According to a recent report by the Australian Taxation Office (ATO), more than 1,200 companies, including international and domestic knowledge firms, failed to pay taxes for the 2022-23 financial year.

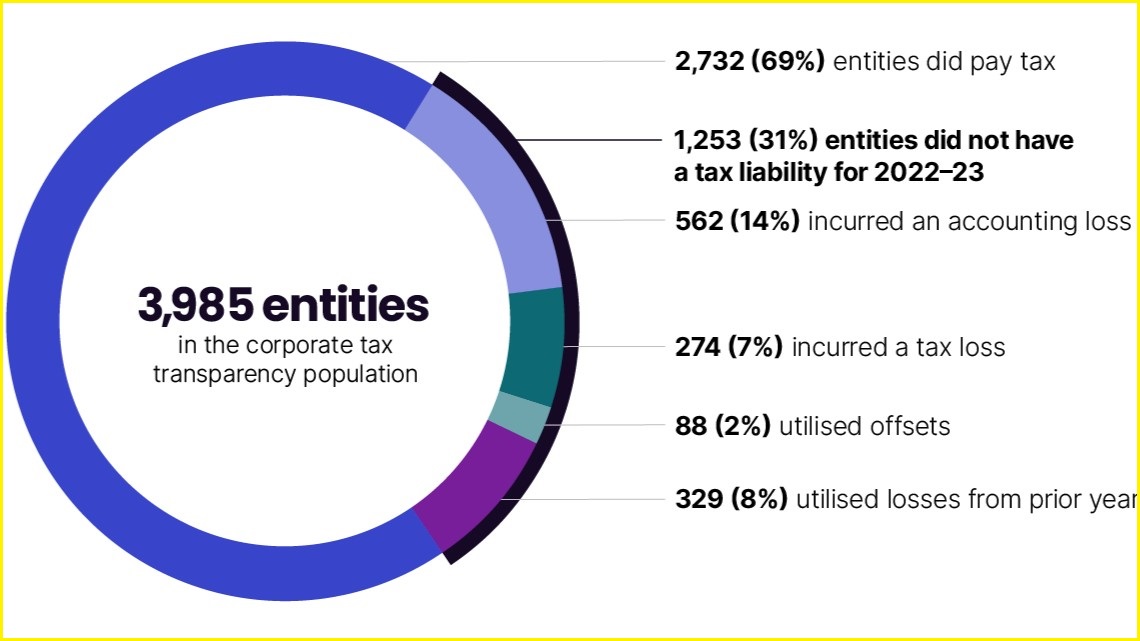

The Australian Taxation Office’s (ATO) tenth company tax transparency report revealed that nearly 30% of the 3,985 entities that lodged tax returns for the 2022-23 fiscal year did not pay any tax in Australia during that period.

Major companies that failed to pay taxes for 2022-23 include TPG Telecom, which generated $5.9 billion in revenue, Sony Australia, with earnings exceeding $1.5 billion, Netflix Australia, which made over $1.1 billion, and Canva, the Australian design giant, reporting revenues of more than $1.4 billion and taxable income of $69.9 million.

A number of smaller companies with negligible taxable income in the 2022-23 fiscal year were CyberCX, a cyber safety specialist, alongside Pattern Micro, Tesserant, and other IT firms like Datacom and telecommunications provider Superloop, as well as fintech agency Zip Co and Chinese technology giant Huawei Technologies.

Retrieve the comprehensive listing of entities from the ATO report below.

ATO Deputy Commissioner Rebecca Saint noted that the company had “points with the tech sector”, but highlighted in a press release that the ATO has witnessed sustained improvement in tax compliance from major corporations as it continues to combat tax evasion.

“While some organizations may have legitimate reasons for paying little to no revenue tax, our government remains vigilant in scrutinizing those who do not contribute to the public purse, ensuring that no one attempts to exploit loopholes or manipulate the system.”

Assistant Treasurer Stephen Jones advised ABC Information On Friday, determining multinational tax avoidance marked an enormous precedent for the federal government; yet, some corporations occasionally had valid reasons not to pay taxes.

“Companies may struggle to pay taxes due to financial difficulties – some are barely breaking even, while others have invested heavily in capital projects and are using profits to offset those expenses.”

“So, some key signs of healthy financial performance include significant capital investments, which can boost productivity.”

“As soon as avoidance tactics come into play, we’re all over it.”

The Australian Taxation Office’s latest data provides insight into the taxpayer compliance rate for 2022-23, showcasing which entities paid their dues and those that didn’t. Picture: ATO / Provided

Massive Tech’s revenue minimisation

The proportion of companies that paid zero corporate tax has declined significantly, plummeting from 36% in the Australian Taxation Office’s inaugural company tax transparency report for the 2013-14 fiscal year to 31% as of 2022-23.

Notwithstanding, major knowledge companies have consistently exploited loopholes in Australia’s corporate tax regime by employing sophisticated accounting strategies to minimize their liabilities beneath the country’s 30% corporation tax rate.

Microsoft’s Australian subsidiary, rather than its native knowledge centre enterprise, reported a significant tax burden in 2022-23, paying over $118 million in taxes despite generating $7.5 billion in revenue, with almost $400 million being subject to taxation.

Apple reportedly paid around $142 million in taxes for the 2022-23 period, despite generating an impressive AU$12 billion in revenue in Australia – a mere $481 million, or roughly 4%, of this sum was declared as taxable income.

Facebook Australia incurred almost $38 million in taxes on approximately $1.3 billion in revenue within the same fiscal year, whereas Google Australia paid a significantly higher tax bill of $124 million on revenues totaling around $2 billion, with its Google Cloud subsidiary contributing nearly $9 million in taxes on $158 million in revenue.

In the financial year 2022-23, Samsung Electronics Australia contributed a substantial amount of over $38 million in tax payments following its remarkable domestic revenue of almost $3.4 billion.

Massive corporations reported a record-high revenue tax payment of $97.9 billion for the 2022-23 financial year, representing a substantial 16.7% increase from previous years and the largest amount since reporting began, according to the Australian Taxation Office (ATO).

The surge in economic growth was largely driven by increased revenue from the mining, oil, and energy sectors.

According to Saint, the tax revenue from the oil and fuel sector reached a record high of $11.6 billion in 2022-23, with certain companies in this industry now ranking among Australia’s top taxpayers.

“This outcome was driven by a combination of commodity prices, the maturity of our manufacturing lifecycle, and timely ATO intervention.”

For the second consecutive year, the mining industry paid more taxes than all other sectors combined.

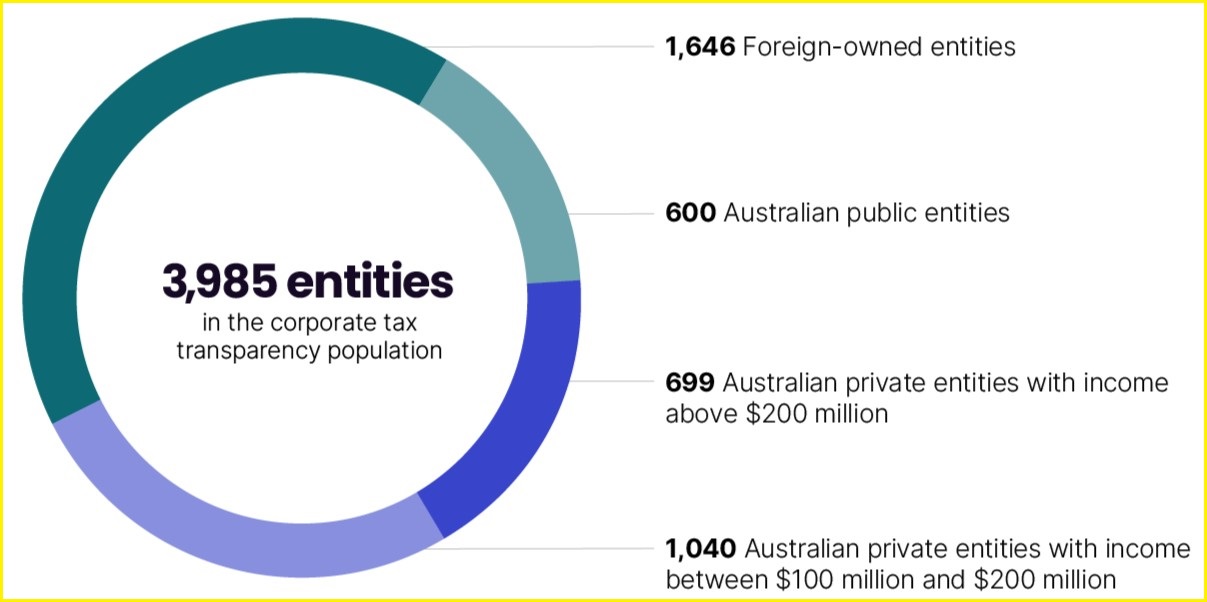

The Australian Taxation Office’s 2022-23 entity possession graph provides insight into the ownership structure of various companies at a specific point in time. Picture: ATO / Provided

ATO’s AI-based tax cheats plan

The Australian Taxation Office (ATO) recently detailed how it leverages artificial intelligence technologies to streamline operations and combat tax evasion effectively.

In its submission to a parliamentary inquiry into the use of AI programs by the general public sector on October 25, the company highlighted how it leverages AI “to process vast amounts of unstructured data, generate risk models that identify potential non-compliance, provide real-time prompts to taxpayers and draft and edit communications”.

The Australian Taxation Office (ATO) revealed that in a singular occasion, it employed pure language processing to process an astonishing 36 million documents, successfully identifying “entities of interest” and their connections.

“Since its inception in 2016, the initiative has yielded impressive results, successfully elevating more than $256 million in liabilities and securing over $65 million in funds by September 2024, according to recent statistics.”

The Australian Taxation Office (ATO) utilised AI to deliver real-time prompts to taxpayers through its MyTax platform, following completion of their tax returns. The system identified individuals with outstanding funds owed but considered “unlikely to pay on time”, according to the ATO.

The company leverages AI to enhance fraud prevention by cross-checking taxpayer-submitted information and identifying “excessive risk work-related expense claims that require substantiation”, thereby streamlining the verification process.