Arbitrage continues to be one of the crucial easy but best strategies of constructing earnings in monetary markets, and the identical applies to the crypto market.

With hundreds of tokens and common fluctuations in provide and demand, the alternatives for promising offers not solely persist however are literally rising in 2025.

Ethereum has at all times been one of the crucial essential ecosystems for arbitrage owing to its excessive liquidity, in depth community of decentralized exchanges (DEXs), and extremely lively developer group.

However is Ethereum nonetheless price becoming a member of for arbitrage functions? The quick reply: sure. Though the market has toughened, the event of Layer 2 (L2) protocols, cross-chain bridges, and custom-made arbitrage bots continues to supply new avenues for merchants and companies eager to earn on market inefficiencies.

Some Info on Ethereum Ecosystem Buying and selling Exercise

What Is an Ethereum Arbitrage Bot?

Blockchain arbitrage is defined because the act of making the most of value discrepancies of the identical asset on totally different markets, protocols, or networks.

So, an Ethereum arbitrage bot is automated software program that independently seems for interesting value disparities, however throughout the Ethereum ecosystem.

In distinction to guide buying and selling, the place worthwhile alternatives are often gone by the point a dealer can react, a bot can monitor, choose, and act in seconds or milliseconds.

For instance, if ETH is at $1,600 on one cryptocurrency change and $1,605 on one other, the bot should purchase on the cheaper value instantly and promote on the costlier value for a small revenue.

In comparison with crypto buying and selling bots produced for different blockchains, Ethereum bots have a couple of distinctive attributes:

- They need to rigorously oversee fuel charges, which might make or break a commerce.

- They immediately work together with good contracts and subsequently want safe Web3 integration.

- They face harsh competitors in Ethereum’s lively mempool, and thus velocity and execution methods matter.

How an Ethereum Arbitrage Bot Works

The Ethereum bot, by the use of fundamental logic and goal, is just about like different crypto arbitrage bots. Nonetheless, as it’s made particularly for Ethereum, it nonetheless retains some peculiarities that set it other than different bots that work on different blockchains.

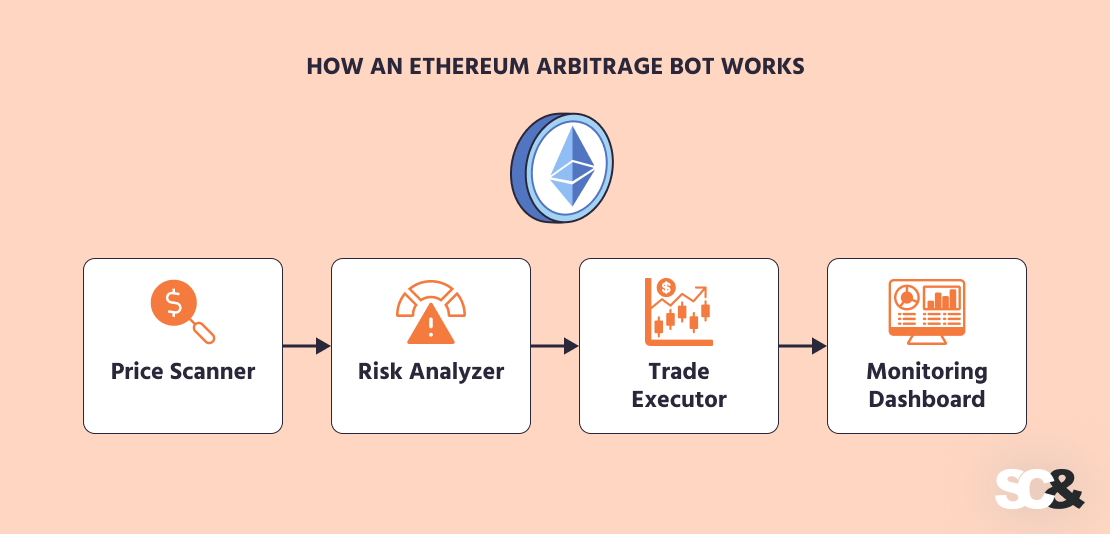

Bot Structure

Typically, Ethereum arbitrage cryptocurrency bots consist of 4 principal components:

- Market Information Collector – extracts related costs from CEXs (centralized exchanges), DEXs, or Ethereum nodes.

- Arbitrage Engine – crosses costs and uncovers worthwhile choices.

- Execution Layer – executes trades, usually making all elements of the commerce occur atomically.

- Monitoring Dashboard – watches efficiency, sends alerts, and offers management to the dealer.

By and enormous, such a modular format permits flexibility, so bot builders can add new exchanges, modify algorithms, or tweak execution with out overhauling the bot.

Worth Scanning

The bot’s intelligence comes from its scanning algorithms. Some merely examine costs on two exchanges, whereas others observe a number of token pairs for extra complicated prospects, like triangular arbitrage.

Ethereum bots in DeFi are in a position to learn good contracts immediately utilizing Web3 libraries. In an effort to seize alternatives quick, they usually work in parallel, preserve value information prepared in reminiscence, and even attempt to guess short-term value strikes.

Execution

Timing of execution in crypto arbitrage is of utmost significance. Upon discovering a deal, the bot:

- Executes trades atomically so both all elements succeed or none do.

- Makes use of personal transaction channels (i.e., Flashbots) to keep away from front-running.

- Scores fuel charges to maintain prices lower than income.

Some superior bots additionally use easy machine studying to resolve whether or not a commerce is price making based mostly on the present community standing.

Ethereum-Particular Instruments

Ethereum crypto bots depend on blockchain-native instruments:

- Web3 libraries (Web3.js, Web3.py) to work together with nodes and good contracts.

- EVM (Ethereum Digital Machine), the place transactions are run.

- GraphQL endpoints to question blockchain information effectively.

- RPC and WebSocket connections for quick, real-time communication.

These applied sciences permit the bot to scan costs, calculate earnings, and execute trades in a rush earlier than they’re misplaced.

Applied sciences and Instruments Behind Automated Buying and selling

To make an Ethereum arbitrage buying and selling bot, builders require the correct mix of programming languages, blockchain companies, and change APIs. Because the bot’s success depends upon how rapidly it might spot and commerce, what you develop it with issues lots.

Programming Languages

- Python – nice for testing methods and connecting to change APIs.

- Node.js – well-suited for stay information streams and WebSocket connections.

- Golang or Rust – usually used when velocity and low latency are the priority.

Many bots mix all of those: Python for evaluation, Node.js for dealing with information, and Go or Rust for the quickest elements of the execution.

Blockchain Instruments

These instruments assist bots spot revenue alternatives and attain trades with out delays:

- Flashbots – allow bots to submit non-public Ethereum transactions to keep away from being front-run.

- Blocknative – helps observe the mempool so bots can see how transactions are lining up.

- QuickNode (and comparable suppliers) – give quick and dependable entry to Ethereum and Layer 2 networks.

Trade Connections

In an effort to be worthwhile, a bot will usually connect with each decentralized and centralized markets:

- CEXs: Binance, Kraken, Coinbase, and many others., give in depth liquidity and stay order books.

- DEXs: Uniswap, Curve, SushiSwap, and Balancer are well-known Ethereum platforms the place value variations are more likely to occur.

By combining CEXs and DEXs, bots get extra possibilities to catch worthwhile trades.

Actual Challenges and Limitations of ETH Buying and selling Bot

Blockchain buying and selling software program could be just about worthwhile, however the actuality is much from uncomplicated. The market is very aggressive, and plenty of technical and monetary limitations can lower into doable good points.

Let’s begin with competitors. There are literally thousands of merchants and bots watching the identical markets, many with seasoned groups and infrastructure behind them. Due to this, value discrepancies shut in seconds, giving barely any time to react.

One other drawback is how trades in Ethereum are settled. When a commerce continues to be unconfirmed, it goes into the mempool, the place everybody can view it.

It’s subsequently doable for different bots to repeat the commerce and have it executed first by paying a bigger fuel payment, which is named front-running. In that state of affairs, the unique commerce can fail and even lead to a loss.

Fuel charges are an issue in and of themselves. Ethereum charges change rapidly relying on community utilization. A commerce that appears worthwhile at first look can very simply be rendered unprofitable as soon as the fuel payment is included. As a consequence of this, bots have to consistently calculate if the unfold is large enough to cowl charges.

Pace can be a constraint. A bot should course of data and ship transactions extraordinarily quick with a view to win. Even a small lag will consequence within the alternative being taken by one other quicker competitor. That’s the reason profound builders use optimized code, paid RPC nodes, and personal transaction relays.

| Problem | Impression | Answer |

| Market Competitors | Fewer worthwhile alternatives as many bots compete. | Use {custom} methods and monitor a number of exchanges/DEXs. |

| Delays & Entrance-Operating | Trades can fail or be overtaken by quicker bots. | Optimize execution velocity and take into account MEV-resistant instruments. |

| Pace Necessities | Bots should execute in milliseconds to remain aggressive. | Use low-latency infrastructure and environment friendly code. |

| Safety Dangers | Vulnerabilities can result in losses or information breaches. | Implement safe coding, audits, and protected key administration. |

| Liquidity & Slippage | Low liquidity can cut back or get rid of earnings. | Give attention to liquid pairs and modify commerce sizes dynamically. |

| Community & Fuel Charges | Excessive charges might wipe out good points. | Monitor charges in real-time and use L2 options when doable. |

Challenges and Limitations of Utilizing Bots

Prepared-Made Bots vs. Customized Ethereum Buying and selling Bot Improvement

When it’s a matter of utilizing a crypto buying and selling bot, often there are two alternate options: off-the-shelf options or {custom} ones. Each have severe professionals, but cons too.

Off-the-shelf bots are common resulting from ease of set up and minimal technical data required. They sometimes embody simple-to-use dashboards and pre-programmed methods, so merchants can begin testing in virtually no time.

For people or small teams, it’s a affordable technique of attempting arbitrage. The draw back, nevertheless, is that these bots can be found to many merchants. Their methods quickly grow to be well-known, and markets modify quick, which suggests earnings often shrink over time.

Customized improvement affords better management. A bot developed in-house or with a crypto arbitrage buying and selling bot improvement firm, can go well with particular buying and selling methods, be modified to work with particular platforms, and be tuned for efficiency and safety.

Why Select SCAND?

At SCAND, we specialise in designing, creating, and supporting arbitrage crypto bots in order that they will final lengthy and survive market competitiveness.

Our companies cowl every thing from preliminary structure planning and change integrations to ongoing efficiency tuning and safety enhancements.

In shut cooperation with clients, we be sure that each bot shouldn’t be solely technically sound but in addition well-aligned with the consumer’s enterprise technique.

Potential Instances for B2B Purchasers

For B2B purchasers, SCAND can develop {custom} cryptocurrency bots that open up arbitrage alternatives going far past easy methods.

Hedge funds, for instance, can automate and scale a number of methods directly, similar to inter-exchange arbitrage on centralized platforms and triangular alternatives on Ethereum DEXs. A SCAND-built bot can course of hundreds of market alerts per second and execute trades quicker than any guide method.

Crypto exchanges can use SCAND-developed bots to handle liquidity, right value variations throughout markets, and preserve spreads tight. This ensures smoother buying and selling and makes the platform extra enticing to each retail and institutional customers.

Buying and selling corporations coming into DeFi can profit from cross-chain and Layer 2 arbitrage bots constructed by SCAND. These techniques can handle a number of networks, optimize fuel prices, and execute complicated trades with precision — far above what ready-made options permit.

Steadily Requested Questions (FAQs)

What’s an Ethereum arbitrage bot?

It’s a program that robotically seems for value disparities for Ethereum or associated tokens throughout totally different markets and executes trades to make a revenue. It really works a lot quicker than guide buying and selling, appearing in seconds or milliseconds.

Why select a {custom} bot over a ready-made one?

Pre-built bots are fast and straightforward to make use of however aren’t versatile or worthwhile in the long run. Customized bots, in flip, could be programmed for multi-strategy use, connect with chosen exchanges or networks, be optimized for efficiency, and alter because the market modifications.

Are arbitrage bots dangerous?

Sure. Entrance-running, fluctuating fuel costs, competing bots, and safety threats are a few of them. A rigorously designed bot with correct safety features, nevertheless, will cut back these dangers.

How can SCAND assist companies?

SCAND builds {custom} Ethereum bots for B2B purchasers, taking good care of every thing from technique design and system setup to change and blockchain integrations, monitoring, and additional help. Get in contact with us to e book a session and get extra particulars.