It’s no secret that probably the most secure and fixed attribute of crypto markets is their volatility.

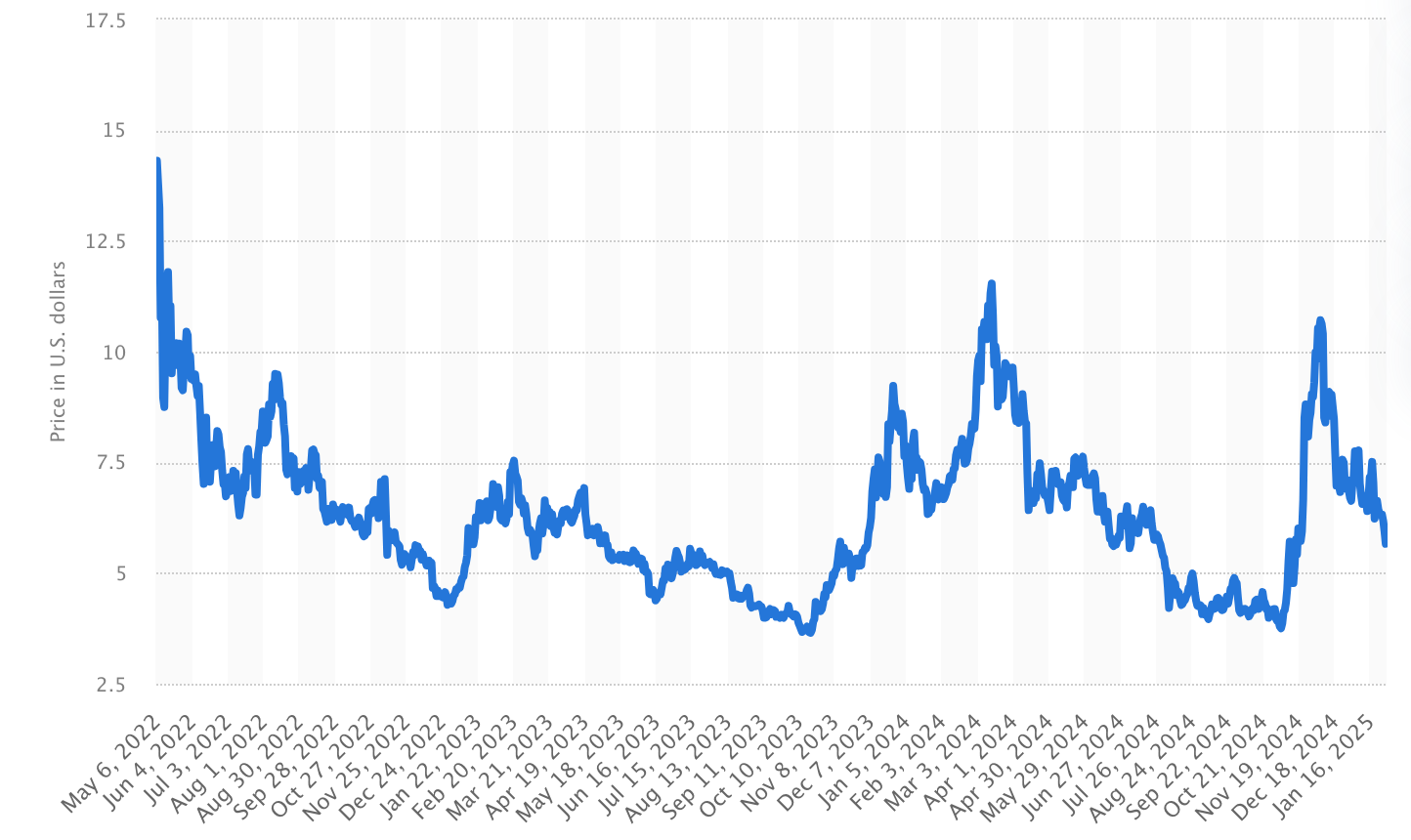

The worth of Polkadot, for instance, price $9.36 within the first 12 months, which was 199.85% up from its preliminary launch. The perfect 12 months for Polkadot was 2021 when the value reached its most of $54.87. As of January 29, 2025, one DOT token was solely price $5.76 {dollars}.

Polkadot worth fluctuations (Could 2022-January 2025), Statista

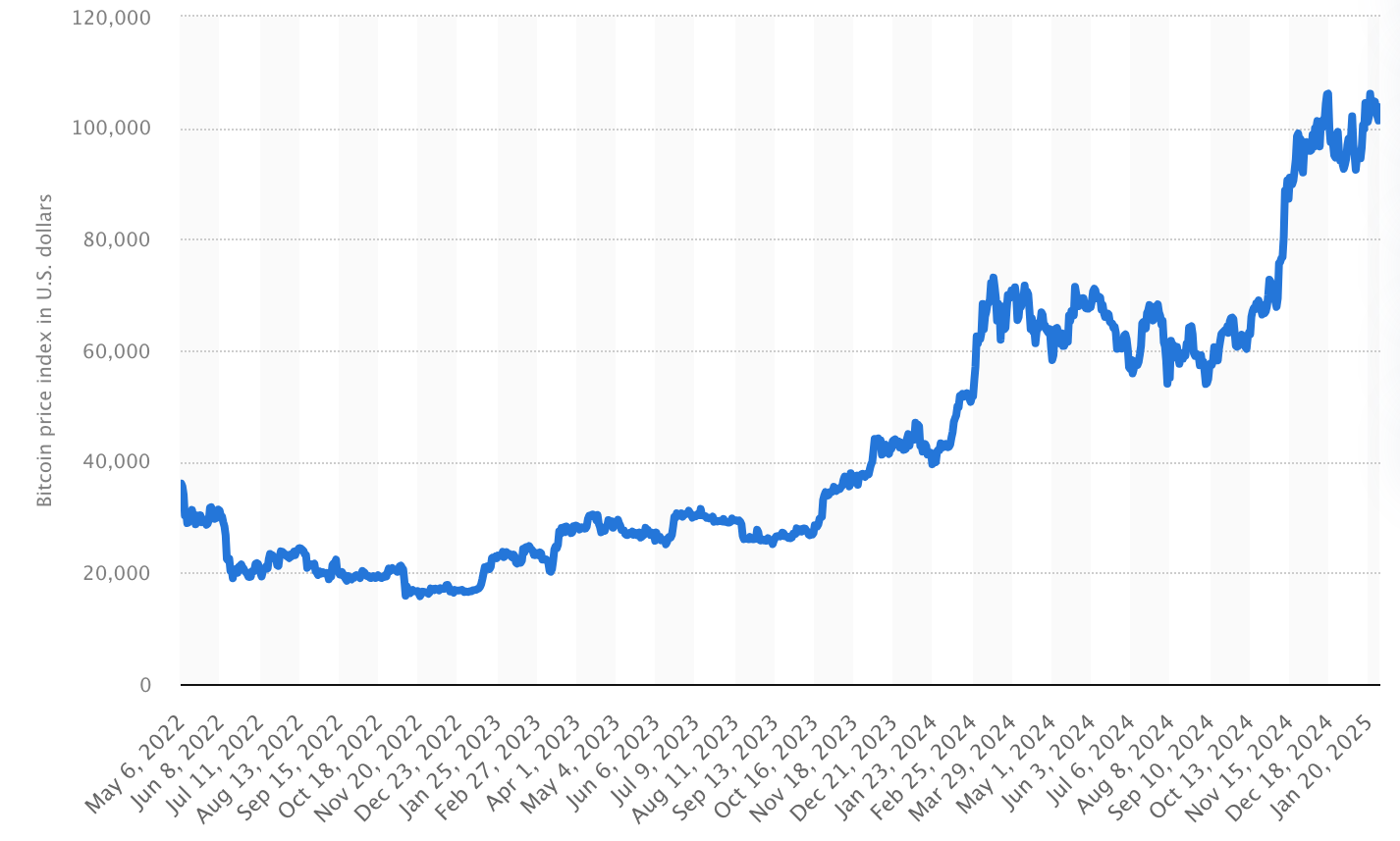

Bitcoin and Ethereum, which collectively make up greater than half of the crypto market, have been by no means significantly secure both.

The primary change fee of Bitcoin detected, as an illustration, was $134.40. Subsequently, its worth has repeatedly risen and fallen, various from $70.15 to $106,744.

Bitcoin worth fluctuations (Could 2022-January 2025), Statista

Ethereum, in flip, began at $2.92, then as soon as dropped to $0.4457 (October 2015), and even reached $4,786 in November 2021.

Seeing how dangerous and on the identical time worthwhile (in the event you catch the second) the crypto market will be, merchants started to search for auxiliary instruments when buying and selling. Some of the environment friendly means has develop into sandwich bots.

What Are Sandwich Bots?

A sandwich bot (which falls underneath the class of MEV bots) is a crypto buying and selling algorithm that independently generates earnings by way of DEX worth disparities.

It “sandwiches” or inserts a dealer’s transaction between two of its personal trades to revenue from worth motion, particularly by inserting purchase and promote orders at strategic moments.

Right here’s the way it works: The bot often scans pending transactions on the blockchain. When it sees a big commerce ready to undergo, it shortly locations a purchase order simply earlier than it, pushing the value up.

The above worth triggers the unique dealer transaction, and, at the exact same second, the bot sells its belongings at a revenue. All that is usually achieved in milliseconds and lets the bot extract the value slippage to generate features at low threat.

As a result of decentralized exchanges are constructed on clear blockchain transactions, sandwich bots can scan for these worthwhile moments in actual time.

Sandwich bots have develop into a typical follow amongst many merchants and companies because of the automated technique of producing earnings with out interference.

They assure revenue potential, can be found 24/7, react sooner, and strengthen dealer’s positions out there.

Nevertheless, their use is very controversial: some discover them fairly ingenious for buying and selling, whereas others declare they’re a method of unfair worth manipulation. And in some jurisdictions, they could even be in a authorized grey space.

An Instance of Crypto Sandwich Buying and selling Bot

Let’s say a sure dealer desires to purchase 50 ETH on a decentralized change by way of a market order. Because the nature of DEX transactions is public earlier than they get confirmed, a sandwich bot notices his/her commerce within the mempool. Right here’s what goes down subsequent:

- The Bot Spots the Dealer’s Deal. The bot notices that the dealer goes to purchase 50 ETH, which is able to barely drive the value up attributable to slippage.

- Entrance-Operating (Shopping for First). The bot instantly locations a purchase order of ETH in entrance of the dealer’s deal, pushing up the value.

- The Commerce Will get Executed. The dealer’s order goes by way of, however due to the bot’s earlier purchase order, they’ve to purchase ETH at a barely larger worth.

- Again-Operating. Again-running means profiting by way of the sale. Instantly following the primary transaction, the bot immediately sells the just-bought ETH for the next worth, which ensures a sure revenue.

This complete course of occurs within the blink of an eye fixed, and the bot continues on the lookout for extra alternatives to repeat the cycle.

For merchants working on DEX, nonetheless, “sandwiches” develop into an irritant since they all the time find yourself paying greater than anticipated. Because of this some merchants use personal transactions or slippage controls to keep away from getting “sandwiched.”

Why Put money into a Customized Sandwich Bot?

If you’re totally devoted to crypto buying and selling, then making your individual sandwich bot may give you a quantum leap.

To start with, a customized bot helps you get the very best returns. It strikes quick and snatches the value alternatives in one of the simplest ways ever earlier than they vanish. With it, every commerce shall be as worthwhile as potential as a result of it’s executed with precision.

In fact, you’re additionally free to resolve for your self how the bot works, be it choosing goal tokens or setting your threat ranges. Mainly, you get to set the whole lot as much as precisely match your plans with no forcing of technique into some one-size-fits-all bot.

Second, your cryptocurrency sandwich bot will repeatedly be on, working 24/7, watching the blockchain for commerce and instantly catching the second.

This feature saves you from having to be caught in entrance of the display on a regular basis and as a substitute focus your vitality on different, maybe extra significant, features of the method.

To not point out, customized bots have higher safety: builders often deal with encrypted transactions and common updates to maintain them protected and up to date.

Lastly, even if a customized bot requires a lot to be constructed, it pays extra in returns over time, in contrast to subscription bots which have countless charges or share income.

Should-Have Options of a Excessive-Performing Sandwich Bot

A high-performance sandwich bot have to be lightning-fast, each millisecond will rely in figuring out and executing a commerce. The sooner it acts, the higher the possibilities of its revenue.

However pace alone isn’t sufficient. A sensible bot additionally mandates prudent algorithms that would prognose worth actions, calculate slippage, and determine the perfect occasions to purchase and promote.

In fact, not each dealer acts the identical manner, which is why a bot ought to allow you to tweak settings to match your crypto buying and selling technique, whether or not which means amending slippage tolerance, going after particular tokens, or administering your dangers.

The third necessary criterion considerations availability. With stay monitoring, the bot can watch blockchain transactions as they pop up. Nonetheless, since blockchain transactions are public, a bot should additionally govern personal transactions to stop different bots from front-running your trades.

Subsequent comes asset safety accompanied by threat administration. A really good bot ought to have built-in stop-loss settings, slippage limits, and commerce measurement caps to assist preserve losses low. And since the crypto market by no means stays nonetheless, the bot should stay adaptable and regulate itself when market situations swap up.

And eventually, even if the bot does all of the arduous work, it nonetheless have to be simple to make use of. So be sure that no function confuses you in order to not make foolish errors on the most inopportune second.

Tips on how to Develop a Crypto Sandwich Buying and selling Bot: A Step-by-Step Information

From the technical viewpoint, constructing your individual crypto buying and selling bot is undeniably difficult. Nonetheless, in the event you break up the event course of into smaller, extra handleable levels, it may be a a lot less complicated enterprise.

1. Determine What Form of Work You Need Your Bot to Do

Earlier than even beginning to code, put some thought into what you wish to obtain together with your bot. Are you targeted on sure tokens? Wish to reduce slippage? Want the bot to commerce inside specific ranges of costs? Understanding exactly what you want will make it easier to form how your bot works proper from the beginning.

2. Choose Your Blockchain and Change

Since your bot will work on a decentralized change, resolve which blockchain (Ethereum, Binance Good Chain, and so forth.) and DEX you’ll be utilizing. This alternative will make it easier to type out the instruments and frameworks you could combine.

3. Delegate the Growth to a Software program Accomplice

Because the technical aspect takes lots of talent and time to grasp, it’s wiser to delegate the venture to a software program growth accomplice. They’ll direct all of the expert-level bits and items to get your bot in motion.

First, they’ll arrange your growth atmosphere, selecting the best instruments and libraries. Then, they’ll join your bot to the blockchain utilizing wallets and APIs to work together with DEXs.

The following step is to implement mempool monitoring, so your bot can spot massive transactions. Lastly, they’ll develop the sandwich technique—deciding when to purchase and promote to revenue from worth actions, whereas organizing charges and slippage.

By working with an skilled accomplice, you’ll be able to assure your bot is constructed proper and able to begin buying and selling.

4. Add Danger Management Options

The principle thought of cryptocurrency buying and selling is to make earnings, however you undoubtedly don’t need your bot working wild and blowing out your funds. The danger management options will assist put the brakes on and be sure you don’t take hits bigger than what you’ll be able to afford.

5. Check and Debug

Earlier than you begin buying and selling with actual cash, take a look at your bot on the testnet, a simulation of the blockchain. That manner, it is possible for you to to make sure the whole lot works simply nice with out threat to any funds. When you find yourself assured sufficient, you may take a look at it on smaller trades in an actual market.

6. Watch Over Your Bot

Your bot is lively, however the work isn’t over. You’ll want to observe its efficiency, troubleshoot issues, and replace it when vital. As market situations change, you could wish to amend its technique to preserve it performing at its finest.

Why Select Our Growth Group for Your Sandwich Bot?

Once you’re able to construct your customized sandwich buying and selling bot, you want a staff that is aware of the ropes.

That’s the place SCAND is available in. With years of expertise in software program growth, we’re the perfect crypto bot buying and selling growth firm to create a completely personalized bot that works simply the way you need it to.

We’ve been in blockchain software program growth since its inception, so we all know tips on how to make your sandwich bot work on decentralized exchanges (DEXs) and work together with sensible contracts.

Constructing the bot is, nonetheless, only the start—we’re in it for the lengthy haul. Our blockchain builders might help you fine-tune and improve your bot so it retains acting at its finest.

All in all, we’ve acquired a confirmed observe report of constructing pro-level software program options, so you’ll be able to rely on us to make sure the bot is quick, glitch-free, and arrange excellent to match your buying and selling technique.

Authorized and Moral Issues for Sandwich Bot Growth

Once you’re diving into crypto buying and selling bot growth, it’s necessary to consider the authorized and moral aspect of issues. Although these bots are certainly appropriate for buying and selling, additionally they include some authorized and moral issues you’ll be able to’t ignore.

Authorized Elements

The legal guidelines round crypto sandwich bot growth is usually a little quirky and differ by location. Legal guidelines about crypto buying and selling differ relying in your nation, so that you’ll wish to know whether or not or not there’s any particular laws you’ll have to stick to.

For example, sandwich assaults may be thought of as a kind of market manipulation in sure locations, which could possibly be legally problematic if not approached with care.

Notice! In the US, market manipulations are unlawful underneath Part 9(a)(2) of the Securities Change Act of 1934. Equally, the European Union prohibits market manipulation underneath Article 12 of the Market Abuse Regulation. Australia and Israel even have legal guidelines banning market manipulation.

Additionally, in case your bot collects any private knowledge or interacts with different customers, you’ll want to pay attention to privateness insurance policies. Do not forget that staying clear with knowledge and retaining issues legit is the best way to go.

Lastly, don’t neglect to test the phrases of service of the decentralized exchanges (DEXs) you’re utilizing. Some platforms have guidelines about automated buying and selling bots, and ignoring these might result in your bot getting banned and even some authorized points.

Moral Issues

Although you select to work within the space the place sandwich bots are authorized, there’s nonetheless the moral aspect to consider. One of many fundamental considerations is unfair buying and selling practices. Some folks argue that sandwich bots and front-running bots exploit worth variations in methods which might be dishonest to different merchants, particularly those that don’t have entry to the identical tech.

One other challenge is front-running—when your bot makes a commerce primarily based on details about another person’s transaction earlier than it’s processed. Whereas that is frequent in high-speed buying and selling, many see it as unethical as a result of it takes benefit of different merchants.

To maintain issues on the up and up, it’s necessary to be open and unbiased about how your bot works and be sure you’re not “hacking” the system to deceive others. The objective is to make use of your bot as a instrument to strengthen your buying and selling technique with out hurting the general mechanics of the market.

FAQ

How do sandwich bots work?

A sandwich bot watches for giant trades ready to be confirmed on the blockchain. When it spots a big transaction, it buys the asset simply earlier than that commerce goes by way of, pushing the value up. Then, after the commerce occurs and the value jumps, the bot sells its place for a fast revenue.

Are sandwich bots authorized?

It relies on the place you’re situated and which platform you utilize. In some locations, utilizing a sandwich bot may be seen as market manipulation or front-running, which may get you into authorized bother. It’s all the time finest to test native legal guidelines and the principles of the change you’re on to be 100% positive you’re on the correct aspect of the laws.

Why ought to I develop a customized sandwich bot as a substitute of utilizing a pre-made one?

A customized sandwich bot is all the time constructed to match your actual desires, which means you’ll be able to regulate buying and selling technique and threat administration as you see match. Pre-made bots are often a one-size-fits-all resolution, so they may not provide the freedom or management you need. With a customized bot, you’re taking the motive force’s seat.

How lengthy does it take to develop a customized sandwich bot?

It relies on how difficult you need the bot to be. On common, it might probably take just a few weeks to a few months to make and take a look at a completely purposeful bot. After it turns into lively, you’ll in all probability wish to make tweaks over time, so there’s some ongoing work concerned too.

What sort of efficiency can I count on from my sandwich bot?

If constructed and optimized accurately, your sandwich bot must be quick and execute trades in a break up second. A very good bot can even have threat management mechanisms to assist defend your investments.

Can I exploit a sandwich bot on any crypto change?

Sandwich bots often work on decentralized exchanges (DEXs), similar to Uniswap or PancakeSwap, which run on blockchains like Ethereum or Binance Good Chain. However not all exchanges enable buying and selling bots, so you will need to double-check their phrases of service to substantiate it’s allowed.

Can I observe my sandwich bot’s efficiency?

Sure, you’ll be able to watch your bot’s efficiency by way of a dashboard or by connecting it to analytics instruments. Keeping track of the way it’s doing will make it easier to amend settings if wanted and make it work as you need it to.