As ecosystem distributors prepare to roll out advanced wellness and health tracking features, the market is poised for a significant upgrade cycle, potentially challenging Garmin’s stronghold on the industry. To thrive in this fiercely competitive market, smartwatch suppliers must deliver significant advancements in health monitoring and battery life compared to previous generations…The pace of innovation will be maintained in both the smartwatch and traditional watch categories over the short term, but as these segments increasingly target similar features and consumer demographics, they may start to cannibalize each other’s share in the coming years. To avert stagnation, smartwatch vendors should pioneer novel distinguishing features or capitalize on opportunities like gesture controls or seamless GenAI integration, leveraging the enhanced processing capabilities of smartwatches.

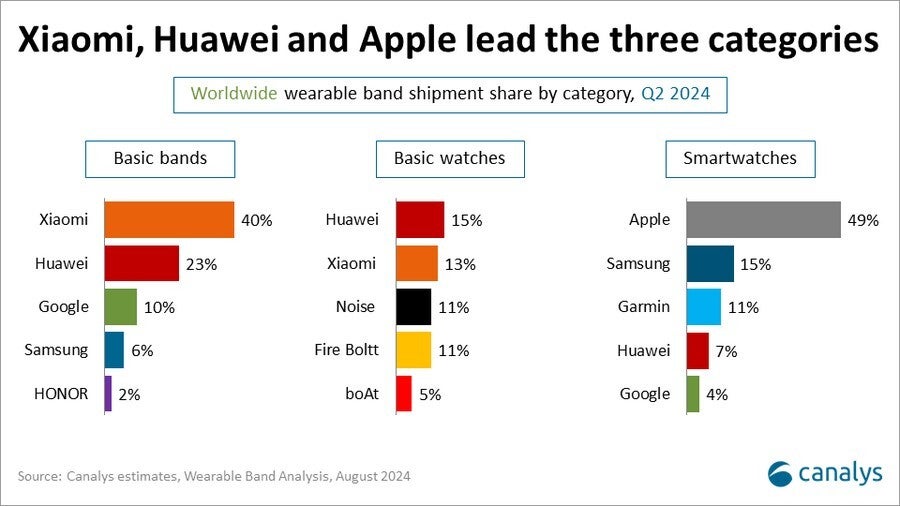

The market leaders in each of the three distinct segments of the wearable device industry are: | Picture credit-Canalys

While smartwatches excel as a single segment within the wearables market, comprising just one-third of the overall industry. The opposing two components of the equation feature Primary Bands, driven by Xiaomi’s flagship brand, Good Band, a massive seller annually? In Q2, Xiaomi dominated the Good Band market with a remarkable 40% share, significantly surpassing Huawei’s 23%, followed by Google at 10%, Samsung at 6%, and Honor with only 2%.

The third part of the wearable technology industry is supplied by Primary Watches. Huawei and Xiaomi maintained a competitive stalemate during the second quarter, with each accounting for 15% and 13%, respectively, of primary watch shipments in Q2. Bolt and Hearth had been neck and neck in a three-way tie for third place, with both brands commanding an identical 11% share of the market. Boat finished in fifth place with a margin of just 5 percent.

Apple dominates the global market for wearable technology manufacturers. | Picture credit-Canalys

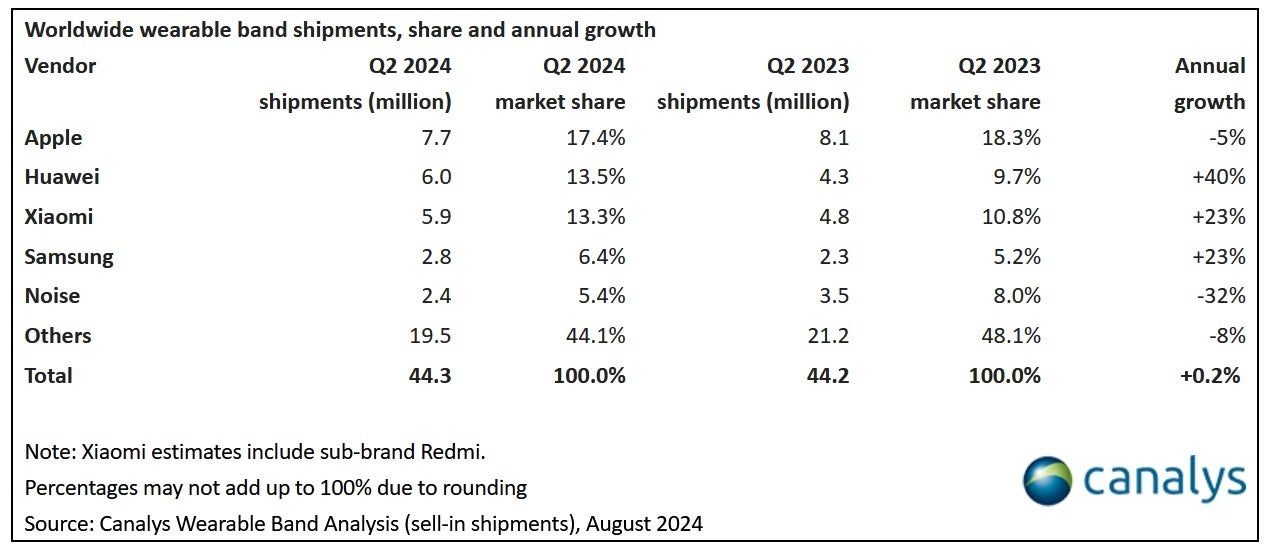

Throughout the second quarter of 2024, Apple emerged as the dominant player in the wearable bands market, shipping a total of 7.7 million units – a 5% decline compared to the previous year. With a significant lead, Apple held a commanding 17.4% market share. Huawei secured a significant position in the wearable bands market with 6 million shipments, accounting for 13.5% of the total industry output. China’s ailing tech giant saw a significant surge in wearable band shipments, with deliveries rising 40% year-on-year.

During the second quarter, a total of approximately 44.3 million wearable bands were shipped, representing a modest 0.2% year-over-year growth for the period.