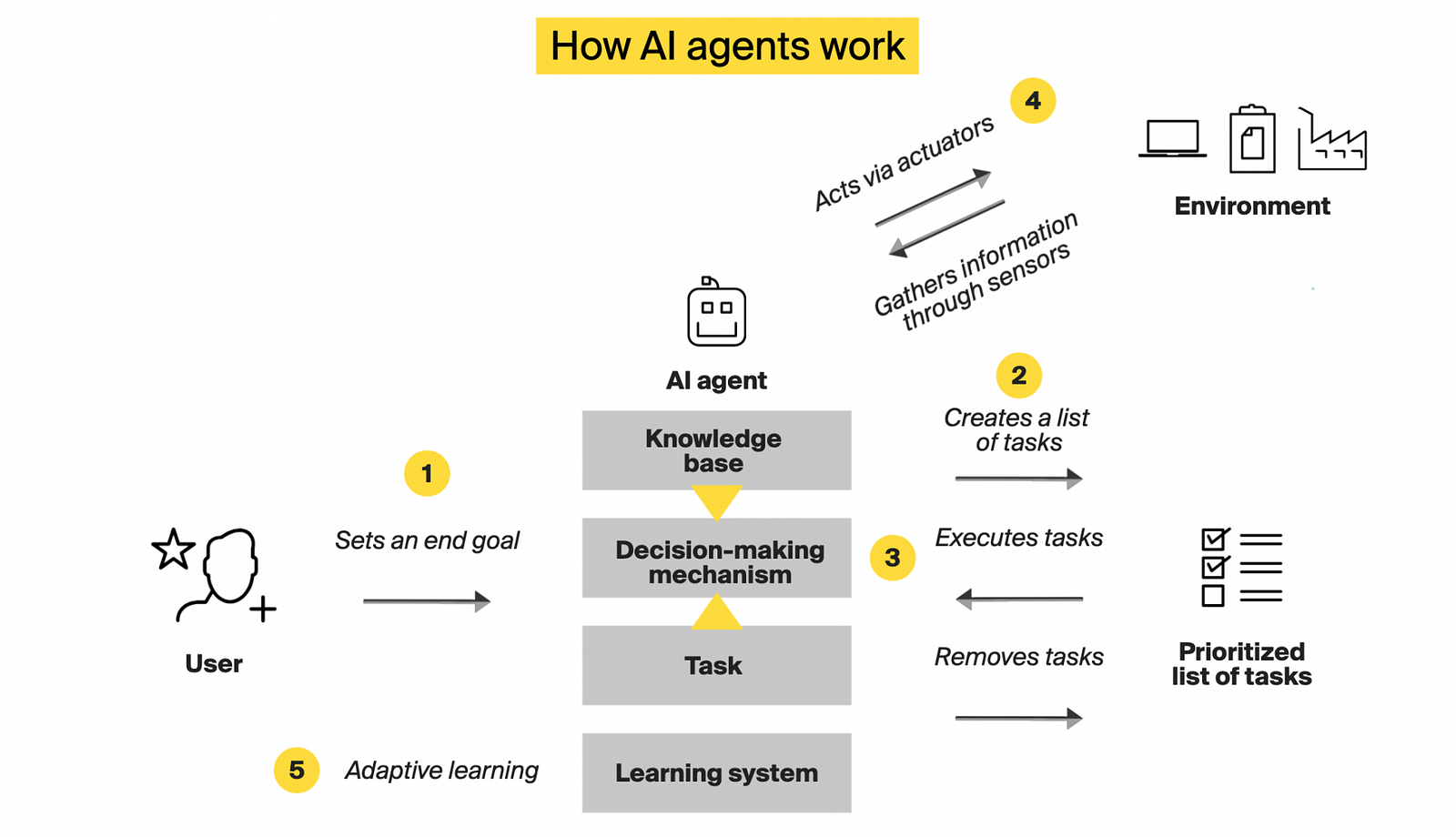

How AI brokers work

After gaining insight into what brokers are, let’s delve into their operational framework. To streamline processes, brokers’ workflows can be condensed into five fundamental stages.

- . A real estate agent receives a property inquiry from a prospective buyer. The customer can request that an agent investigates their support ticket on their behalf.

- . The agency’s task management system generates a prioritized list of specific actions necessary to accomplish the primary goal.

- . The agent accumulates knowledge from its environment through a variety of interfaces and sensors, meticulously collecting insights for future tasks. This IoT device enables real-time monitoring by leveraging web-based interfaces, integrating with various software programs, and harnessing sensor technologies to track a range of key indicators, including temperature and strain readings. Brokers utilize a comprehensive repository of collective knowledge, leveraging advanced algorithms to distill valuable insights and maintain an up-to-date database to inform informed decision-making processes.

- . Based on its selections, the agent carries out specific actions, such as dispatching notifications, offering recommendations, and so on.

- . The agent continually refines its decision-making processes by learning from the consequences of its actions, thereby improving its effectiveness as it navigates shifting environments.

As AI-powered intermediaries gain traction, their practical applications within corporate structures are coming into sharp focus.

According to a recent analysis by Accenture, organizations are expected to achieve significant benefits from their partner ecosystems over the next three years, with guarantees in place to ensure success. Where can they potentially generate the greatest returns? Let’s discover.

AI brokers in healthcare

There are a multitude of benefits associated with. Brokers’ implications for the sphere typically encompass a complex array of market insights, transactional expertise, and risk management strategies that collectively shape the trajectory of the industry.

Brokers assess patients’ symptoms and medical histories, potentially ordering scans as necessary, analyzing resulting images, and reporting directly to assigned physicians with a recommended diagnosis and personalized treatment plan.

Tars collaborate seamlessly with patients, carefully evaluating symptoms, offering tailored guidance, dispatching educational materials, and sending appointment reminders to facilitate informed navigation of health conditions.

Brokers can optimise hospital workflows by predicting patient admissions and improving resource allocation thereby streamlining operations and enhancing overall efficiency. An AI-driven predictive analytics system can accurately forecast that approximately ten patients will require hospitalization tonight, prompting the automated adjustment of physicians’ schedules to ensure seamless admission processes.

AI brokers in customer support

These brokers can provide personalized assistance to clients 24/7 in a environmentally friendly setting. They will respond to questions, manage the process of refunds, troubleshoot technical issues, and perform a wide range of other tasks. An automated agent promptly responds to incoming requests by leveraging the corporation’s database, internet resources, and other information sources. It then thoroughly processes the obtained data before taking actionable steps or escalating the issue to a live human operative for further resolution. Brokers learn from each interaction, potentially delivering enhanced responses over time.

The generative agent startup offers ready-to-use, pre-trained brokers alongside the flexibility for companies to tailor their own tools. When using pre-packaged brokers, you can typically deploy them within a matter of seconds. They adhere to GDPR guidelines and may operate on a regional basis or within a cloud infrastructure.

AI brokers in manufacturing

Brokers can assume control over the production process, ensuring high-quality products through rigorous testing and monitoring of the manufacturing unit’s operations from the ground up.

- . Manufacturing facility managers can seamlessly process broker transactions by monitoring and controlling all available tools. Brokers will continuously scrutinize machine sensor performance data and efficiency metrics to pinpoint potential degradation at its earliest stages.

- . Brokers rely heavily on a combination of sensor-based data and visual examinations to detect product flaws, including those that are imperceptible to the naked eye.

- . Brokers can leverage their expertise to collect and scrutinize data on manufacturing processes, identifying potential security threats and reporting any instances of leakage or non-compliance with worker safety protocols. Are brokerages capable of monitoring a single instance of manufacturing services?

Unlike typical fashion trends, market brokers can respond proactively. These devices have built-in actuators that enable them to control various machine settings, trigger alarm notifications, halt conveyors, and perform additional tasks.

AI brokers in finance

Brokers acting as financial advisors engage in conversations with clients, scrutinize market trends, consider investor preferences, and suggest tailored real estate investments to craft bespoke funding portfolios. Brokers are able to autonomously manage these portfolios, effectively defending them against market volatility.

Brokers in finance have another pivotal role to play: fraud detection. Brokers can leverage advanced analytics to identify and track cybercrime patterns, monitoring individuals’ actions and financial transactions in real-time to swiftly detect and prevent fraudulent activities. Transactions exhibiting suspicious behavior will be swiftly flagged and terminated in accordance with standard protocols. Brokers can also study to scan financial software programs for vulnerabilities and promptly repair or report them before malicious actors can exploit them.

If you’re interested in learning more about this sector, you may want to study additional information on our blog concerning these topics.

Artificial intelligence (AI) brokers in transportation and logistics revolutionize supply chain management by streamlining operations, reducing costs, and increasing efficiency. By leveraging AI’s predictive analytics capabilities, these brokers can anticipate and mitigate potential disruptions, optimizing routes and schedules to ensure timely delivery of goods. With real-time monitoring and tracking, clients gain transparency into their shipments’ status, allowing for proactive decision-making and improved customer satisfaction.

Brokers are experiencing significant success in the transportation sector, with autonomous vehicles, logistics, and supply chain route optimization being key areas of growth. Self-driving vehicles rely on sophisticated algorithms to navigate roads safely, avoid collisions, comply with traffic regulations, and continuously update themselves to the dynamic environment surrounding them? Brokers can leverage the technology to simultaneously drive and monitor the vehicle’s systems for any irregularities, sending alerts directly to their supervisors if necessary.

Brokers can leverage data on street conditions, climate, and vehicle efficiency to inform optimal route planning by combining it with supply schedules. Real-time traffic data enables autonomous systems to proactively reroute vehicles to lower-congestion routes and dynamically adjust logistics schedules in response. Take a look at our blog post on that topic for some extra inspiration.

In cities like Phoenix and San Francisco, you might have already experienced the autonomous ride-hailing service offered by. The ride-hailing service has fully transitioned to autonomous vehicles, with no human operators behind the wheel. Automobiles are completely controlled by brokers. They rely on a comprehensive array of sensors to orient themselves during both daytime and nighttime navigation. Each autonomous vehicle is trained on a staggering 20 billion miles of simulated routes and boasts around 20 million miles of actual road experience. Waymo asserts that its self-driving cars decrease incidents of accidents both on the roads where they operate and in surrounding areas.

What AI brokers really mean for institutional traders?

Can corporate entities currently operate and execute their existing structures with optimal efficiency? Isn’t the know-how still in its early stages, likely to yield limited benefits at best? ITRex CTO, , explains.

Theoretically, it is possible to implement any of the brokers described in this article. Despite these efforts, achieving accurate and consistent results at scale will likely prove to be a significant challenge. It takes mere weeks to build a functional prototype of an instructional assistant agent leveraging a GPT-based interface capable of producing results with 60% accuracy. However, achieving an accuracy level of 90% would require a minimum of ten months.

But do not anticipate an easy, incremental improvement. Fashion’s inherent complexity arises from its black box structure, rendering it challenging to pinpoint precisely which aspects are flawed and which algorithm is influencing the results? Why would an agent’s accuracy stage suddenly surge to 70% one day, only to plummet back down to 50% the following day, leaving a trail of confusion in its wake?

Typically, brokers in their current state excel in roles that tolerate minor performance fluctuations. In most cases, we highly recommend implementing robust human verification mechanisms to ensure optimal security and integrity of systems.

Limitations of AI brokers

As the conversation unfolds, brokers are hindered by two primary constraints:

- Uncertainty’s shadow looms large: a tug-of-war between precision and unpredictability. Fashions, in essence, resemble black boxes: once something goes awry, identifying the exact cause can be a daunting challenge, as it’s unclear which component is malfunctioning. If an agent relies heavily on a large language model, it may potentially hallucinate, generating a plausible yet inaccurate response, further complicating the situation?

A prominent financial institution, keen to provide exemplary buyer assistance, was understandably cautious about furnishing inaccurate responses. They implemented a framework that aggregates all written content generated by the brokers. If the textual content meets all quality and accuracy standards, then it is promptly delivered to the end-user. When an inquiry isn’t processed, the agent deliberately avoids responding and instead routes the customer through to a live representative.

- Scalability. According to McKinsey’s research, many business leaders find it challenging to scale their operations when using managed environments and intermediaries such as brokers. While this statement may seem somewhat vague, it’s possible that the core idea is being conveyed effectively? To leverage data at scale, organizations must reconfigure their operational infrastructure, thoroughly cleanse the data to ensure its accuracy and integrity, and verify compliance with relevant regulations and standards, among other considerations.

Different limitations embrace:

- Excessive preliminary funding. could be costly. You’ll likely need to invest in software programs, hardware, knowledge, and expertise. Take a glance at our most recent reports on the subject matter.

- Integration with the present programs. To fully leverage its capabilities, you need to integrate it seamlessly into your organization’s existing workflows and processes. For users of outdated software, this process can be surprisingly complex. Additionally, you will need to combine knowledge from diverse sources into a single, integrated system that brokerages can easily access and utilize.

- Moral and authorized considerations. Navigating the authorized panorama around can be particularly troublesome, especially in tightly regulated sectors like healthcare and finance. Brokers’ outputs are susceptible to being skewed and unreliable. When fashion’s triggers of hurt are scrutinized, whose responsibility takes center stage? Who bears responsibility when brokers’ ill-advised decisions lead to costly consequences?

Brokers can serve as a powerful tool to automate laborious tasks and simplify processes, thereby freeing up time for more strategic decision-making. Despite their current capabilities, it’s essential to recognize the limitations when delegating critical responsibilities, as ironically, even AI-powered brokers can be prone to mistakes while attempting to minimize human error. Although even fashions crafted by behemoths like Google exist. Recently, Google’s massive language model, Gemini, has been generating remarkably lifelike images that were previously unimaginable.

Wanting to test the waters with online stockbrokers? ! We will allocate you a diverse team with expertise in large language models, firmware, and sensor integration. Software-only brokerages enable us to create virtual brokers capable of executing physical actions.

The putt-up appeared first on stage.