Whereas China’s smartphone gross sales stall total, Apple grabbed progress with sensible pricing, subsidies, and its broad iPhone 16 lineup.

Apple posted excessive single-digit progress in China’s smartphone market throughout the second quarter of 2025. Gross sales rose on the energy of promotions and demand for the iPhone 16 Professional and iPhone Professional Max fashions.

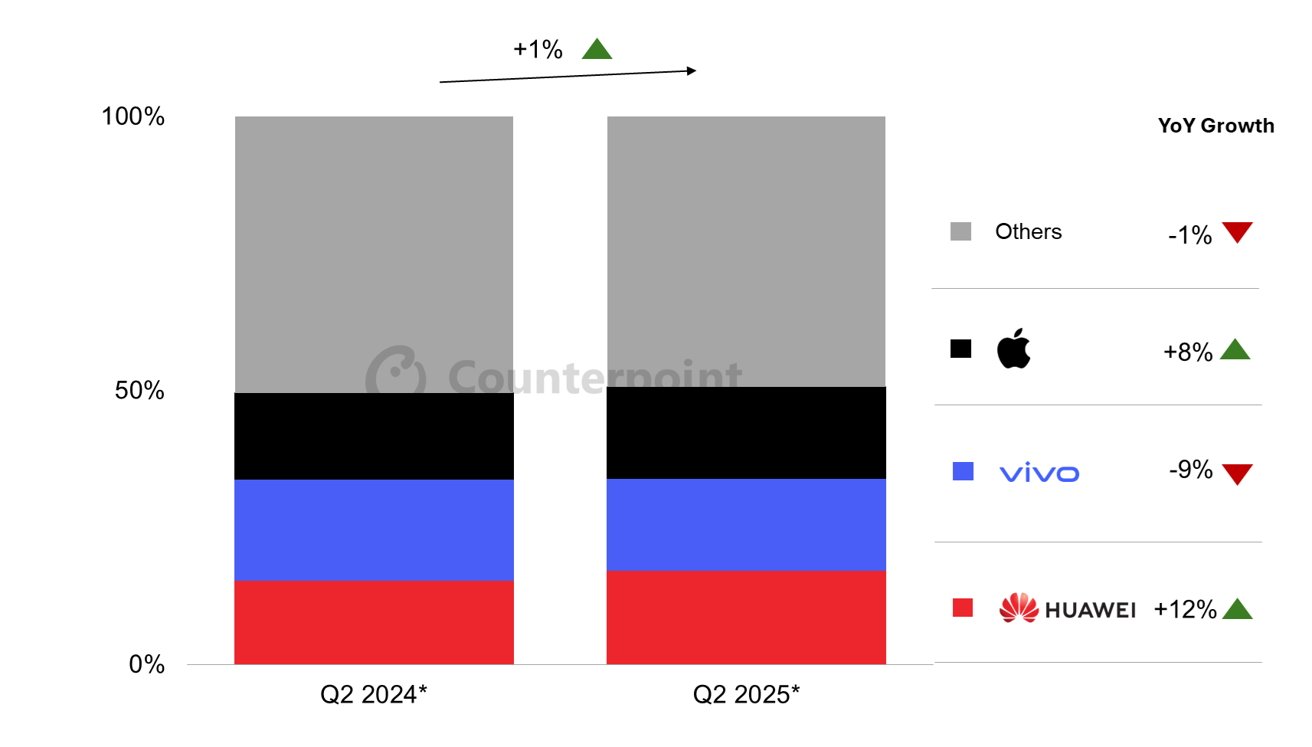

Counterpoint Analysis reported that Apple’s worth cuts in Might lifted efficiency regardless of modest total market progress. China’s smartphone sell-through in Q2 2025 is anticipated to point out slight year-over-year progress.

Huawei led main manufacturers and is projected to take the highest spot for the quarter. Spending throughout the 618 purchasing competition was flat, however Might gross sales improved because of nationwide subsidy packages.

Apple’s outcomes mirrored that sample. Three iPhone fashions landed within the high half of bestsellers throughout the purchasing interval. Analysts warned progress might sluggish within the second half of 2025 if deliberate subsidy cuts cut back client incentives.

Impression of varied iPhone fashions

Apple additionally benefited from the discharge of the iPhone 16e earlier in 2025. The lower-cost mannequin helped Apple appeal to extra budget-conscious patrons in China’s aggressive midrange market.

The iPhone 16e expanded Apple’s attain past premium patrons and added quantity to total gross sales. Mixed with the iPhone 16 Professional and iPhone 16 Professional Max, it delivered robust outcomes throughout worth segments.

China’s economic system has slowed. Shoppers are extra cautious about spending on premium items, together with smartphones.

Subsidies and promotions have develop into important instruments to take care of gross sales on this atmosphere. Manufacturers are below stress to justify costs to hesitant patrons.

Longer-term implications for Apple

Apple faces intense competitors in China. Huawei is regaining share after sanctions minimize its gross sales in prior years. Xiaomi, Oppo and Vivo goal price-sensitive clients with aggressive pricing and superior options.

Apple should preserve its premium picture whereas competing on worth throughout key gross sales durations. The corporate minimize iPhone 16 costs forward of the 618 competition. That transfer inspired patrons to improve earlier than opponents launched their very own reductions.

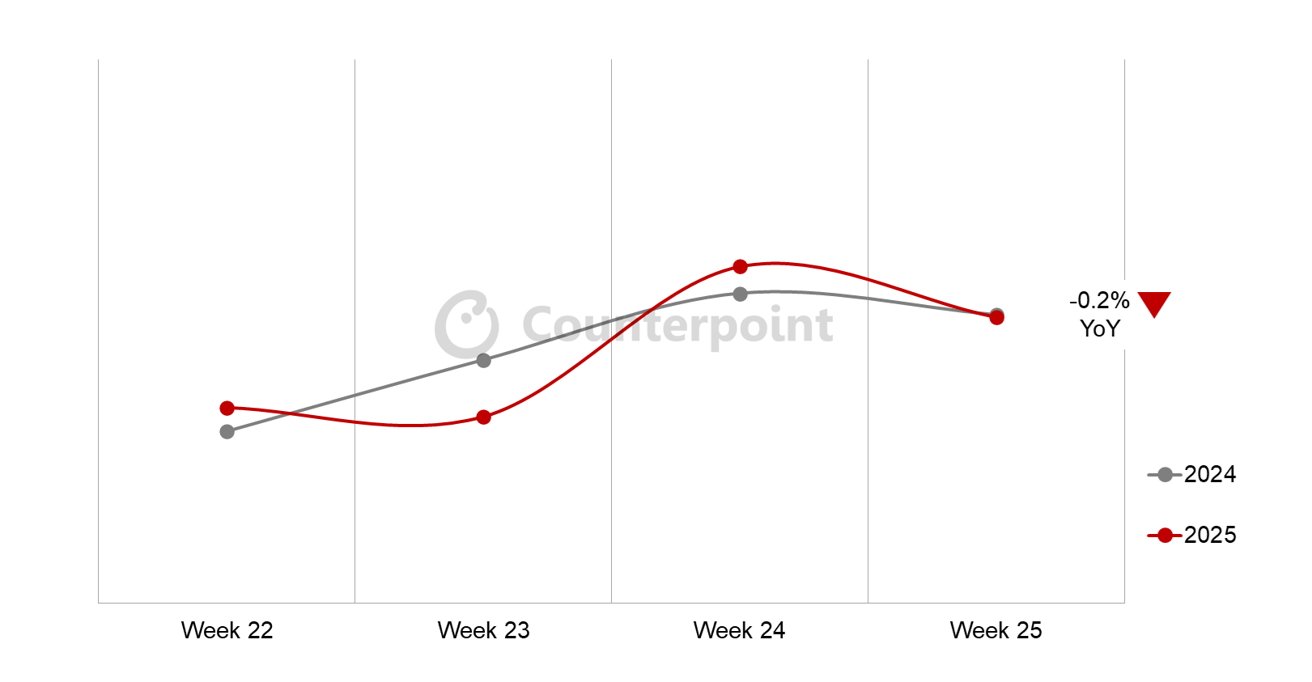

The technique boosted Might gross sales whilst June’s competition outcomes had been flat 12 months over 12 months. The timing confirmed Apple’s understanding of China’s promotional calendar.

Smartphone gross sales in China throughout the 2025 618 occasion. Picture credit score: Counterpoint Analysis

Authorities subsidies in Might supported demand. These packages intention to spice up client spending and assist native manufacturing.

Analysts warned that reductions in these subsidies later in 2025 might reveal weaker underlying demand. With out incentives, market progress could sluggish or reverse.

Apple’s robust second-quarter outcomes affirm its grip on China’s premium market. Sustaining that success shouldn’t be assured. Rivals are closing the {hardware} hole whereas providing decrease costs.

Development in smaller cities is dependent upon reaching extra price-sensitive patrons. Apple might want to steadiness premium branding with broader market attraction.

Historic comparability and provide chains

Apple’s present momentum follows years of market volatility. The pandemic disrupted provide chains and weakened demand. Commerce tensions added uncertainty.

The corporate has recovered up to now by localizing manufacturing and adjusting advertising to Chinese language preferences. The market stays unpredictable, with regulatory dangers and geopolitical pressures nonetheless current.

Apple has expanded native manufacturing to cut back import prices and ease regulatory considerations. It has additionally grown its retail footprint in China. These investments construct model loyalty and enhance service in a market identified for fast-changing client tastes.

The corporate’s second-quarter efficiency demonstrates its resilience in China. Apple might want to preserve adapting as subsidies decline, competitors intensifies, and customers develop into extra selective with spending.