Ranging from the bottom, investing apps are digital websites that refine the method of investing & managing monetary portfolios. Residents allocate their piggy banks into ventures needing to generate future restoration and amplification of a potbelly.

Nearer, for a person or an enterprise, money restorations might embrace shares, bonds, ETFs, mutual funds, & cybercurrencies, with actual property setting on prime.

These collected belongings indicate quite a few advantages for residents, first & foremost vesting them to diversify their cash reserves. They grant multifariousness to possessions, diminishing the chance of cash misplacement.

Arguments to personal on-line funding app

Subsequently, investing apps alter the way in which folks interact in monetary actions, encouraging buyers to handle their cash briefcases from wherever. With the growing demand for usable spots that proffer shielded transactions and sagacious analytics, devising an investing app seems as an thrilling enterprise shot.

Cash accumulation serves residents to unfold belongings throughout classifications or websites, pushing prosperity amplification, & aiding folks to realize monetary requirements. Withal, investments stability dollars-&-cents self-discipline, forcing clever investing habits. As an illustration, it backs up retirement & training financial savings.

As for companies, placing cash properly conveys an organization’s development for the approaching by equating dangers, correcting liquidity supervision, & abiding by short-term obligations & properties.

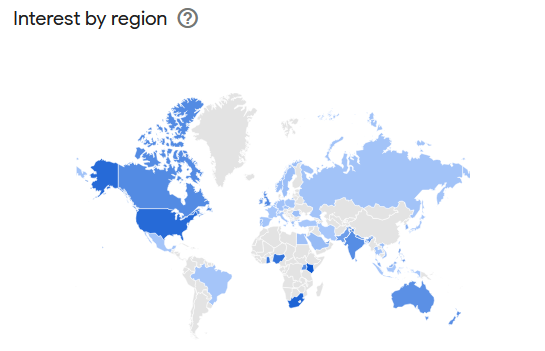

Investing cash tendencies by area, from Google Tendencies, 2024

In response to Google Tendencies, the U.S., Canada, alongside Australia are the states with the loftiest demand for investing cash. So, examine events of learn how to make funding apps and path your investments in a conscious and irresistible manner.

So, it implies incorporating in your app options and funding choices that thoughts up about these behemoth states—the utmost investing influencers. To understand this perception at full capability, grasp this imaginative and prescient to draw highly effective firms’ insights to your on-line funding app.

Because you perceive the worth of a fiscal pack for purchasers, how about creating your funding app, might it additionally produce perks for single individuals & enterprises?

On this information, we’ll take you thru these important strikes and cogitations to craft a thriving funding app, additionally consolidating stability.

What Are Funding Apps?

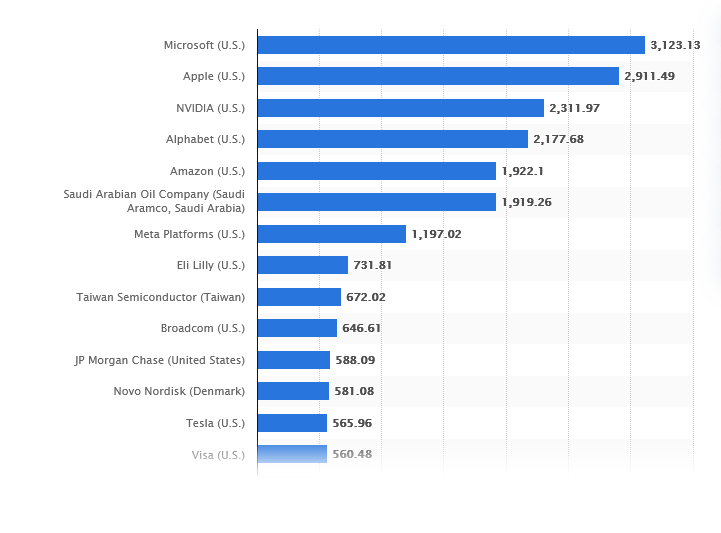

Considering these 100 largest enterprises on the planet by market capitalization in 2024, it could be advantageous so that you can hold observe of their triumph data and pull out some insights.

Now, for the reason that sixteenth century, the New York Inventory Change (NYSE) is the topmost inventory market globally, with a market cap of almost $30 trillion. To evaluate this globally, it’s greater than your entire financial output of most nations.

There are about 60 main inventory exchanges worldwide, as per Statista. The oldest is the Amsterdam Inventory Change (now Euronext partly), based in 1602. This was the onset of up to date inventory buying and selling, shaping monetary markets as we all know them at the moment. In the meantime, essentially the most potent world actor in inventory markets is the U.S.

It guides the world attributable to its sturdy monetary historical past and guidelines, internet hosting 1000’s of native and worldwide firms, together with the most important world manufacturers. In the meantime, Japan Change Group and Canada’s TMX Group have essentially the most firms listed, every with near 4,000.

Keen to know the way they made their revenue on on-line funding apps, make a sensible journey into the depths of our complete article on inventory funding functions, with the most effective digital funding choices & websites.

Past that, scrutinize the looming inventory funding markets in China, India, & Brazil. These are named “rising” attributable to their swiftly increasing deposits. Although perilous attributable to political shifts, they beckon buyers & are creating into extra financially mattered websites.

So, don’t overlook them whereas producing your on-line funding app.

100 wealthiest worldwide firms by market capitalization, Jul 2024, in billion $U.S., Statista

Sorts of Funding Apps

Whereas constructing your inventory funding app, the foremost level is to pick between the varieties of investing apps. This shift will foster the checking course of for you on which area of interest to focus on.

Summing up, the core function of funding banking apps is to empower residents with the potential for absolutely dealing with their outlay. However, the analogous course of takes place in each investing cellular app growth, however the package deal of options differs, so let’s dive into the main points.

Robo-Advisors

Simply commencing your journey with funding cellular apps, or having excessive deficiency of time, chances are you’ll put your eye on these on-line funding platforms. Chasing down for low-cost and simplified apps, take a look at Wealthfront or Betterment.

They robotize funding administration through algorithms and low charges to craft & rebalance financial briefcases, additionally due to letting you make passive outlay. These yielding app fashions are predicated by person predilections, monetary aspirations, & threat tolerance.

Thus, robo-advisors are modifying the way in which folks attain out to take a position with low charges underneath the belt.

Human Advisors

In contrast to automated digital spots for financing, the beautiful work is ready right here by licensed professionals in financing. Keen to make use of their cash correctly, folks eagerly profit from knowledgeable funding recommendation, and thus, are wanting to be charged further for the perk of human experience.

Now, human advisor apps accommodate shoppers with giant cash instances, insisting on a extra hands-on approach.

One very good illustration of such an app is Private Capital, a virtuoso app for high-net-worth people to offer customers with subtle monetary objectives. It carries out a mixture of expertise and human experience to information shoppers by way of knotty budgetary choices, enriching them with straight connections—from retirement planning to wealth surveillance.

Banking Apps with Funding Potential

As soon as you’re lacking a monetary device to include funding, you’re in the fitting place. Banking apps with funding options just like the distinguished Revolut and Chime uphold customers in dealing with their funds and investments in a single spot. So, banking apps mix routine banking with buying and selling shares or cryptocurrencies, integrating funding instruments that merge on a regular basis monetary oversight with depositing events.

Observe your financial savings, understand tradings, & conduct index funds’ investments, multi function place. This comfort fosters holistic monetary management, however customers might miss out on the superior instruments or in-depth analytics supplied by devoted funding functions.

The app is a wonderful decide for consumers in search of simplicity and unified monetary administration.

Hybrid Apps

Mixing robo-advisors and human-backed apps, hybrid options excel as a combo magnifying the perks of each options. As a promising monetary course, it encompasses automated improvements with human mastery, this fashion turning investing into an opulent journey.

Accessible, environment friendly, and customized for customers who need the comfort of digital instruments but additionally worth the steerage of economic professionals. Right here’s a better take a look at how hybrid funding apps work, their key options, and why they rework the funding panorama.

A number of potent instances are Betterment Premium, Private Capital, & Vanguard Private Advisor.

Micro-Investing Apps

One of these app seems as greater than only a starter-friendly utensil. Bragging polished exteriors with the likelihood for tradesmen to remain versatile, micro-investing devices grant the choice for judiciously saving money.

A perk of this funding app is a cellular & low-charge entry into the investing discipline, in order that merchants might check brand-new investing recipes or automate part of their cash briefcase into tech-shrewd experience. Equally, these apps sanction consumers to put money into parts.

Like this, merchants might buy quotas of high-value shares (assume Tesla or Amazon), thus, branching out their budget-free money. Moreover, micro-investing options instruments make duties of cash briefcase surveillance automatable, releasing your time. Furthermore, they supply certified information evaluation proper within the app, with funding methods & routes to filtered briefcases, all by tracing your productiveness on-line. Preserve fruitful studying paths alongside the way in which!

The fruitful instances of micro-investing apps are Robinhood & Acorns.

For an augmented perspective, put in your investing pocket extra varieties of cash investing apps: funding portfolio administration, academic funding apps, & inventory buying and selling apps.

Crucial Options of Funding Apps

- Zero / low buying and selling costs on frequent offers.

- Simplified observe to plentiful belongings (ETFs, cybercurrencies, and so on)

- Refined analytics with efficiency diagrams, inspecting dangers, & mart flows.

- Embedding exterior monetary instruments/apps for flexibility.

For an augmented perspective, put in your investing pocket extra varieties of cash investing apps: briefcase administration, academic funding apps, & inventory buying and selling apps.

Key Options of an Funding App

To face out in a aggressive market, your funding app should embrace the next core options:

Nucleus Traits of an Funding App

- Straightforward-to-comprehend interface. An effortlessly readable structure provides readability in numbers, additionally entitling the swift shopping by way of an internet funding app—even for funding inexperienced persons.

- Registration and welcoming show. Make the most of multi-step verification with secure biometric entry to pledge sturdy safety. Help creating funding accounts handily with protected signing-up add-ons and an intuitional onboarding—with getting into key functionings.

- Consumer profile. Accredit consumers to manipulate over their predilections, observe cash briefcases, & study fiscal exercise per a handy panel.

- Transaction oversight. Elucidate deposits and money pullbacks, with funding gross sales, but, sustaining a transparent file of all monetary actions.

- Integration with the fiscal platform. Tie your inventory funding app with banks to harmonize person accounts and supply exact financial inputs.

- Secure & comfy buying and selling. Grant shoppers the choice to buy & vend belongings straight throughout the app with decreased retardations. Qualify them to course of this measure immediately throughout the app to hoist your app over the rivalries.

Further Options of an Funding App

- Embedding analytical insights & market information. Carry efficiency imaginative and prescient, market currents, & surge forecasts to direct customers to make conversant judgments. Furnish your funding banking app with related market streamlines and commerce prices, with monetary information as the ultimate flourish. It will solidify your guests’ perspective on the tendencies.

- Experiences and streams. Stay changes on market affairs, feedback, & communications to remain abreast of the adjustments with a compelling board of investing devices.

- A mix of capabilities KYC & AML. Figuring out your buyer & anti-money laundering embeddings intensify shoppers’ security. They authorize customers to take a position and abide by governing notes to flee dishonest measures.

- Searchings and filters entitle customers to comfortably discover shares, funds, or different funding alternatives on specific qualities like threat profiles.

- Instructional movement. So, embed handbooks, thematic essays, & tutorial movies on investing subjects.

- Digital counselor. Embed AI-guided consultants to abet customers with portfolio supervision and funding situations affiliated with their objectives.

- Push reminders. Convey well-timed changes on costs, market flows, or portfolio mileposts for customers being tuned.

- Asset calculator. Current package for appraisal of potential earnings according to movable parameters like funding quantity, time, & threat favorable.

- Customer support. Provide your inventory funding app with built-in chat or consumer help prospects. This fashion, your guests will swiftly resolve arising challenges or get acceptable assist.

- Portfolio monitoring. Authorize customers to hint their funding data & oversee the efficiency & belongings’ allotment.

- Guarded fee gateway. Certify protected transactions for deposits and pullouts through codified on-line paying routes.

Steps to Construct an Funding App

Coming nearer, the worldwide economic system is discovering its footing after years of successive antagonistic shocks. Regardless of ongoing geopolitical tensions, all-over-the-world buying and selling exercise gained energy in early 2024. With this tendency underneath the belt, financial hoisting is projected worldwide, shifting at a barely faster tempo than earlier. That is largely tied to the regular momentum of the U.S. economic system, and right here‘s one other privilege of sticking to the funding app growth

Therefore, world buying and selling is steadily hoisting, supported by tourism that has almost returned to pre-pandemic ranges. Regardless that the general commerce stance lingers tepid in comparison with previous years, the juice of creating a prolific funding app is unquestionably well worth the squeeze.

Constructing an funding app requires a mixture of technical experience, market information, and user-centric design. By rigorously planning and executing every part, you’ll devise your money-investing app that qualifies clients to avoid wasting money prudently and safe a spot within the dynamic fintech variety.

Nicely, how do you go about creating a cellular funding app? There’s the plunge into the subject.

Define Your Area of interest and Goal Guests

Earlier than diving into the event of funding functions, analysis the market. On this survey and discovery chapter, determine your audience, research the competitors, & decide which options your app ought to possess. Portfolio course, inventory monitoring, information feeds, & secure fee integrations are important. It’s additionally essential to replicate on the enterprise mannequin and monetization technique (e.g., premium subscriptions, commissions on trades).

Catch Up on the Area Section You Wish to Serve

Every plentiful app commences with a profound understanding of the market, audience, & key challengers. This part contains holding market analysis, person interviews, and investigation into contenders to disclose and refill gaps in working ware. Use this perception to outline distinctive promoting factors in your app.

For instance, take a consumer who needs to construct an funding app focusing on younger professionals new to investing. By way of an enlarged advertising and marketing survey, we disclosed a scarcity of academic content material for newbies. That is an knowledgeable resolution to include academic modules throughout the app, serving to customers find out about funding ideas whereas utilizing the platform.

Choose a Monetization Technique

Resolve how your funding app will generate revenue whereas holding your viewers and app worth in thoughts. Provides-on incorporate in-app adverts, premium subscriptions, transaction charges, or a mixture of these. The hot button is to seek out the fitting stability — keep away from overwhelming customers with too many adverts or charges that may drive them away.

Consider the Correct App Improvement Firm

Therefore, begin by testing software program growth firms and shopping by way of their portfolios. At this level, seek for their consultants’ acceptable expertise in producing funding apps in your case.

Stroll by way of their case research to seek out what you require and be choosy. Deal with previous references and data on tasks carried out, in order to painting the precise associate in your app enterprise.

Constructing an funding app insists on a profound comprehension of each the monetary panorama and the technical points of cellular app craft. Right here’s how one can proceed.

An intuitive and user-friendly interface is essential for any funding app. A clear design ensures customers can simply navigate their monetary information, whether or not by buying shares, viewing tendencies, or studying funding information.

In one in all our tasks, we prioritized making a minimalist design for the app’s dwelling display screen, permitting customers to rapidly see their briefcase efficiency. We additionally built-in easy, interactive graphs for visualizing their investments. Suggestions from preliminary person testing helped us refine the design to make it much more accessible.

Go for the Proper Tech Stack and Improvement Method

Choosing the relevant expertise in your objectives is crucial. It’s the center of your app making certain your cash funding app may have the potential for scaling, holding efficiency, & safeguarding buyer information.

So, decide the right stack for front-end, back-end, & database growth. Customary selections sometimes stand in selecting React Native for cellular apps and AWS or Google Cloud for back-end companies.

Thereupon, SCAND makes use of industry-leading applied sciences to construct dependable and high-performance apps.

As an efficacious instance of devising a inventory buying and selling app at SCAND, whereas crafting software program for buying and selling, chances are you’ll go for React Native for the front-end. This shift will permit your organization to construct a cross-platform (iOS and Android) effectively. On the back-end, we built-in Node.js and MongoDB for seamless information administration and high-speed transactions, which is crucial for buying and selling apps.

Moreover, there are two principal approaches to app growth — native and hybrid. Native apps are constructed for particular working methods (iOS or Android), providing a seamless expertise however could be costlier. The hybrid technique empowers each iOS apps and Android websites, saving growth time and app growth prices however won’t be as optimized as native options.

Combine Safety Measures

Safety is an obligation in monetary apps. At SCAND, we combine best-in-class safety measures and requirements, resembling two-factor authentication, encryption protocols, & safe API integrations to safeguard person data & transactions from hacker raids.

Taking for instance our firm, when designing a money-investing app for buying and selling, we hold centered on shielding customers’ privateness. So, our app builders embed military-grade encryption and multi-signature authentication to flee from hacking entry. We additionally built-in fraud detection algorithms to flag suspicious actions, making certain the platform’s integrity.

Past that, name to perspective conformity with information security rules. Incorporate information encryption, SSL, and safe APIs. Adhere to monetary provisions like GDPR, PCI DSS, or legal guidelines on the bottom.

Again-Finish Improvement and Embedding APIs

Therefore, incorporating central options and essential performance is a . Place the options that align together with your area of interest & add worth for purchasers within the first row. Keep in mind to wireframes or prototypes to map the person journey.

The back-end structure ought to deal with complicated monetary information effectively. So, collaborate with builders to include APIs for issues like real-time merchandising information, fee processing, or robo-advisory companies, & don’t overlook about banking methods. Make sure that your back-end can increase with the person numbers enhance.

This stage is the place the precise growth occurs. SCAND’s skilled app growth workforce works to carry the app to life, integrating third-party APIs for market information, monetary transactions, and fee gateways.

As an illustration, for a inventory buying and selling app, you’re beneficial to take care of APIs from monetary information suppliers like Bloomberg and Reuters to make sure real-time market information uninterrupted integration, along with on-line fee (e.g., Stripe) for protected procedures.

Testing and High quality Assurance

Extreme testing is ponderous in monetary apps as these should be dependable and error-free, with Agile methodologies at hand. Accordingly, your testing interval ought to cowl efficiency, safety, & person expertise throughout numerous units and platforms.

Rigorously checking your funding cellular app is essential to figuring out & resolving any errors or usability points. Mainly, SCAND conducts intensive testing for efficiency, safety, & person expertise.

Launch, Submit-Launch Backup, & Promotion

As soon as your app is overly developed and examined, roll it out on the respective app shops like Android. Use digital monetization methods (social media, content material advertising and marketing, and so on.) to entice customers. Nonetheless, the work shouldn’t cease there, present buyer help, launch updates, & monitor app efficiency to ensure fixed person delight.

At SCAND, we help shoppers with the deployment and launch of all relevant app shops. Submit-launch, our growth workforce holds on to offer ongoing backup, guaranteeing the app stays practical, shielded, & up to date.

Collect Suggestions and Iterate

Lastly, surf the person habits and collect suggestions to strengthen options, modify bugs, supplying updates usually to understand the whole pack of success.

Leveraging S&P 500 Information in Funding Apps

Total, the S&P 500 index trails the achievement of the five hundred guiding U.S. companies, so it’s extremely uncovered to market oscillations. Musing learn how to create an funding app, take these firms’ perceptions in your product’s profit.

Furthermore, method these information beneath as a precious yardstick for inspecting market drifts for truly-based funding resolutions. Right here’s the way you might apply this info in your inventory funding app:

- Perspective on market habits. Therefore, your app can show dwell information with fiscal vogue from contained in the S&P 500 companies to understand the market values.

- Portfolio yardstick. With this side in perspective, potential buyers will evaluate their portfolio’s efficiency to this sphere, thus, sticking to the true tendencies of their investments’ boons.

- Funding recommendation. Your app’s shoppers might make the most of the S&P 500 zone and information to underscore high-performing or undervalued companies, diversifying their funding briefcases.

- Instructional objects & market indices. Incorporate this precious information into manuals to teach shoppers on clever investing.

By integrating S&P 500 information, funding apps develop into extra sturdy instruments, equipping customers with the knowledge they should navigate markets successfully and make smarter monetary choices.

Examples of Profitable Funding Apps

Therefore, observe a few of the greatest funding platforms that you could pay tribute to whereas crafting your product.

Wealthfront

This app, Wealthfront, embeds automated investing with full-fledged monetary preparations, proving customers to be potent in directing their wealth in a single app. It employs subtle algorithms to ship environment friendly, low-cost funding options.

- Robo-advisory companies with diversified portfolios.

- Monetary planning instruments for retirement, dwelling shopping for, and training.

- Money administration accounts with larger rates of interest than conventional banks.

- Tax-efficient methods, together with direct indexing.

- Wealthfront stands out for its all-in-one method, combining funding surveillance with monetary scheduling. Its tax-efficient methods and money administration options appeal to customers in search of long-term development and monetary stability.

- Routine calls out to new buyers, turning inventory buying and selling into a straightforward pie course of.

E*TRADE App

That is an exhaustive investing app that distributes to customers every part—from on-line offers to retirement planning. Due to the full-cycle package deal of funding devices, real-time market data, with academic instruments for the attitude on prime, E*TRADE turns investing into an reasonably priced sport for hundreds of thousands.

With its native-looking exterior and sweeping suite of options, E*TRADE brags the next points, each advantageous to newbies and enlightened merchants:

- Like different instruments, this app gives a variety of funding commodities—ETFs, items, trusts, choices, futures, & bonds enriching sellers with miscellaneous cash briefcases acceptable for his or her monetary aspirations.

- Retirement and holding financial savings, clear and intuitive show, multifarious account sorts like IRAs & deposit accounts—with all underneath the belt the E*TRADE app is a prevalent alternative for planning for retirement or saving for his or her kids’s future.

- With this, the app provides possession of potent devices for dealing to swiftly observe their portfolio & hint efficiency, by conducting trades fluently.

- Extra so as to add, it’s enriched with platforms of E*TRADE Core—for sporadic buyers, with integral instruments for buying and selling, surveying, & profile course, and Energy E*TRADE—for industrious merchants. It encompasses devices for superior charting, threat inspecting, & adjustable buying and selling methods’ picks.

Coinbase

One of many foremen within the cryptocurrency enterprise, Coinbase amplifies customers’ expertise in shopping for, promoting, and accumulating digital coinage. Its heightened tiers of information safety and ease of use have made it an superior web site for cryptocurrency lovers keen to take a position properly with no strings connected.

Its performance boasts killer options like:

- Assist for over 200 cryptocurrencies, with Bitcoin & Ethereum on prime.

- Progressive buying and selling devices for skilled merchants through Coinbase Professional and guarded digital purses for saving digital belongings.

- Instructional belongings to realize crypto by way of puzzles and manuals with a simplified interface appeal to freshmen, whereas its superior traits are directed at practiced crypto merchants.

- Serving to with buyer calls, adjustable reminders, and glorious survey devices full the Coinbase victory lap.

Binance

This terrific cryptocurrency trade digital terrain is likely one of the hugest apps worldwide, boasting its huge vary of digital belongings and progressive buying and selling traits. The shining perks are a large & sturdy buying and selling devices array, & highly effective safety actions. Very good performance for newcomers and practitioners alike:

- Upholds a number of world cryptocurrencies, together with Bitcoin & Ethereum.

- Renders progressive buying and selling instruments like futures & margin buying and selling.

- Secure cash pouch integration to retailer & direct digital financial savings.

- Instructional assets to assist customers perceive blockchain expertise and crypto investments.

Challenges in Growing an Funding App

Regardless that creating an funding app is a worthwhile enterprise, it comes with vital challenges. Fintech builders ought to stroll by way of intricate monetary rules, perform sturdy cybersecurity measures, & devise intuitive interfaces that cater to each novice and skilled buyers.

Moreover, embedding real-live information, maintaining scalability, & strengthening belief in an bold area provides shades of complexity to the event course of.

Safety Dangers

Investing apps are prime targets for cybercriminals. So, working sturdy safety measures resembling encryption, biometric authentication, and safe information storage are intrinsic however extraordinarily important.

Embedding Market Information

Entrance to real-live market data is essential for funding apps. Integrating dependable third-party APIs for inventory market information, monetary information, and buying and selling updates requires cautious planning to make sure accuracy and reliability.

Regulatory Conformity

Based mostly on the area, funding apps should follow extreme safety pointers. For instance, apps providing funding companies within the U.S. should adhere to SEC (Securities and Change Fee) insurance policies. Acquiring the mandatory licenses and making certain information privateness could be difficult.

Person Reliability

Constructing person belief is significant for monetary apps. Implementing high-level safety, clear payment buildings, and providing glorious buyer help may also help construct credibility in a aggressive market.

How SCAND Can Assist You Create an Funding App

At SCAND, we concentrate on constructing high-performance, safe, and user-friendly funding apps that meet the best {industry} requirements. Whether or not you want a primary platform for portfolio administration or a complicated app with cryptocurrency buying and selling, SCAND’s consultants in coding and design can flip your imaginative and prescient into actuality.

Our consultants stability the mergeк of user-easiness, safety, and high-end applied sciences that run far. We deal with every part from preliminary analysis and planning to post-launch help, making certain that your app not solely works flawlessly however stands out within the aggressive market.

Prices of Growing an Funding App

The expenditures for creating an funding app depend on multifarious points. Thoughts incorporating and estimating separate budgets for the design, growth, & testing of the web funding app, together with your on-line funding apps’ geolocation on prime. Observe a preliminary breakdown beneath:

Design

Crafting an intuitive and interesting person interface might disburse between $10,000 & $30,000. This part focuses on wireframes, prototypes, and visible parts that ameliorate useability.

Improvement

Constructing the integral and progressive functionalities sometimes requires $50,000-$150,000. This contains coding, back-end structure, API integrations, & cellular platforms’ cohesiveness.

Testing and High quality Assurance

Making certain dependability & app productiveness by way of rigorous testing can roam from $10,000-$20,000. This chapter identifies and resolves bugs, safety weaknesses, and efficiency bottlenecks.

Withal, a mid-range app with sturdy options and cross-platform compatibility typically falls within the $100,000-$200,000 scope.

One other perspective is to treat an app’s crafting with the variety of traits in view.

Therefore, the price of crafting an funding app varies based mostly on a number of components, together with the intricacy of options, platform (iOS, Android, or each), and the event workforce’s location.

- A primary funding app with primary performance, resembling portfolio administration and inventory monitoring, shifts between $30,000 to $60,000.

- A medium complexness app with embeddings like real-live data, protected on-line fee service gateways, and person authentication will enhance the associated fee to $60,000-$120,000.

- An developed app enriched with high-experience options like cryptocurrency dealing, embedded monetary companies, AI-driven insights, & professional-grade safety may attain from $120,000 to $300,000 or extra.

It’s important to think about ongoing upkeep prices, resembling updates, safety patches, and server administration, which may cost an extra 15-20% yearly of the full growth value.

FAQs

How a lot does it value to develop an funding app?

As talked about, the worth can roam from $30,000 to over $300,000, grounded on the app’s elaborateness and traits.

How lengthy does it take to construct an funding app?

It usually takes 1,5-2 trimesters for a primary funding app, however extra complicated platforms may take as much as a yr or extra.

Can I embrace cryptocurrency buying and selling in my funding app?

Sure, cryptocurrency buying and selling could be built-in into your funding app, however it requires adherence to safety requirements and regulatory compliance, significantly in several areas.