By autumn 2024, the cryptocurrency market had surged to a record high following the US election results, which saw crypto-friendly candidates secure key positions in government.

The phenomenon was observed to surge substantially following the implementation of the Division of Authorities Effectivity on November 24, 2024.

Notwithstanding the previous fluctuations, it is plausible that a rapid increase may be followed by an equally swift decline. For instance, the market has experienced striking highs and lows over the past two years, plummeting below $20,000 in December 2022 before surging above $100,000 in December 2024.

Despite widespread acceptance of cryptocurrencies in major economies, they remain an inherently volatile investment option. Those looking to capitalise on digital assets should consider leveraging supplementary software tools and options and transition to a more streamlined approach.

A cutting-edge AI-powered crypto trading bot is a sophisticated software program that utilizes artificial intelligence and machine learning algorithms to analyze market trends, make predictions, and execute trades in the cryptocurrency space.

A sophisticated AI-powered cryptocurrency trading bot utilizes machine learning algorithms, data analysis, and automation to execute informed buy and sell decisions.

Always active, constantly scouring marketplaces, monitoring purchasing and sales opportunities, and swiftly implementing trades. These automated trading systems operate continuously, never pausing their activity in cryptocurrency markets.

Why Should Your Business Invest in AI Development for Crypto Trading Bots?

By 2024, the global user base of cryptocurrencies had essentially surpassed one billion. If your organization aims to enter the crypto space, a sophisticated AI-powered trading bot could be just the solution you’ve been searching for.

While bots excel at processing vast amounts of data in mere milliseconds, surpassing human capabilities in this regard. Notwithstanding these limitations, what truly sets them apart is their ability to devise optimal solutions grounded in real-time data, rather than intuition, biases, or external influences.

Merchants can exploit bots by crafting tailored strategies, analogous to trend-following or statistical arbitrage, which enable them to pivot or abandon a profitable approach whenever market conditions turn adverse.

From a financial standpoint, AI-powered bots notably reduce labor burdens and streamline investment allocation processes. The demand for endless human monitoring is satisfied due to the fact that software scripts can operate continuously without committing errors.

Lastly, bots perceive no difference in managing a single portfolio versus overseeing multiple accounts across various platforms. Projects are designed to be scalable and can evolve in tandem with shifting funding arrangements?

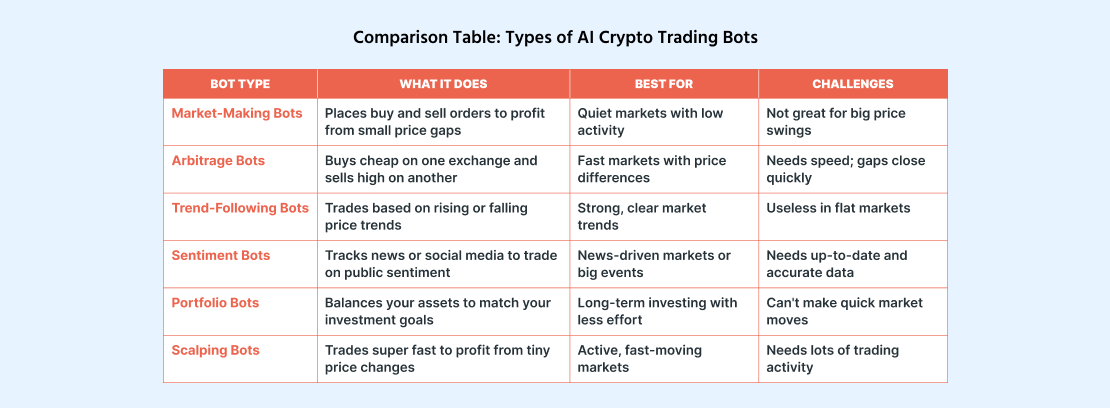

There are numerous forms of AI-powered crypto buying and selling bots that utilize machine learning algorithms to analyze market trends and make informed investment decisions. Some popular examples include:

Traders who leverage cryptocurrency trading bots can benefit from increased accuracy, speed, and efficiency in their trades.

In reality, AI-powered crypto buying and selling bots lack any tangible substance. Markets attract investors with diverse approaches and strategies, comprising various trading tactics and functionalities.

Market-Making Bots

Market-making bots operate by establishing buy and sell orders at marginally distinct prices. These entities derive revenue from the disparity between buying and selling prices. In many cases, these automated trading systems perform well in quiet market conditions where smaller transactions can accumulate to substantial profits over an extended period.

Arbitrage Bots

This algorithm detects minute fluctuations in multiple markets with ease. By simply acquiring an asset at a discounted trading fee and subsequently reselling it at a higher rate elsewhere, traders can capitalize on significant price discrepancies in rapidly fluctuating markets.

Pattern-Following Bots

Pattern-following algorithms, driven by innovations in artificial intelligence, excel at identifying and capitalizing on trends, as well as mitigating risks, to inform investment decisions that profit from market fluctuations.

These algorithms operate in opposition to bots that predict market trends, buying assets when their value is increasing and selling when they start to decline? Pattern-following bots are designed to operate effectively in scenarios featuring consistent and sustained upward or downward trends.

Sentiment Evaluation Bots

Market sentiment bots rely heavily on current content and publicly available data from open sources. A constructive tone in reports tends to prompt the bot to acquire an asset, while a negative tone prompts it to divest.

In scenarios where a specific event unfolds, this bot proves remarkably adept at adjusting to changes that significantly impact user behavior.

Portfolio Administration Bots

Portfolio management robots strive to maintain cryptocurrency investments in a state of optimal equilibrium. Investment managers mechanically acquire or resell liquid assets to effectively manage the desired mix of securities within a portfolio.

These bots are ideal for long-term traders seeking consistent development without the need to constantly monitor and manage their trades.

Scalping Bots

Scalping bots capitalize on minuscule fluctuations in prices throughout the trading day. With remarkable speed and efficiency, they execute numerous transactions, safeguarding assets for mere instants or brief moments. Despite their modest nature, these small earnings accumulate significantly over time. Scalping bots typically thrive in high-speed, ultra-liquid markets akin to those found in cryptocurrencies such as Bitcoin and Ethereum.

How to Develop a Trading Bot Using Artificial Intelligence: A Comprehensive Guide

Would sound sophisticated, but by breaking it down into straightforward steps, the approach becomes significantly more accessible. Here’s a straightforward guide to building your own AI-powered crypto trading bot.

Make clear Your Intentions

Defining the fundamental objective of your bot requires identifying its intended purpose and desired actions. What a unique market existed then? Will it scrutinize market fluctuations and identify potential arbitrage opportunities across trading platforms?

You could also specify which cryptocurrency exchanges your bot will operate on, establishing certain principles that guide its behavior. Determining exactly what you want your bot to accomplish will guide every subsequent decision towards the optimal outcome.

Put together Needments

The AI algorithm requires a substantial amount of training data to learn from various sources: historical costs, transactional volumes from buying and selling activities; and insights derived from online information repositories, including blogs, social media platforms, and others. When you possess knowledge, it’s crucial to refine and polish it, correcting any mistakes or augmenting it with missing information.

What would you like to name your innovative startup? Would you like to capitalize on the ever-growing demand for AI-powered crypto trading solutions, revolutionizing the way investors make money in the digital currency market?

A revolutionary growth firm focused on developing cutting-edge AI-driven crypto buying and selling bots, poised to transform the industry with unparalleled efficiency and accuracy.

Without the necessary technical expertise to develop the bot yourself, it may be more advisable to outsource the project to a reputable external provider with bot development as part of their core offerings.

Experienced construction professionals can successfully navigate complex features that mirror the intricacies of programming, machine learning, and systems integration. Moreover, collaborating closely with a precise companion can indeed save valuable time while yielding a superior-quality outcome.

Combine with Crypto Exchanges

When a bot becomes operational, it seeks to connect with cryptocurrency exchanges that enable its functionality? The trades’ API will be combined to enable your bot to access real-time market data, facilitate transactions, and manage funds seamlessly.

Probe and Polish

Before putting your bot’s financial capabilities to the test, simulate a real-world scenario by providing it with a controlled environment where it can demonstrate its effectiveness without risking actual losses. This will help you identify and troubleshoot any potential issues before entrusting it with valuable assets. Once you’re confident in its performance, consider allocating a limited amount of capital to test how it performs in live market conditions.

Deploy and Watch

Deploy your bot script to the marketplace to gauge interest and generate revenue. Don’t abandon the situation completely; instead, observe the circumstances and remain vigilant for any emerging problems that might arise.

As technology advances rapidly, AI-powered crypto trading bots have become increasingly popular among investors.

An excessive-efficiency AI crypto buying and selling bot offers unparalleled precision in executing trades, leveraging market data, and optimizing portfolio performance. These sophisticated algorithms analyze vast amounts of information to predict price fluctuations, enabling timely buy and sell decisions.

Moreover, AI-driven crypto trading platforms seamlessly integrate with major exchanges, allowing for seamless transactions and minimizing downtime. Furthermore, advanced security features safeguard sensitive user data, ensuring a reliable and secure trading environment.

In addition, AI-based bots proactively monitor market trends, identifying potential opportunities before they arise. By incorporating sentiment analysis, these intelligent systems anticipate market shifts, reducing the risk of significant losses.

Ultimately, an excessive-efficiency AI crypto buying and selling bot empowers investors with unparalleled insights, precision, and control over their digital assets.

A cutting-edge AI-driven cryptocurrency trading platform should boast a plethora of features to maximize returns from market anomalies.

The system must be capable of real-time market analysis, leveraging the latest data to identify pertinent trading opportunities, quickly adapting to changing conditions and capitalizing on them in a seamless manner.

Backtesting is one other must-have. The platform enables merchants to simulate the bot’s performance based on historical market data before executing trades with real assets.

Fail to overlook robust threat governance options, akin to automated stop-loss, which effectively caps your losses when the market takes an unfavorable turn. Additionally, it should boast the capacity to trade on multiple exchanges, thereby providing users with a broader range of options to navigate.

As the cryptocurrency market remains in a state of constant flux, it is crucial that your bot operates continuously, providing real-time updates, notifications, and alerts to keep you informed about market movements at any given moment.

To ensure seamless transactions, the bot must employ robust encryption methods and secure Application Programming Interfaces (APIs), thereby safeguarding your financial information and personal data from unauthorized access.

Can SCAND’s innovative AI-powered platform streamline your crypto trading experience by building a custom-made bot tailored to your unique investment strategy? By leveraging advanced machine learning algorithms and real-time market data, SCAND can help you create a sophisticated trading bot that executes trades with precision and speed. Are you ready to revolutionize your crypto trading journey?

Are you feeling perplexed by the multitude of options for software development companies, leaving you uncertain about your selection? With SCAND’s expertise, you can create an exceptional AI-powered crypto trading bot for seamless buying and selling.

With more than two decades of experience in software development and a profound understanding of AI and machine learning, our team knows exactly how to craft software scripts that deliver results – whether it’s a custom-built bot tailored to specific processes or a versatile solution that can adapt to various applications.

We manage the entire process from concept generation and strategic analysis through design and deployment, ensuring your complete satisfaction without any undue worry or concern. Our bots are designed to handle even the heaviest of commerce volumes without experiencing any disruptions.

While residing with our bot, your dedicated team remains available to assist and fine-tune its performance in real-time, ensuring seamless adaptability to evolving market conditions.

Regardless of whether you’re just starting out in crypto or running a financial behemoth, SCAND enables you to build a trading bot tailored to your goals.

Cryptocurrency market volatility poses a significant hurdle to creating reliable AI-based buying and selling bots. The ever-changing nature of the cryptocurrency landscape demands adaptive algorithms that can swiftly respond to shifting market conditions, ensuring bots remain profitable and minimizes losses.

Unfortunately, cryptobots are not without their shortcomings. One of the biggest challenges lies in managing market worth fluctuations. While this limitation may not significantly impact bots in general, it could still have a considerable bearing on the bot’s overall performance.

Cryptocurrency prices fluctuate wildly, necessitating a bot that is resilient enough to navigate unpredictable market shifts with ease?

It is crucial to prioritize maintaining the integrity and quality of data on a comparable scale. If the information utilised is tainted or replete with significant errors and inaccuracies, the conclusions drawn by the bot will be rendered meaningless and devoid of logical significance.

One potential pitfall is the risk of overfitting, wherein the algorithm becomes overly reliant on historical pattern recognition, rendering it inefficient at processing real-time data effectively?

Striking a delicate balance is crucial in integrating historical understanding with the ability to evolve and respond effectively to contemporary realities.

Integrating Human Judgment with AI-Driven Insights: The Key to Unleashing Cryptocurrency Trading Bot Potential?

Developing an AI-powered crypto buying and selling bot demands a unique blend of technical proficiency, market understanding, and strategic foresight.

Significant breakthroughs in bot technology are expected to unfold in the near future. By employing advanced analytical techniques, experts will scrutinize intricate data and produce far more accurate market forecasts.

Another unexplored avenue will be the integration of sentiment analysis, allowing them to monitor breaking news and track social media trends to respond to market fluctuations?

Cloud-based bots are poised to become the new standard, enabling faster scalability, quicker deployment, and freedom from reliance on powerful hardware infrastructure.

We can provide you with a detailed breakdown of our estimated costs and timelines for creating an AI-powered crypto buying and selling bot. Here are the key details:

**Phase 1: Research and Development (4-6 weeks)**: In this phase, we will conduct extensive research on the crypto market, blockchain technology, and AI algorithms to develop a deep understanding of how they interact and impact each other. We will also identify the most suitable AI frameworks and libraries for building the bot.

**Phase 2: Data Collection and Integration (4-6 weeks)**: Once we have a solid understanding of the technical requirements, we will collect and integrate relevant data from various sources such as crypto exchanges, market APIs, and financial news outlets. This data will serve as the foundation for training our AI model.

**Phase 3: AI Model Development (8-12 weeks)**: In this phase, we will develop a sophisticated AI model using machine learning algorithms that can analyze market trends, predict price movements, and make informed trading decisions. Our team of experts will work tirelessly to fine-tune the model, ensuring it meets our high standards for accuracy and performance.

**Phase 4: Integration with Trading Platforms (2-4 weeks)**: After the AI model is developed, we will integrate it with popular crypto trading platforms such as Binance, Coinbase, or Kraken. This integration will enable seamless communication between the bot and the trading platform, allowing for efficient buying and selling of cryptocurrencies.

**Phase 5: Testing and Deployment (2-4 weeks)**: In this final phase, we will thoroughly test our AI-powered crypto buying and selling bot to ensure it functions as expected. Once testing is complete, we will deploy the bot on a suitable cloud infrastructure or dedicated server, ensuring its constant availability and scalability.

**Estimated Total Costs**: Our estimated total costs for creating an AI-powered crypto buying and selling bot range from $50,000 to $100,000, depending on the complexity of the project and the level of customization required.

The complexity and timeframe for developing an AI-powered cryptocurrency trading bot app vary significantly depending on several key factors.

The level of complexity involved in developing a sophisticated AI system significantly impacts project timelines and costs – seamless integration with multiple components can lead to increased timeframes and expenses.

The contractors you hire – skilled professionals may come at a higher cost, but they typically deliver faster and more satisfactory results.

Additionally, you’ll need to factor in the time-consuming process of compiling and preparing historical context. While don’t neglect to thoroughly test and refine the bot to ensure its performance in live market scenarios, which may necessitate additional time.

Typically, developing a trading robot requires an investment of two to six months, with costs ranging from $20,000 to $100,000, depending on the complexity of the desired functionality.

FAQs

The development of a sophisticated AI-powered cryptocurrency trading bot typically requires a substantial investment of time and resources. Factors such as the complexity of the algorithm, the volume of data to be processed, and the level of customization desired can significantly impact the duration of the project.

On average, it may take anywhere from 3-12 months or more for an experienced development team to design, implement, test, and refine a comprehensive AI-based crypto trading bot. This timeframe is influenced by several factors, including:

* The scope of the project: A basic AI-powered trading bot that uses pre-existing APIs and algorithms can be developed relatively quickly (in a few weeks), whereas a more advanced bot that incorporates machine learning techniques, real-time data processing, and sophisticated risk management strategies may take months or even years to develop.

* The level of customization required: If the client has specific requirements for the trading bot’s behavior, such as custom indicators, unique trading strategies, or integration with third-party APIs, this can add complexity and extend the development timeframe.

Growth typically unfolds over a period of 2-6 months, contingent upon the bot’s complexity.

Machine learning algorithms specifically designed for predicting financial market trends and pattern recognition, such as recurrent neural networks and gradient boosting decision trees, would prove to be the perfect applied sciences for AI auto-trading bot growth.

Natural Language Processing (NLP), Machine Learning (ML), and APIs are broadly used to construct AI-powered buying and selling bots.

Can you integrate your AI-powered chatbot with cryptocurrency exchanges to enable seamless trading and market analysis, thereby revolutionizing the financial landscape for users worldwide by providing instant access to real-time data and enabling efficient transactions through intuitive interfaces that cater to diverse user needs and preferences?

Bots designed to buy and sell engage directly with exchanges via distinct Application Programming Interfaces (APIs), as exemplified by those provided by Binance or Coinbase.

It is generally not recommended to use AI-powered cryptocurrency trading bots without thorough research, understanding of their underlying mechanics, and compliance with relevant regulations. However, the legality of using such bots depends on various factors, including jurisdiction, the specific type of bot, and the nature of the transactions involved.

The use of buying and selling bots is permitted, provided that you refrain from violating any applicable local regulations.

Can you leverage machine learning to enhance your cryptocurrency trading bot’s performance and decision-making capabilities?

Completely. Machine learning algorithms significantly boost predictive accuracy and inform strategic decision-making processes.

Yes, SCAND can certainly design and develop custom bots tailored to specific buying and selling strategies.

SCAND empowers businesses with entirely customisable bots tailored to their unique needs.

SCAND ensures knowledge safety by providing secure trading platforms for buying and selling bots, utilizing robust encryption methods to safeguard sensitive information, and regularly updating systems against emerging cyber threats.

We implement robust encryption methods, secure Application Programming Interfaces (APIs), and comprehensive testing protocols to ensure the utmost protection of sensitive data while adhering to rigorous legislative standards.