Apple has announced a second consecutive rate cut on its Apple Card Savings Account in partnership with Goldman Sachs, following a previous reduction last month. Notified clients about the change on Thursday evening, and the update will take effect on Friday, October 11th.

Apple Card Financial Services to slash interest rates again?

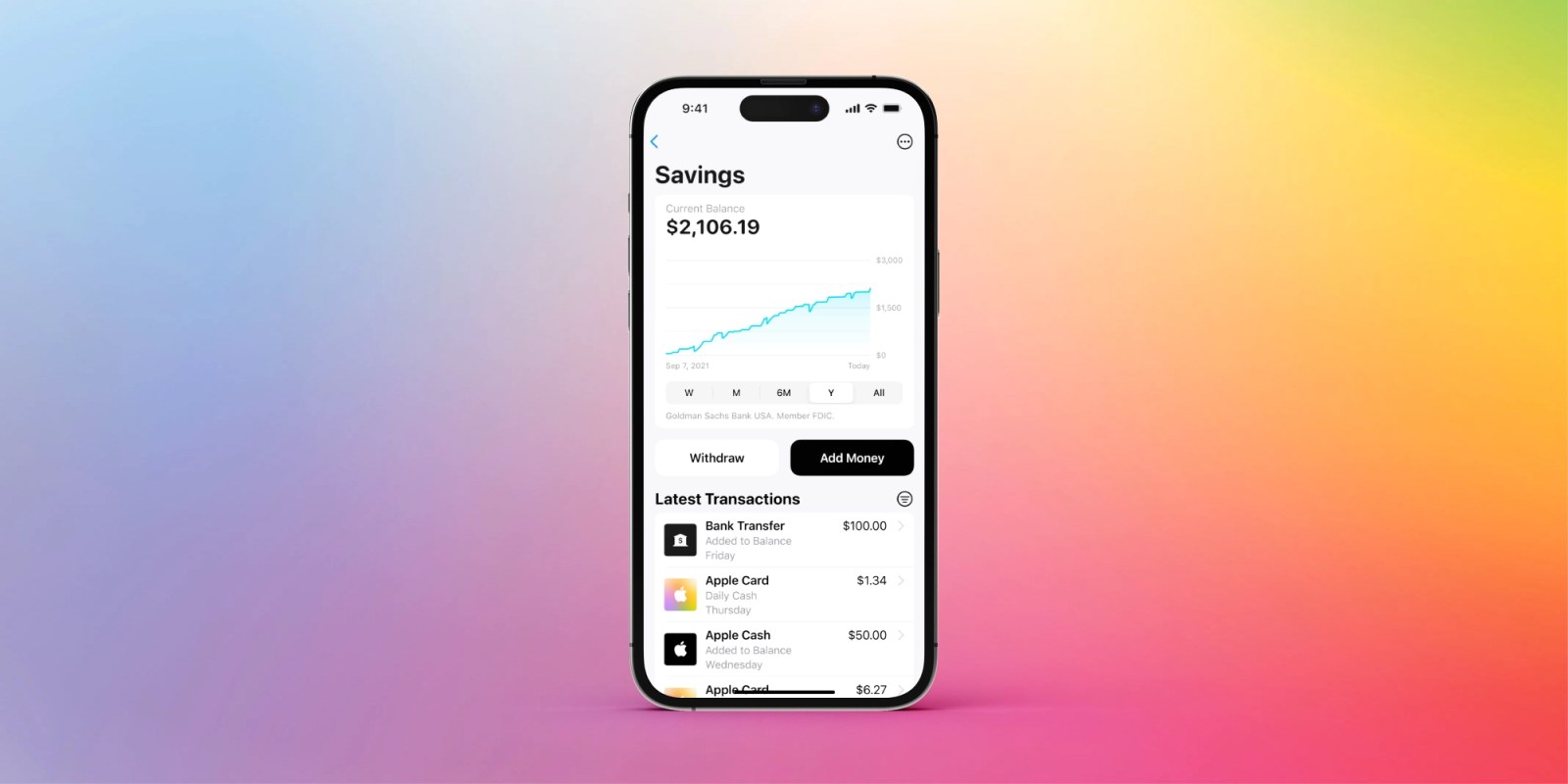

The Apple Card Financial Savings Account initially featured a competitive 4.15% annual percentage yield (APY) for the first eight months after its launch. The company’s growth accelerated to 4.25% in December, marking the second consecutive month of strong performance for the year’s final quarter, before slowing slightly to 3.75%. After a brief increase in pace, the speed subsequently slowed.

As a response to shifting market conditions and in accordance with decisions made by the US Federal Reserve, charges on financial savings accounts have been reduced to a competitive 4.10%.

The Apple Card Savings Account offers exclusive benefits solely to Apple Card account holders. Clients can seamlessly deposit their daily earnings directly into their high-yield savings account within the Pockets app. Customers with an Apple Card can top up their credit by transferring funds from a connected checking account or their Apple Cash balance.

Apple’s innovative bank card, Apple Card, is a collaboration with Goldman Sachs. This exclusive offer provides a wealth of benefits, including 0% financing options for all Apple products. The application process for Apple Card is straightforward: you need to open the Wallet app on your iPhone, tap the “+” icon, and follow the prompts to apply for an Apple Card. When you’re invited to use a feature, you can access it right away within the Pockets app on your iPhone.

You may learn more about Apple Card Savings Account in our online support center.

Learn additionally