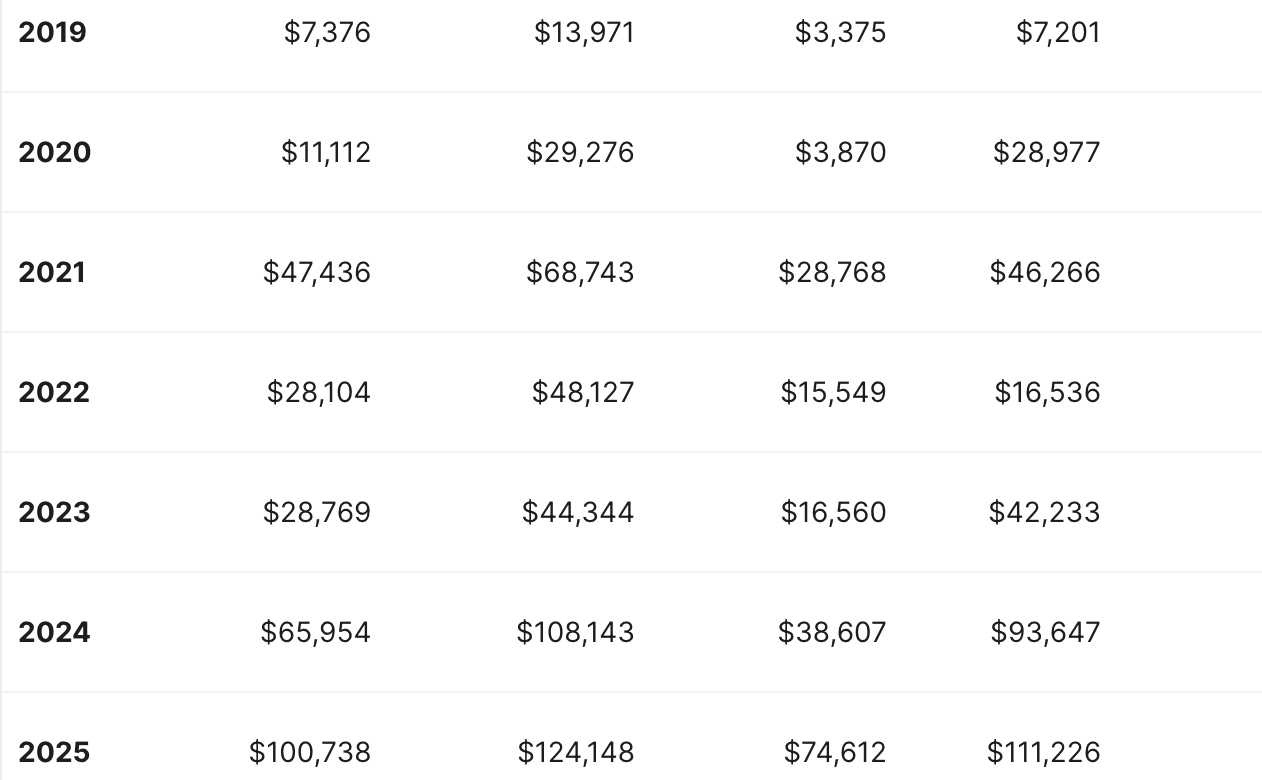

After the outcomes of the US elections in late 2024 and pro-crypto appointments in key authorities positions, the costs of a number of cryptocurrencies considerably elevated.

The value of Bitcoin, for instance, reached $108,143 in 2024, though its peak in 2023 was solely $44,344.

Nonetheless, the crypto market by no means stands nonetheless — what was price tens of 1000’s of {dollars} yesterday could also be price just some dozen at the moment or might utterly disappear into oblivion.

Due to this fixed volatility, crypto buying and selling and arbitrage methods usually really feel like a guessing recreation, with merchants ready for the precise second and second-guessing if their predictions will really repay.

In such an atmosphere, success usually depends upon velocity: the power to acknowledge and act on alternatives in simply milliseconds. One such technique merchants and builders have been experimenting with these days is triangular arbitrage.

Historic Costs of Bitcoin by Years, Coinlore

The values are organized within the following order: Worth → Max Worth → Min Worth → Shut.

What Is a Triangular Arbitrage Bot?

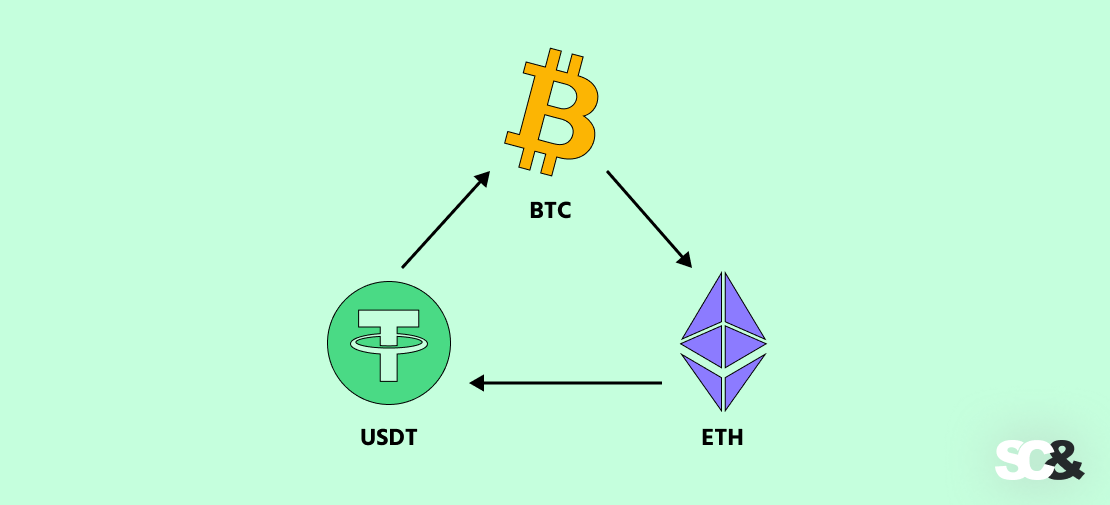

A triangular arbitrage buying and selling bot is software program that mechanically finds and makes fast trades between three completely different foreign money pairs on the blockchain (e.g., BTC, ETH, USDT) to make the most of small worth variations.

Right here’s the concept:

- A dealer begins with one coin, equivalent to BTC.

- The bot then trades BTC for ETH.

- After that, it trades ETH for USDT.

- Lastly, it trades USDT again into the unique BTC.

The Concept Behind a Triangular Buying and selling Bot

If the cycle ends with extra BTC than the dealer began (after charges), the bot has made a revenue.

This profit extraction is made doable by the truth that crypto markets are fragmented throughout exchanges, and costs incessantly deviate. But, these prospects often final solely a fraction of a second, and with out the assistance of a bot, it might be virtually unattainable for a dealer to earn on market inefficiencies.

How a Bot Works: Well-liked Triangular Arbitrage Methods

Triangular crypto arbitrage bots can be utilized in some ways, relying on the platform and the style wherein merchants need to commerce.

1. On One Crypto Alternate

That is the commonest setup and often the simplest to manipulate: the bot appears for worth misalignments between all pairings out there (e.g., BTC/ETH, ETH/USDT, BTC/USDT) on the identical change.

As all of the trades are being completed inside one spot, the merchants don’t want to maneuver cash from one level to a different, and thus the trades could be executed in a short time.

Instance: If 1 BTC → 15 ETH, 15 ETH → 30,500 USDT, and 30,500 USDT → 1.01 BTC, the dealer finally ends up with a 1% revenue cycle.

2. On A number of Exchanges

Bots also can function between two or extra platforms, benefiting from liquidity gaps: if, let’s say, ETH is cheaper on Alternate A and pricier on Alternate B, the bot should purchase low on one and promote excessive on the opposite platform.

Regardless of all its obvious simplicity, shifting funds between exchanges can eat into income. To get round this, many merchants pre-fund accounts on a number of markets so trades could be made on time.

Instance: If ETH is $2,010 on Alternate A and $2,020 on Alternate B, the bot can seize the $10 unfold per coin.

3. In DeFi (Decentralized Finance)

Decentralized exchanges (DEXs), equivalent to Uniswap, SushiSwap, or Curve, provide one other playground for arbitrage bots: as a result of DEX costs are set by liquidity swimming pools and automatic market makers (AMMs), worth slippage between swimming pools usually creates arbitrage alternatives.

Additionally, bots in DeFi can use flash loans, which let merchants borrow giant quantities of crypto with out collateral, so long as the mortgage is repaid in the identical transaction. This enables arbitrage with virtually no upfront capital.

Instance: A bot might borrow 1,000 ETH by way of a flash mortgage, run a three-step arbitrage commerce throughout swimming pools, immediately repay the mortgage, and maintain the leftover revenue.

Advantages of a Crypto Triangular Arbitrage Bot

In keeping with the analysis, some sorts of triangle arbitrage methods accounted for round 2.71% of all trades on Binance. However why do an increasing number of merchants go for triangular arbitrage cryptocurrency buying and selling?

One of many largest benefits of utilizing a triangular arbitrage crypto bot is its skill to automate buying and selling and work at unimaginable velocity and accuracy.

On the identical time, it removes the emotional aspect of buying and selling. In contrast to human merchants, who might hesitate or act on concern and greed, the crypto buying and selling bot depends purely on logic and predefined situations.

One other vital profit is that the bot by no means rests. Crypto markets run continuous, and whereas no particular person can keep alert across the clock, a bot can monitor markets 24/7 and make the most of fleeting alternatives at any time of the day or night time.

Lastly, triangular arbitrage is commonly thought of a comparatively low-risk strategy in comparison with common buying and selling, as a result of it doesn’t rely on whether or not a coin’s worth goes up or down.

As an alternative, the bot merely exploits momentary mismatches between foreign money pairs. Whereas charges, slippage, and market competitors can nonetheless have an effect on outcomes, a well-designed bot may help merchants seize income with much less publicity to conventional market dangers.

Important Parts & Structure

A crypto triangular arbitrage bot isn’t only a easy script that trades — it’s a system made up of a number of parts that work collectively to identify alternatives and act on them quick.

- Market Knowledge Assortment: The bot wants a continuing stream of dwell market information to operate. It attaches itself to change websockets or APIs to obtain order e-book data and costs in actual time.

- Alternative Detection: This module checks 1000’s of doable three-currency loops and calculates if going by way of them will deliver a revenue after fee charges. For instance, it would try BTC → ETH → USDT → BTC and see when you have extra BTC than if you began. To preserve time, the bot could be set to ignore feeble indicators, as an example, something with lower than a 0.2% revenue margin.

- Execution Engine: When a worthwhile alternative is discovered, the bot wants to answer it. The execution engine carries out trades within the correct order as quick as doable. Some programmers even colocate their bots subsequent to change servers in an effort to cut back lag, as a matter of some milliseconds would possibly lead to revenue or loss.

- Danger Administration: Not each probability must be taken. Charges, illiquidity, or wild worth fluctuations can flip a “worthwhile” commerce right into a loss. The chance administration module double-checks each commerce and prevents it from being executed if there isn’t sufficient liquidity or costs exceed a specified tolerance.

- Monitoring & Logging: All bot actions ought to be recorded: time of commerce, revenue/loss, charges, and errors. Such vigilance permits for efficiency monitoring and may show outcomes or spot issues, equivalent to a excessive failed commerce charge.

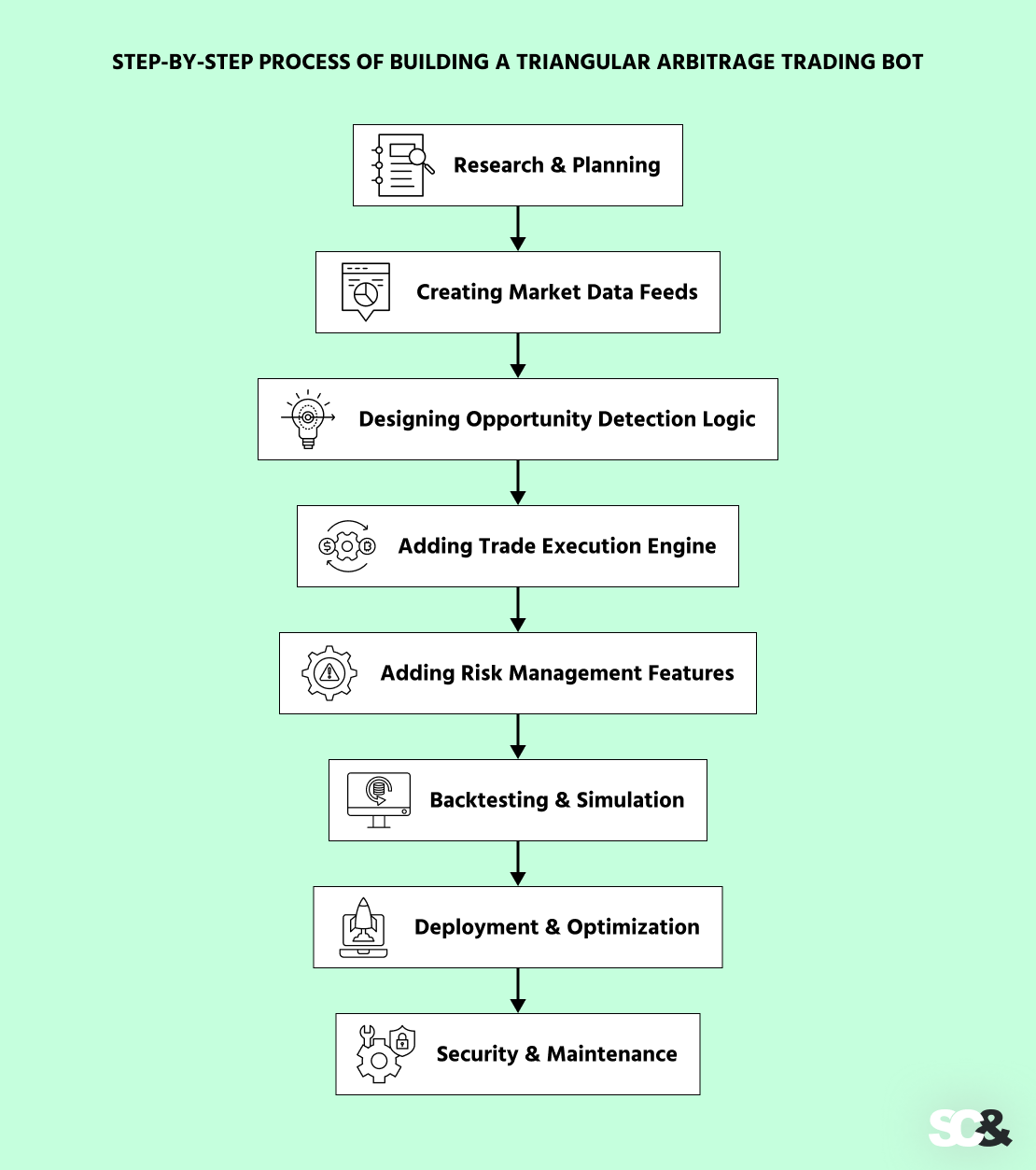

Step-by-Step Improvement Information

Constructing a crypto buying and selling bot is all the time a step-by-step course of. Whereas every developer or staff might do it a bit in a different way, that is what often occurs:

1. Analysis & Planning

Planning all the time comes first earlier than coding. Stakeholders often determine which exchanges to enter, which pairs to give attention to, and what revenue margins to focus on. For instance, some builders might give attention to liquid pairs like BTC, ETH, and USDT, however others might embody smaller tokens if they’ve extra interesting arbitrage spreads.

2. Creating Market Knowledge Feeds

The following step entails connecting to exchanges by way of APIs or websockets that enable the bot to get dwell worth feeds. Since arbitrage alternatives are fleeting, builders use exchanges with good, low-latency information feeds.

3. Designing Alternative Detection Logic

When information is flowing, programmers develop algorithms that discover doable triangular loops and calculate potential income after fee. This step additionally entails including guidelines to omit cycles too tiny to be price buying and selling.

4. Including Commerce Execution Engine

Right here, programmers create a module that may submit and perform trades one after the other, sometimes using asynchronous programming to put a number of orders with out dropping time.

5. Including Danger Administration Options

Even the perfect prospects can fizzle resulting from slippage or liquidity. Subsequently, builders add an inherent danger filter into the situations checked by the bot earlier than every commerce.

6. Backtesting & Simulation

Earlier than going dwell, the bot is usually examined on historic information or run in simulation mode with dwell information however with out really performing trades. General, software program testing confirms that the detection logic works as wanted and that the execution engine can tolerate any market situations.

7. Deployment & Optimization

After testing, the bot is deployed to run dwell. However usually, this isn’t all. Over time, builders sometimes work on enhancing the detection logic, modifying revenue boundaries, and adjusting efficiency.

8. Safety & Upkeep

Lastly, the bot is hardened for safe, long-term use. Builders safeguard API keys, arrange entry privileges, and apply common updates to stay in sync with change API modifications.

Step-by-Step Strategy of Constructing a Triangular Arbitrage Buying and selling Bot

To get a head begin and cut back growth time, you should utilize instruments like SCAND’s Bot Starter Package, which offers ready-made frameworks and parts for making crypto buying and selling bots approach quicker. It’s an effective way to give attention to technique moderately than beginning solely from scratch.

Challenges & Danger Elements

Whereas triangular arbitrage crypto bots in look could be profitable, they’re fraught with challenges. One of many largest is competitors — an excellent many different bots have a look at the identical markets on the identical time. By the point your bot tries to behave, the chance might already be gone.

Transaction value is an equally vital consideration. As a result of the arbitrage income are often so small, charges or slippage can shortly flip a successful commerce right into a loser. That’s why the bot all the time has to calculate internet revenue earlier than it does a commerce.

Latency isn’t any much less vital. Alternatives don’t last more than milliseconds, and even tiny delays in receiving worth updates or submitting orders can remove potential income.

Exchanges additionally carry dangers. Outages, withdrawal restrictions, or API throttling could cause trades to be lower off in mid-cycle. If one leg of the commerce falls by way of, the bot would possibly discover itself with an undesirable place.

In observe, all this implies is that whereas a bot might discover 1000’s of potential alternatives in a day, solely a handful of them really develop into worthwhile after adjusting for charges, slippage, and the dangers of execution.

Future Tendencies & Superior Buying and selling Methods

Sooner or later, conventional triangular arbitrage bots, which now scan 1000’s of foreign money combos utilizing brute-force strategies, will barely sustain with quicker and extra aggressive markets. AI-driven strategies are going to alter this.

As an example, one of many anticipated improvements might be Graph Neural Networks (GNNs), which is able to deal with exchanges and foreign money pairs as a community of related factors, permitting bots to identify worthwhile triangular cycles in actual time.

GNN-powered bots will be capable of shortly filter out trades that aren’t price executing and adapt to altering market situations, giving them a transparent benefit over older strategies.

One other development might be reinforcement studying that, along with GNNs, will outline the following technology of bots. As anticipated, these bots won’t solely react to the market however may even study and anticipate worthwhile cycles, turning into quicker and smarter than ever earlier than.

Ceaselessly Requested Questions (FAQs)

What makes triangular arbitrage completely different from common arbitrage?

Common arbitrage appears for worth variations between two markets, whereas triangular arbitrage finds variations between three foreign money pairs, often inside one change or between exchanges.

How a lot capital do I want?

You can begin small (roughly $100 to check), however to have a big revenue, you will often want $10,000 or extra to have sufficient liquidity for transactions.

Which exchanges are finest for triangular arbitrage?

Excessive-liquidity exchanges with low charges are supreme. Well-liked selections embody Binance, Kraken, and KuCoin.

Is triangular arbitrage nonetheless worthwhile in 2025?

Sure, however competitors is hard. Success depends upon optimizing your bot, decreasing delays, and managing charges fastidiously.

How do charges and slippage have an effect on income?

Modest features are sometimes eaten up by charges and slippage. But, a very good bot all the time elements in buying and selling charges, community charges, and worth actions earlier than it locations a commerce.

Need to profit from cryptocurrency market gaps? Group up with SCAND, and we’ll provide help to construct a customized triangular arbitrage bot to catch alternatives as they occur.