Apple’s Chief Monetary Officer, Kevan Parekh, has testified at a UK trial, disputing claims by the prosecution that the corporate has a 75 % revenue margin on its App Retailer for iPhone and iPad.

The seven-week trial occurring in London is more likely to the be the primary case in a sequence of assaults on numerous Huge Tech corporations and their numerous paid providers or app shops. The case is being heard by the UK’s Competitors Enchantment Tribunal.

Antitrust and shopper advocates within the case say that as a result of the iPhone and iPad app shops are the one approved retailers for acquiring apps and providers on these platforms, they represent a monopoly. The lawsuit, filed on behalf of 20 million UK Apple customers, says that this monopoly permits Apple to cost a regular 30 % fee, resulting in inflated prices for customers.

Apple has rebutted the costs, noting that 84 % of the apps within the App Retailer are free, and thus builders pay Apple nothing in fee. These apps usually maintain their prices by operating advertisements inside the software.

Apple’s reduce of App Retailer gross sales

Paid apps and in-app purchases are topic to the 30 % payment, however recurring subscription apps pay solely a 15 % fee after the primary 12 months. Apple modified this rule barely in late 2020, giving builders with lower than $1 million in annual income a cap of 15 % fee.

The corporate has additional identified in its submitting that it considers the charges honest, noting that different app shops have comparable fee charges. It notes that the commissions cowl the price of the shop and providers supplied to builders — comparable to safety, promotion, and the event of digital instruments for entry.

Barrister Michael Armitage, representing the claimants, pointed to proof cited in a separate however comparable case by the Division of Justice within the US as the premise for the 75 % profitability declare. He additionally engaged an knowledgeable accountant on behalf of the UK lawsuit, who got here up with an identical determine, in accordance with the Monetary Occasions.

In his testimony on January 16, Parekh attacked the prosecution’s declare of such a excessive revenue margin, saying each that the 75 % declare “wasn’t correct,” and likewise prompt that separating out App Retailer income from Apple’s built-in providers was all however unimaginable.

“I feel it is attainable to do a directional estimate” of the App Retailer’s profitability, he stated. Parekh testified that there have been too many “oblique prices” that the corporate couldn’t allocate to “particular services or products.”

In response to the barrister’s skepticism, Parekh stated that “any try to allocate most of these prices would contain imprecise and subjective judgments.” The prosecution identified that Apple was claiming that determining the revenue margin of the App Retailer by itself was primarily unimaginable.

The case towards Apple’s App Retailer charges

The case within the UK is being led by digital economic system specialist and lecturer at King’s Faculty Dr. Rachael Kent. The category of claiments are looking for 1.5 billion kilos (round US $1.82 billion) in damages on behalf of App Retailer prospects.

Kent stated in an announcement that Apple has “no proper” to cost such a major fee payment — “notably when Apple itself is obstructing our entry to platforms and builders which can be in a position to provide us a lot better offers.”

It is not clear why Kent believes that Apple has no proper to cost what it needs. It very clearly does — till the legal guidelines about platform accessibility get modified.

“Apple achieves this by slapping unjustified prices on its customers,” she stated in her submitting, stating that world App Retailer revenues topped $15 billion in 2021. “It will not have the ability to impose these exorbitant prices if competitor platforms and cost methods had been allowed to compete on its units,” the transient famous.

Apple’s attorneys have countered that the App Retailer’s integration into iOS enhances consumer privateness, safety, and the worth of a seamless expertise, and disputed the prosecutions estimate as flawed.

Will customers use various app shops?

In contrast, the European Union dealt with this matter otherwise, by passing laws that mandates that Apple enable various app shops — though so far, the outcomes are decidedly blended. Below the EU’s Digital Markets Act, Apple is allowed to create guidelines and tips for various app shops.

Apple, in an announcement, stated that its strategy to the DMA is guided by two elementary objectives: “Complying with the legislation, and lowering the inevitable, elevated dangers the DMA creates for our EU customers.”

In keeping with Apple’s assertion, “that meant creating safeguards to guard EU customers to the best extent attainable and to reply to new threats, together with new vectors for malware and viruses, alternatives for scams and fraud, and challenges to making sure apps are purposeful on Apple’s platforms.” The corporate added that regardless of this effort, “these protections do not get rid of new threats the DMA creates.”

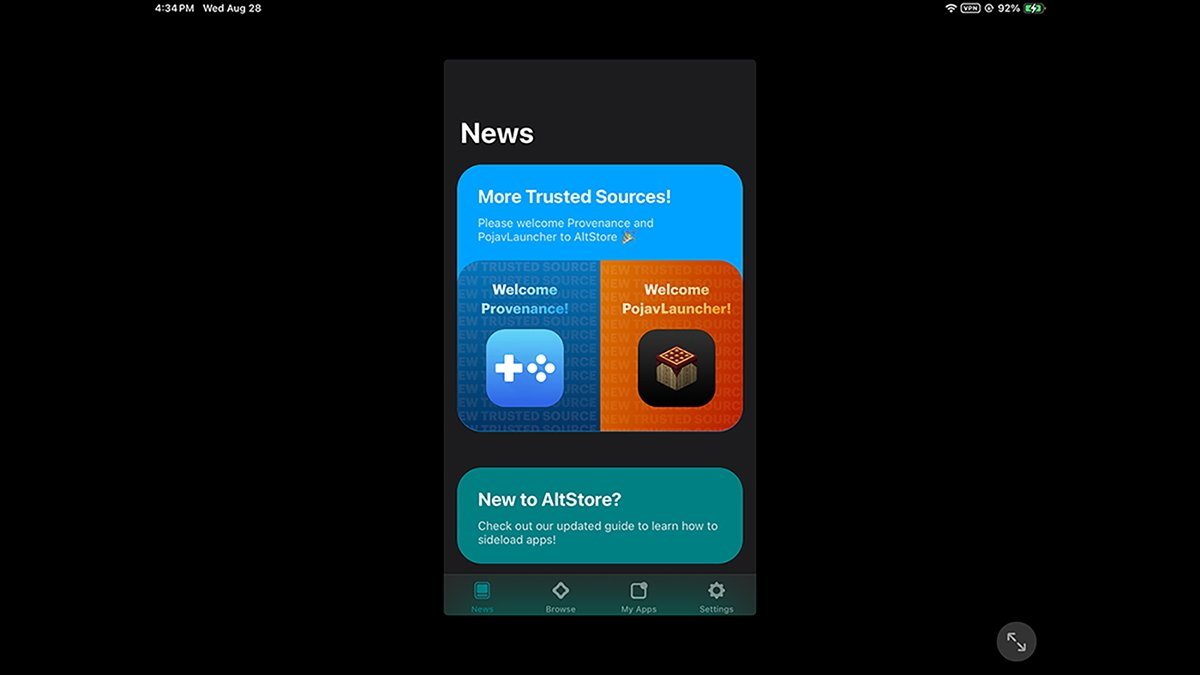

Regardless of these restrictions, no less than 4 various app shops are working within the EU. The most effective-known examples are Riley Testut’s AltStore, and the Epic Video games Retailer.

Apple continues to be in a position to evaluate any apps provided on these various shops to verify they adjust to Apple’s security and safety guidelines, a course of it calls “notarization.” And, there are nonetheless charges.

The choice shops should additionally pay Apple a Core Know-how Price of about half a Euro (round 51 cents US) after the primary million installs of a paid app, and for each new obtain of a paid app after the primary million.

Different various app shops embody the games-focused Aptoide, productivity-focused Setapp Cell, and Buildstore. The latter two use a month-to-month subscription mannequin to entry their curated collections of apps.

On the whole, apps which can be utterly free usually are not topic to any charges or restrictions, or as within the case of Setapp Cell, the apps are included as a part of the month-to-month subscription. It’s so far unclear how profitable these two EU various shops have been, as they don’t seem to be required to report gross sales figures or income exterior of the EU.

The UK trial is predicted to final for roughly seven weeks. Comparable circumstances towards Alphabet, Meta, and Microsoft are anticipated within the US and UK later in 2025.