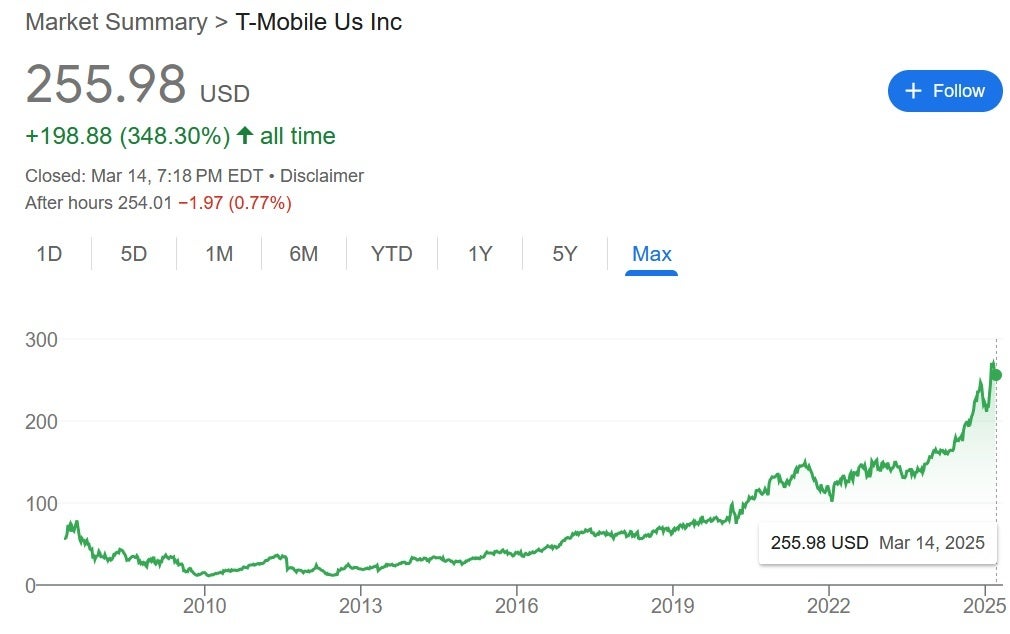

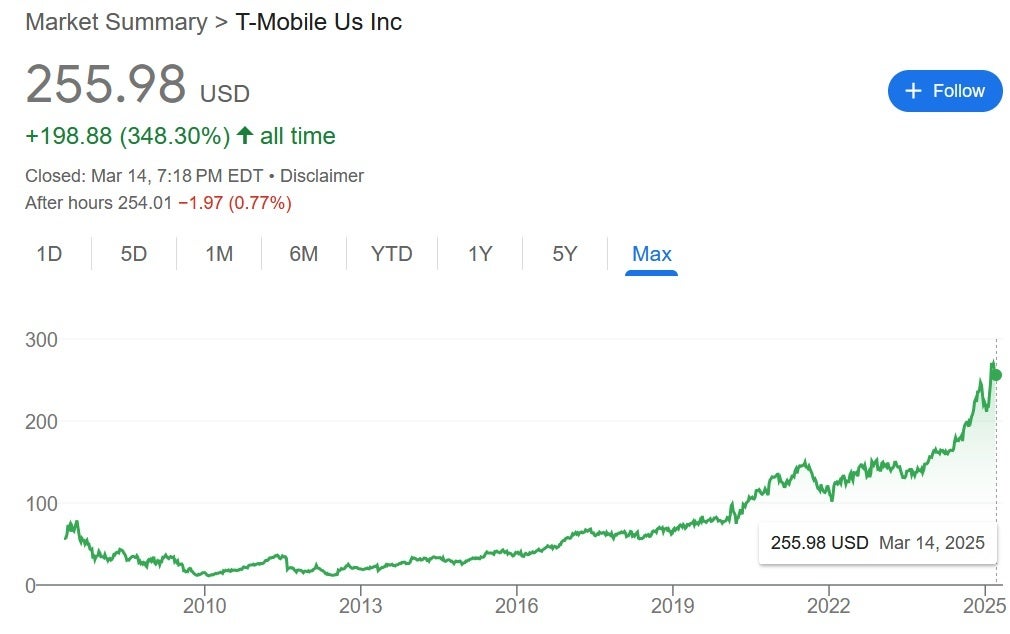

Since hitting a 52-week excessive of $276.49 final month, T-Cell‘s shares have dropped greater than $20 closing the week at $255.98. The shares declined $3.12 (1.2%) throughout common buying and selling hours on Friday. After hours on Friday, the inventory dropped some extra ($1.97 or .77%) to $254.01. What set off the selloff was a downgrade in T-Cell inventory by Citi analyst Michael Rollins who stated that the provider’s days of outperforming its rivals may quickly be over. Rollins minimize T-Cell to Maintain from Purchase whereas maintaining his goal worth of $268 the identical. A transfer to the goal would end in a 3% rise within the firm’s shares.

It has been a protracted and worthwhile run for T-Cell’s inventory. | Picture credit-Yahoo Monetary.

A technique that T-Cell might scale back that premium with out the shares declining can be by rising its market share or by buying a significant cable firm. As attractive as such an acquisition is likely to be for T-Cell, Citi’s Rollins says that such a pick-up would most likely finish T-Cell‘s progress and considerably dilute top-line income progress. During the last 12 months, T-Cell‘s shares are up 58.2% which is above the 55.9% rise pulled off by AT&T and the ten.33% acquire that Verizon took on. The S&P 500 is up 7.2% over the identical time span.

With a market capitalization of $293 billion, T-Cell is probably the most priceless of the three main wi-fi corporations based mostly on market cap. AT&T is valued at $190.7 billion adopted by the $183.4 billion that Verizon is valued at. Talking of AT&T, the corporate’s shares bought a shot within the arm yesterday once they acquired an improve from Raymond James analyst Frank Louthan. The latter affirmed his robust purchase ranking on the inventory whereas elevating his goal worth to $29 from $28. The inventory is already in a pleasant uptrend and provides you a 4.18% dividend yield when you look ahead to the inventory to rise.