By the end of 2024, the value of private financial instruments, specifically in banking and financial services, has significantly increased. The proliferation of private monetary software programs has significantly impacted our daily lives.

By having our app installed on your smartphone, you’ll be able to easily monitor and manage your expenses in real-time, create personalized budgets, and receive timely notifications for important financial milestones or gift-giving occasions.

Beyond traditional financial tools, private finance instruments provide a wide range of benefits to customers, allowing them to manage bills, mitigate risks, grow savings, access credit and loans, and secure insurance coverage – both in physical and digital formats.

This article delves into the technical nuances of the private finance app development process, shedding light on the costs and complexities involved.

Join us along the journey as we share new insights and valuable information that will guide you alongside the way. Regardless of whether you choose to tackle the issue independently or seek assistance, having all necessary information at your disposal will make the task manageable. Wishing you success on your journey!

What’s a Private Finance App?

Private finance apps function similarly to private caregivers, fostering both financial stability and mental tranquility in their users. These functions enable users to abandon outdated units and facilitate budgeting, spending, and financial planning across both physical and digital platforms.

In this era of unparalleled technological advancement, where every process seamlessly unfolds within the digital realm, bolstered by the power of artificial intelligence (AI) and machine learning, the decision to create a personalized financial application for your organization seems an obvious and rational choice.

As the private finance app market experiences immense demand, it’s essential to examine key statistics to gain a comprehensive understanding of areas requiring enhancement and opportunities for innovation.

Following the TEM journal’s August 2024 research, households with a keen sense of fashion are increasingly seeking guidance to track their income and daily expenses, make informed investment decisions, create realistic budgets, and constructively organize their financial strategies.

Achieving complete control over one’s finances is a significant milestone on the path to realizing financial freedom. The emergence of these innovative solutions yields substantial boosts to both personal and corporate endeavors, thereby driving market dominance and stimulating exponential enterprise growth.

By 2023, the global private finance administration functions market is projected to reach $1.23 billion, with a predicted growth trajectory that would see it surpass $1.61 billion by 2030, driven by increasing demand for efficient financial management solutions. Therefore, this could be a compelling catalyst for entrepreneurial success.

Private Cash Administration Software Trends in Building Personal Finance Apps

Research in the Journal of Financial Schooling and Entrepreneurship reveals significant potential to scale a personal finance app development business among Generation Y users.

By leveraging private finance apps to track expenses, create household budgets, and manage financial offers, individuals, especially Millennials, can curate their personal lives by executing numerous tasks simultaneously, responding to their dynamic needs and diverse financial demands.

Information security and personal privacy are the paramount concerns for millennials when utilising fintech applications. The utmost priority is ensuring the confidentiality of personal data and protecting individual privacy. For developer groups, a significant opportunity exists to further enhance and upgrade their safety programs and privacy practices.

What are the defining characteristics of Gen Z, the next-generation customers? Here’s a revised version: For builders and companies seeking insights into the driving forces behind this generation’s behavior, understanding statistics on their motivations can be particularly valuable.

As the financial landscape undergoes rapid transformations, fintech companies, banks, personal financial planning software, and mobile app developers catering to Generation Z’s preferences have witnessed an uptick in engagement from these digitally savvy consumers.

Accordingly, Generation Z plays a crucial role in the prosperity of personal financial applications, accounting for a significant portion of customers for banking institutions and financial technology companies.

Among their top priorities are ensuring inclusive, safe, and accessible economic opportunities for all. For entrepreneurs, this implies additional factors to take into account when developing a personal finance app.

As a notable trendsetter among multiple high-spending generations worldwide, Zoomers are driving innovation in private finance apps alongside their Gen Y counterparts.

The company aims to enhance its private finance app by introducing tech function traits that improve user experience and drive business growth. Key areas of focus include AI-driven budgeting tools, personalized financial planning, and seamless integration with existing bank accounts. To achieve this, the development team will leverage machine learning algorithms, natural language processing, and APIs to create a seamless and intuitive interface.

To stay attuned to the needs and priorities of prospective users for your personal finance app, it is crucial to track the technological trends surrounding private financial software development. This will aid you in constructing answers that meet the requirements of future customers.

As a consequence of increasing efficiency and leisure time, the private apps sector is poised for remodelling to accommodate emerging trends.

- AI and machine studying

- Digital help bots and chatbots

- Open banking options integration

- Blockchain applied sciences

- Gamification

- Person-centric person interface

Sorts of Private Finance Apps

When it comes to managing your finances, a personalized approach is the most effective way to achieve success. Private finance apps abound in various types, each crafted to address specific needs and goals.

On-line Cost Companies

Developing your app in this space comes with a significant amount of competition from established companies. It’s wise for your customers to invest in developing personalized financial software solutions. While traditional banking systems remain rigid in their financial transaction processes, a window of opportunity opens up for innovative approaches that can seize the initiative.

On-line Banking

Developing a personal finance app with such features could be an astute decision, given that traditional financial institutions are increasingly shifting their services into the digital realm. Private nets and cellular finance apps will likely reign supreme in the software landscape.

Crypto Wallets and Crypto Platforms

Cryptocurrencies are revolutionizing the global financial landscape at an unprecedented pace. Many companies and investors are drawn to creating and holding wealth through cryptocurrencies. You won’t make a mistake by selecting the cryptocurrency wallets to build your own personal digital currency management system?

Insurance coverage Tech

The expertise comprises digital insurance coverage firms, leveraging a cutting-edge tech stack that integrates AI, blockchain, big data, and more to deliver enhanced insurance solutions to customers.

Compliance has never been more accessible: The Top Apps for Meeting Regulatory Demands

To grasp the essence of private finance apps, examine leading players in the industry, and consider integrating their best practices into your strategy.

- Mint: The most exceptional and outstanding free application available for tracking one’s budget.

- Prism Finance: Streamline Your Payments, Simplify Your Finances – Cash Tracker: Monitor Every Dollar The app significantly enhances the functionality of a comprehensive private finance application. You can easily synchronize your application with numerous billing providers.

- Spendee: Considering this instrument’s features is often a wise decision in managing your family’s joint expenses, particularly when shared by multiple household members.

- EveryDollar: This comprehensive app offers unparalleled capabilities for managing your finances, allowing you to track every transaction with precision.

Here are several private finance software programs to keep an eye on:

(Note: The original text is rewritten in a more formal and polished tone.)

- PocketGuard: Funds Tracker

- NerdWallet: Handle Your Cash

- Each Greenback: Funds Tracker

- GoodBudget: Funds and Finance

- Mobills: Funds Planner

- Funds Planner: Expense Tracker

What are the key steps to constructing a private finance app?

1. Determine the target audience and their financial goals: Identify who will be using the app and what they hope to achieve by managing their finances digitally.

2. Design the core features: Develop a comprehensive list of essential features that users need, such as budgeting, expense tracking, investment portfolio management, credit score monitoring, and bill reminders.

3. Choose a programming language and development framework: Select the most suitable programming language (e.g., Java, Python) and development framework (e.g., React Native, Flutter) for building the app, considering factors like scalability, reliability, and ease of maintenance.

4. Develop the user interface: Design an intuitive and visually appealing user interface that provides a seamless user experience, incorporating features such as drag-and-drop budgeting, customizable charts, and easy-to-read financial reports.

5. Implement data storage and security measures: Ensure that sensitive financial information is securely stored using encryption and access controls, adhering to industry standards for data protection (e.g., GDPR, HIPAA).

6. Integrate with external financial institutions and services: Partner with reputable banks, credit card companies, investment platforms, or other financial entities to enable seamless data integration and automatic transactions.

7. Conduct thorough testing and quality assurance: Thoroughly test the app on various devices, operating systems, and networks to ensure that it functions flawlessly and identify potential issues before release.

8. Launch and maintain the app: Release the private finance app through popular app stores (e.g., Apple App Store, Google Play) and continue to update and refine the app based on user feedback, market trends, and emerging financial technologies.

As your organization has already reaped numerous benefits and profits from developing bespoke financial software for consumers, it is now imperative to focus on refining this successful strategy. Unlock the full potential of our step-by-step approach to crafting a cutting-edge private finance app.

1. Visualize Your App’s Client

Getting to the heart of your target audience enables you to craft a highly effective and user-focused personal financial tool. Our solution effectively supports customers in achieving their goals while ensuring the confidentiality of their personal data. The demographic trends must be examined to gain insight into the population’s characteristics.

Consider focusing on your person’s desires, routines, surroundings, and more. As promptly as required, assess the accuracy of the bullseye and report the results from the firing.

2. Dive into the Opponents’ Space

Dive into the competitor’s space? Competition includes major players such as PayPal, Stripe, Square, and Intuit, among others. These companies offer a range of financial services and tools, including payment processing, invoicing, expense tracking, and budgeting. This pivotal survey aims to uncover the most sought-after features that your prospective customers crave, thereby enabling informed decisions on which opportunities to capitalize on and propel your business to new heights in the industry.

3. The predominant problem to sort out?

Can data analytics and machine learning algorithms be leveraged to predict users’ financial behavior and provide personalized recommendations? Can predictive modeling be utilized to forecast income and expenses, enabling users to make informed decisions about their spending habits? How can natural language processing (NLP) be applied to streamline budgeting and accounting tasks by analyzing and categorizing transactions? With a focus on seamless integration, we can streamline the UX by leveraging our robust tech stack, including Node.js, React, and MongoDB, to create an intuitive and inviting experience for users.

4. Safety Precedence

For Generation Y and Generation Z users of the most popular personal finance apps, privacy and the safeguarding of sensitive personal data assume paramount importance?

To further elevate customer safety, consider incorporating these best practices.

- Apply two-factor authentication. By incorporating two stages of identification, this system fosters a more secure and reliable individual authentication experience.

- Set a definitive timeframe for each session’s duration.

- Establish a comprehensive framework for safeguarding sensitive business information by implementing both customary and normal information safety regulations.

- Avoid displaying your customers’ personal information publicly in open areas. Without any embellishments, a lack of vibrant coloration and catchy fonts is truly unhelpful.

5. Which private finance app fundamental options do you prefer?

1. Budgeting: Create a budget that tracks your income and expenses to manage your financial resources effectively.

2. Invoicing: Send professional-looking invoices to clients for services rendered, making it easier to get paid on time.

3. Expense Tracking: Log your daily expenses, categorize them, and analyze patterns to make data-driven decisions.

4. Investment Management: Invest in stocks, bonds, ETFs, or cryptocurrencies, and track their performance in real-time.

5. Credit Score Monitoring: View your credit score and report to stay informed about changes that may impact your financial health.

6. Bill Reminders: Set reminders for upcoming bills and payments, ensuring you never miss a payment due date again.

7. Budgeting Alerts: Receive notifications when you go over budget or spend more than intended, helping you stay on track.

8. Financial Goal Setting: Set specific financial goals, such as saving for a down payment on a house or paying off debt, and track progress towards achieving them.

Which ones are must-haves in your private finance app?

Spark the trajectory of personal financial empowerment through a comprehensive suite of features: budgeting tools that track expenses and categorize transactions; investment portfolios that diversify assets and monitor performance; credit score monitoring that offers actionable insights for improvement; bill reminders that ensure timely payments; savings goals that provide a roadmap to financial milestones; and educational resources that equip users with the knowledge and confidence to take control of their financial journey. Take into account the next:

- To safeguard customer data from potential breaches.

- To incorporate and refine essential confidential information securely.

- To observe cash transfers in real-time.

- What prospects lie ahead? Insights into forthcoming financials, expenditure trends, and vital developments.

- To ensure seamless accessibility to authorized users only through a secure and user-friendly login process.

You’ll have the ability to enhance your personal finance application by incorporating additional features such as AI-powered chatbots, seamless connectivity to external financial institutions, advanced calculations, barcode scanning capabilities, and many other innovative functionalities.

6. What drives innovation in software development?

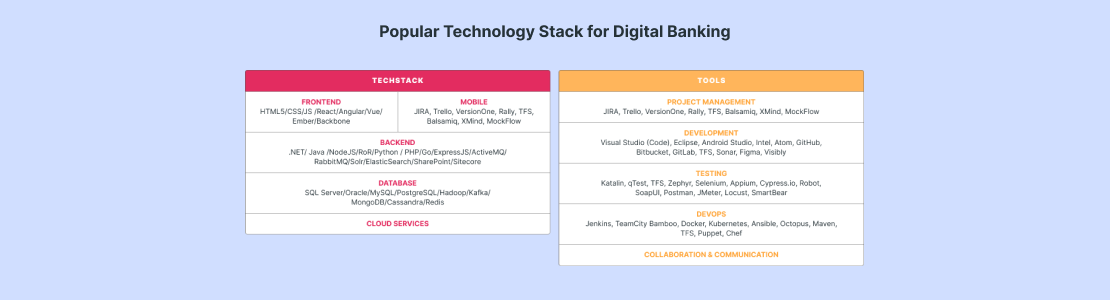

Optimum Applied sciences and Databases, a leading provider of cutting-edge software solutions, is revolutionizing the industry with its data-driven approach. By harnessing the power of big data analytics, AI-powered databases, and agile methodologies, they enable businesses to make informed decisions, streamline operations, and stay ahead of the competition.

Their expertise in applied sciences has resulted in game-changing innovations that have transformed industries. From optimizing supply chain management to streamlining financial transactions, their solutions have made a tangible impact on business outcomes.

What sets them apart is their dedication to staying at the forefront of technological advancements. They continuously invest in research and development, ensuring their clients receive the latest and greatest in software technology.

In an era where data is king, Optimum Applied sciences and Databases is the trusted partner for businesses seeking to unlock its full potential.

Considering the tech stack, we should factor in associated programming languages, databases, and frameworks that harmonize with specific programming languages employed.

- Designs of entrance-end utility applied sciences create a palpable and sensory interaction with the user. Typically, this stack comprises a combination of HTML, CSS, and JavaScript.

- The backend plays a pivotal role in constructing the foundation of your application, exerting control over optimal data loading, ensuring information security, and facilitating seamless cash transactions. Languages such as Ruby, C++, Python, Kotlin, and Node.js are crucial determinants.

- Databases require robust security measures to safeguard sensitive data and respond swiftly to users’ inquiries to ensure seamless operations. Which technology stack best fits your project?

- When designing a comprehensive personal finance application, incorporate API integrations to enhance the user experience and facilitate seamless data exchange.

7. Straightforward-to-Use UX

The effective application of scientific principles to ensure seamless and secure utilization of a personal financial app is crucially important. A harmonious blend of user-centric design, driven by a deep understanding of UX expertise, coupled with intuitive UI elements, can propel your app to unparalleled heights.

While prioritizing safety, avoid using extremely bold font styles and bright colour schemes. The clarity of the user interface demands that the nuances of shading and color take precedence.

Presenting complex information in a controlled manner is crucial; avoid overwhelming customers by breaking down data into manageable chunks, fostering clarity through a consistent delivery format.

8. Testing and High quality Assurance

The stage is set positively not to be skipped. Whenever customer data within your private finance app becomes mislaid or compromised, all prior efforts are rendered futile.

So, dedicate unwavering effort to rigorous testing and verifying the highest standards of quality across all event tiers: meticulous safety assessments, unyielding integrity checks for information, user-friendly usability evaluations, comprehensive purposefulness and efficacy testing, ensuring flawless execution from start to finish. Alternatively, .

Once all bugs and shortcomings are thoroughly addressed, the application will be made available in the app stores.

Users should have access to personalized financial goals and planning tools that provide tailored advice on investment strategies, budgeting, and debt management. Additionally, the app could offer educational resources and workshops on topics such as cryptocurrency trading, retirement planning, and entrepreneurship. Furthermore, it would be beneficial for users to receive alerts and notifications regarding market trends, economic shifts, and changes in their financial status.

Private finance apps offering preferred functions include Mint (free, with optional paid upgrades), NerdWallet (free), Buxfer (free, with paid plans available), Goodbudget (free, with paid options), EveryDollar, Mvelopes (free, with optional paid updates), Primis, Spendee, and Funds Planner – all boasting free versions.

Some apps offer free trial versions, while others do not. However, unlocking the full potential of scaling and selling a private finance app hinges on providing existing and prospective customers with seamless access to your software product at no additional cost.

Here is the rewritten text:

Mint, the world’s leading personal finance app, has achieved unparalleled success by offering its core services at no cost to users. Its innovative approach lies in providing regular, non-intrusive updates that encourage continued engagement without compromising user autonomy. Like many personal finance apps, it synchronizes seamlessly with the relevant financial institutions and boasts an intuitive user interface.

The following are some of the most sought-after private finance application features integrated into several popular applications:

- Professional registration and streamlined onboarding ensure seamless access to the app exclusively for authorized customers via secure login and sign-up processes.

- Streamlined connectivity to a diverse range of financial institutions.

- Managing private price range

- Receiving a comprehensive financial standing report for a specified period?

- The rise of AI-powered chatbots has revolutionized the way we interact with technology, and their insightful recommendations have been a game-changer for many users. With their ability to analyze vast amounts of data in real-time, these intelligent assistants can provide personalized advice that is both accurate and timely. Whether it’s helping you choose a new movie to watch or offering investment tips, AI chatbots are constantly improving the way we live our daily lives.

- Conducting comprehensive assessments of financial performance and trends.

- Foreign money converter

- Extraction of charts

- Moveable calculator

- The data reveals a fascinating tale of transformation, with a marked surge in modern era trends.

- Barcode scanning preview

As you implement additional features, prioritize the protection of customer data by upholding industry-leading security measures and privacy safeguards. For an entrepreneur, it’s essential to consider.

While designing a private finance app?

When developing a private monetary application, consider the following key elements to ensure its success:

When integrating third-party APIs, the time-to-market will increase significantly, thereby complicating the technical infrastructure necessary to safeguard sensitive customer data effectively? Our innovative platform combines a pair of cutting-edge programming languages, advanced synchronization capabilities, multiple versatile screen options, seamless API integrations, and a customizable user interface.

As the duration of the challenge improvement period extends, its associated costs tend to escalate accordingly. When operating under a time constraint, focus on pre-configured software solutions that are readily available. To leverage the benefits of code reuse and ease of development, consider combining Python programming with the Django framework. In stark contrast, when you have ample time to devote to your personal finance app, seize the opportunity to develop an even more comprehensive application, leveraging the Java programming language and Spring framework for maximum impact.

The primary objective is to safeguard a proprietary financial software system through robust libraries and frameworks, thereby mitigating potential cyber risks and hacking attacks, while also complying with industry standards such as the CBDP and PCI DSS framework?

When building a private monetary instrument, considering a microservices architecture may be particularly valuable in order to effectively scale and integrate with third-party systems as needed? A scalable architecture for private monetary software necessitates the inclusion of a high-performance programming language like Ruby to efficiently manage large volumes of concurrent users.

Private finance apps require a robust tech stack to manage complex financial data, provide real-time insights, and ensure seamless scalability. Here’s an overview of the ideal tech stack and APIs for private finance apps:

**Backend:**

* Node.js or Python as primary programming languages

* Express.js or Django framework for efficient API development

* PostgreSQL or MongoDB for robust database management

**APIs:**

* Open Banking APIs (e.g., Plaid, Stripe) for seamless account linking

* Payment processing APIs (e.g., PayPal, Stripe) for secure transactions

* Third-party integration APIs (e.g., Mint, Personal Capital) for data synchronization

**Frontend:**

* React or Angular for a responsive and interactive UI

* D3.js for dynamic charting and visualization

* HTML5, CSS3, and JavaScript for a seamless user experience

**Additional Tools:**

* Cloud services like AWS, Google Cloud, or Microsoft Azure for scalability and reliability

* Monitoring tools like Datadog, New Relic, or Prometheus to track performance metrics

* CI/CD pipelines with Jenkins, Travis CI, or CircleCI for automated testing and deployment

As you begin choosing relevant software technologies for your personal finance app development, keep in mind that safety and efficiency are crucial considerations to navigate.

Here’s a revised version of the text:

To initiate development, we’ve compiled a comprehensive list of relevant technologies essential for your personal accounting app project, including:

1. Entrance-End Development of Personal Finance Apps

- React NativeEnables seamless cross-platform development, allowing a single codebase to effortlessly run on both iOS and Android devices. While streamlining processes to reduce costs and enhance productivity, the solution also preserves a sense of community by maintaining its regional character.

- Databases: MongoDB, Specific.js, Node.js, Angular. For customers seeking a versatile, cross-platform financial application that offers flexibility and adaptability, this option is definitely worth considering.

2. Again-Finish Applied sciences

- Python Programming languages are particularly well-regarded for their ease of use and open-source frameworks, such as Django and Flask, which offer simplified development environments. This innovative solution empowers your private financial app with adaptability and robust security measures. The language can be effectively adapted to fund and AI-driven trades.

- Java Language emerges as a relevant option when configuring an enriched environment for your app. The Spring framework provides a robust foundation for complex enterprise-level applications by offering flexible scalability options.

- Kotlin and Node.js Are a top-notch choice for developing high-performance, real-time private financial applications (such as banking apps), allowing for numerous concurrent connections and robust scalability.

3. Database Applied sciences

- SQL Databases MySQL or PostgreSQL databases ensure the integrity and reliability of utility data, enabling applications to construct information and facilitate seamless transactions.

- NoSQL Databases. While Cassandra and MongoDB databases allow for horizontal scaling and flexibility in meeting performance demands, they also facilitate seamless adaptation to changing requirements within your personal finance application.

4. Cell Improvement

- React Native: A popular framework for building applications that seamlessly run on both Android devices and iOS-powered iPhones, utilizing a single codebase.

- Flutter: Developed by Google, Flutter is an open-source mobile app development framework that enables the creation of high-quality, high-performance applications for iOS, Android, web, and desktop platforms from a single codebase, allowing developers to design innovative and visually appealing user interfaces.

- Ionic: A widely-used, open-source framework that leverages the power of internet technologies (HTML, CSS, and JavaScript) to craft seamless, cross-platform applications.

5. APIs

Based on the geographic location of your associate financial institution and the technical complexity of your private finance application, the checklist of APIs to construct your private finance software will likely be constructed.

Customers typically have control over accessing their personal data, enabling our finance app to analyze their information and enhance the tool’s productivity.

As fintech continues to disrupt traditional financial services, building a private finance app can offer numerous benefits for individuals and businesses alike. By providing users with a comprehensive platform for managing their financial data, a well-designed private finance app can empower users to take control of their financial lives.

In today’s digital age, it is more important than ever to maintain accurate records of one’s finances. A private finance app can help users track their spending habits, create budgets, and set financial goals – all in one place. This level of transparency and control can lead to improved financial decision-making and reduced stress.

Furthermore, a private finance app can offer users valuable insights into their financial behavior. By analyzing data and providing personalized recommendations, the app can help individuals identify areas for improvement and make informed decisions about how they manage their money.

In addition to the benefits it provides to individual users, a private finance app can also be an invaluable tool for businesses. By offering employees access to a comprehensive platform for managing their finances, companies can promote financial wellness and reduce the administrative burden associated with employee benefits administration.

Overall, constructing a private finance app is an exciting opportunity to revolutionize the way people manage their finances – and reap the rewards that come with it.

When assessing the complexity of developing private financial planning software, the next crucial consideration is determining how long it will take to build such an application.

While the complexity of the response cannot be underestimated, it is crucial to consider each aspect carefully? The initial costs for hosting an event through a private financial application typically start at $37,500. The price range for this product fluctuates between $25,000 and $50,000. Whether its features align seamlessly with users’ diverse financial goals and needs, offering intuitive tools that streamline expense tracking, budgeting, investment management, and credit score monitoring.

- Application performance is contingent upon a multitude of factors, including code quality, hardware specifications, and software infrastructure. Complexity of options, in this context, pertains to the nuances of user interface design that facilitate seamless user navigation.

- The proposed mobile application will support multiple cellular platforms, including Android-based devices running versions 5.0 (Lollipop) or higher, as well as iOS-based devices running versions 11.0 or later. Additionally, the application will be compatible with various mobile units, such as smartphones and tablets, featuring a range of screen sizes and resolutions.

- Third-party integration factors

- UI/UX integration

- Smartphone hardware features: GPS navigation capabilities, augmented reality (AR) and near-field communication (NFC) technologies, plus more.

- Upkeep plan

The performance of personal finance apps fluctuates based on factors such as team location, technical infrastructure, and integration of premium features into the product, ultimately affecting the quality of financial software planning.

Here are the charges per hour in various regions: The United States charges $70-$150, Canada charges $60-$120, Western Europe charges $65-$130, the United Kingdom charges $45-$100, Japan and Europe charge $30-$65, and India charges $20-$50.

Considerably, it would be advisable to carefully evaluate only the fundamental features of your personal financial software product for initial customers, thereby gaining valuable feedback without squandering resources on enhanced application performance. The price range for this product varies between $22,500 and $27,500.

Superior options to incorporate:

- Personalized alerts tailored to meet the unique needs of your customers or address specific challenges ($30-$100).

- Seamlessly connecting the application to financial institutions ($250-$350).

- Calculating money owed payoff ($50-150)

- Tax management ($100-150)

- Planning retirement instruments ($100-300)

- Funding evaluation instruments ($100-300)

Software companies that develop and improve programs typically factor in contingency costs within their project budgets to account for unforeseen expenses or changes. Additionally, considering the sustained maintenance and iterative updates required for the ongoing success of the already-launched application from a long-term perspective.

Estimating the time required to build a private finance app depends on several factors, including its complexity, features, and scalability requirements. However, a rough estimate for building a basic personal finance app can be anywhere from 1,000 to 5,000 development hours, assuming an experienced team with expertise in mobile app development and financial technologies.

While the time required to develop each feature in a personal finance app may vary depending on user demands, option complexity, and technologies involved, a baseline estimate for basic features is approximately

- Budgeting – 50-150 hours

- Tracking expenditures with precision – 40-80 hours.

- Payment Reminders: Efficient Time Management (30-100 hours)

- Safety – 100-300 hrs

- Objective setting – 50-150 hrs

Typically, a comprehensive app enhancement program requires approximately 470 hours of dedicated work. However, when building an MVP or an exceptionally advanced options stack, the cost of a private finance app is likely to fluctuate from approximately 470 to 800 hours.

Ensuring App Security: Timeless Guidelines for Safeguarding Financial Information

Keeping your private finance app secure is crucially important, especially when it comes to safeguarding sensitive financial information. We will categorize the most effective safety protocols into distinct segments aligned with performance metrics.

- Person safety ideas prioritize privacy and obtain informed consent, ensuring secure authentication and authorization processes.

- Safe design ideas.

- Practices for Person Safety Training: Customized Coaching and Fixed Safety Education for Customers. Ongoing compliance with regulatory mandates necessitates meticulous attention to detail in updating software, administering patches, conducting rigorous testing, and implementing robust auditing procedures to ensure the highest standards of safety are consistently upheld.

- Data privacy measures include information minimization and encryption, mitigation strategies for third-party risks, secure data storage, and safeguarded knowledge transmission.

- Monitoring and log administration, comprehensive safety evaluations, and constructive appraisals.

SCAND has garnered significant expertise in enhancing fintech applications through its innovative approach and technical prowess.

Lost amidst the choppy waters of software development? Don’t know what to choose? While considering the suggestion, you may also focus on the private financial tools and technologies presented in this piece. This tool will clarify your thinking on how to enhance your personal finance application.

Another effective method for building a reliable resolution is to draw upon the expertise of seasoned veterans who prioritize both exceptional craftsmanship and individual satisfaction. Gain valuable insights into private software development practices.

To develop a bespoke private finance application tailored to an organisation’s unique needs, a digital banking service, or a fintech solution, the company must adhere to the strictest software development standards.

In the highly competitive and demanding field of fintech software development services, SCAND distinguishes itself as a standout player. SCAN’s innovative approach ensures individuals and companies purchasing from them enjoy unparalleled privacy protection and security.

With over two decades of experience in the cellular and desktop enhancement sector, we have successfully transitioned our focus to delivering seamless and secure personal experiences.