I’ve had experience with Copilot’s tools in my financial life, which has made it remarkably easy and enjoyable to track my expenses. Over the past several months, we have introduced innovative features such as “Tags” and “Money Circulation”.

The Copilot experience will be expanding to a new frontier: the iPad. Here’s a rundown of the latest updates with Copilot and how I’m leveraging these fresh features daily.

Before you begin, a quick reminder that unlocking a 60-day complimentary trial of Copilot requires your attention.

Copilot has finally landed on the iPad. For years, I’ve been a dedicated user of Copilot, with a native iPad app consistently ranking near the top of my most-wanted feature list. While maintaining a consistent flow of funds can prove challenging, Apple’s unwavering commitment to excellence across its iPhone and Mac product lines has consistently impressed. We’re excited to bring this experience to the iPad for the first time.

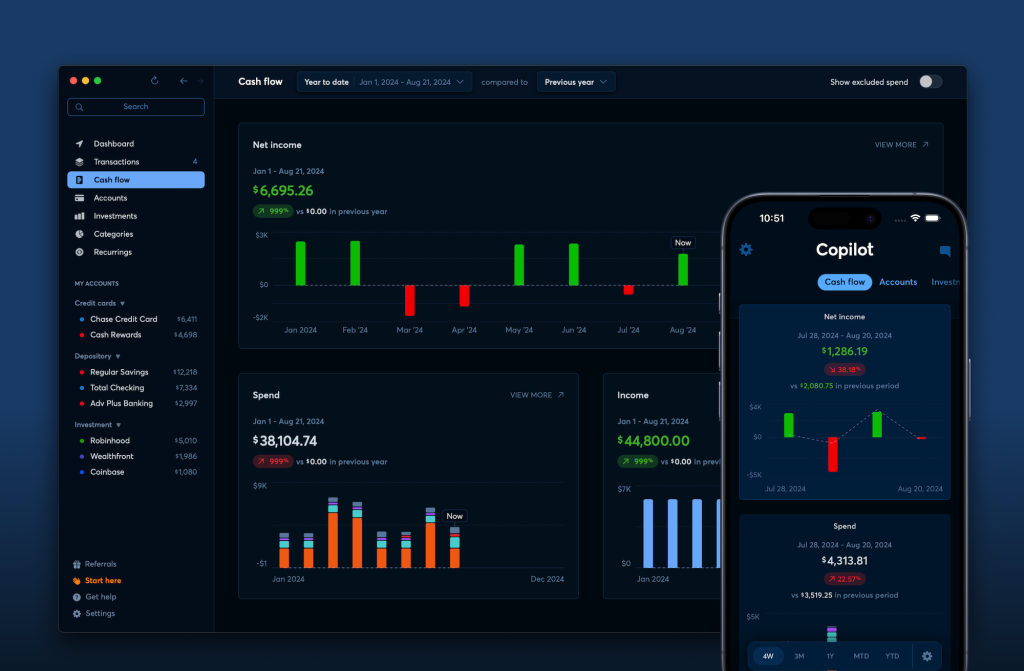

While Copilot may have initially replicated the iPhone app for the iPad, a more thorough approach has been taken to thoughtfully optimize the experience, ensuring a seamless and enjoyable interaction on the larger device. The Copilot for iPad features a sidebar that can swiftly be concealed by a solitary tap. You’ll quickly move between distinct app sections, such as Transactions, Cash Flow, and Accounts, with ease.

The dashboard tab truly steals the show on the iPad’s sleek display. Within a single glance, you can immediately view your monthly expenditures, assets, debts, transactions, major categories, and cumulative online income for the current month. The Copilot dashboard has consistently been a standout feature for me, boasting an unparalleled level of proficiency on the iPad that’s truly game-changing.

On an iPad, the Copilot format exhibits seamless responsiveness, effortlessly adjusting to diverse display sizes and orientations. The on-screen keyboard in Copilot for iPad has undergone optimization to ensure seamless knowledge entry and navigation. This optimisation, in particular, demonstrates the remarkable effort Copilot invested in refining its iPad proficiency.

The Copilot app for iPad enhances multitasking capabilities through its innovative features, including Split View and Slide Over functionality. By leveraging Copilot’s capabilities, I’ve found it essential to streamline financial management by simultaneously reviewing transactions, invoices, and payment details, thereby fostering a high level of engagement with my accounts.

There’s also an added lifestyle improvement that comes with having Copilot on your iPad. I utilize the Copilot app on my iPad to facilitate effortless financial discussions with my partner each Sunday, simplifying our joint budgeting process. While less daunting to use than a Mac, the device still boasts a more extensive and feature-rich display compared to an iPhone. This financial hub is the go-to destination for monitoring expenses and transactions.

There’s a select few of apps that consistently deliver such a high level of expertise across all three of Apple’s primary platforms with the same seamless performance as Copilot does.

I’m pleased with the Tags feature, as it introduces a fresh approach to organizing transactions and expenditures.

Tagging enables seamless tracking and monitoring of transactions, offering considerable flexibility for effortless oversight. By creating numerous tags in Copilot and assigning unique colours to each, you can swiftly pinpoint the information you’re seeking.

By leveraging tags, I’m able to construct a comprehensive picture of my income streams. My revenue derives from a diverse array of sources on a monthly basis, and categorizing individual transactions with distinct labels yields a significantly more lucid understanding of any concerns that may arise each month. We’ve designated specific labels for matters such as “Adsense,” “Amazon Affiliate,” “Podcast Sponsorships,” and more.

With tags, I’m able to gain a more precise understanding of my overall subscription expenses across specific categories each month. Specifically, I’ve developed designated labels for topics such as “streaming providers,” “applications,” “subscriptions,” and more.

Do you find yourself frequently visiting various grocery stores each month? Tag each store with a clear indication of where you spend the most money monthly:

Tags: *Dealer Joe’s: Monthly Top-Spend*

*Costco: Frequent Shopper*

Harris Teeter: Main Grocery Stop*

Walmart: Everyday Essentials*

Target: Family Favorites*

Kroger: Weekly Staples*

Publix: Fresh Market Must-Haves*

Whole Foods: Healthy Habits*

Trader Joe’s: Specialty Sourcing*

Sprouts Farmers Market: Organic Oasis*

I’ve also considered approaches that will enable me to utilize tags at a later time. This holiday season, I intend to leverage the power of tags to monitor my vacation expenses and streamline gift-giving. I couldn’t assist, though what I had learned from my experience with tags in Copilot was invaluable when my spouse and I were planning our wedding several years ago. The options genuinely seem boundless, and I’m confident I’ll furnish you with many more practical applications in the future.

Having a clear understanding of your income and expenditure patterns is essential for maintaining a healthy financial lifestyle. The innovative Money Circulation feature within Copilot precisely fulfills this requirement.

This report provides a clear and condensed summary of your financial activity from the past year, accompanied by a dedicated graph illustrating online revenue trends. The graphs enable rapid comparison of your progress over the past 12 months with that of the same period in the previous year, allowing for insightful analysis and decision-making. You may also delve into every graph to view additional historic data, providing a transparent breakdown of how your revenue and expenses have evolved over time.

As someone who manages my finances closely, I believe I’d greatly benefit from the automated accounting and expense tracking capabilities offered by the Money Circulation function in Copilot. My revenue fluctuates significantly over a 12-month period, making it challenging to gain a clear understanding of my financial situation at any given moment. Money circulation enables me to track my financial performance on both a monthly and annual basis, providing valuable insights into my cash flow and budgeting strategies.

While a consistent income stream provides stability, individuals often still seek insight into fluctuations in their expenses. Copilot’s Money Circulation simplifies the process, regardless of whether it’s conducted on a weekly, monthly, or annual basis.

Using Copilot’s guidance, I’ve been able to effectively manage my financial situation. For years, I struggled in vain to establish a predictable financial routine, ultimately meeting with failure at every turn. With Copilot’s assistance, I’ve successfully developed a tailored system that harmoniously integrates with my household’s needs, further elevating the overall experience with its innovative features.

And enjoy a complimentary, 60-day extension of your Copilot trial experience. Available for seamless use across iPhone, iPad, and Mac devices, a single subscription grants access to the app on all three platforms.

Discover more about my qualifications and experience with Copilot as you explore the links below.