Databricks received’t be going public anytime quickly, if its newest funding spherical introduced yesterday is any indication. However the lack of an IPO doesn’t seem to matter to the corporate’s skyrocketing progress. In reality, the corporate may very well be on tempo to develop into a $1-trillion firm, in line with CEO Ali Ghodsi.

Databricks began out greater than a decade in the past as a personal cloud for working Apache Spark, a distributed computing framework created at UC Berkeley AMPLab. Whereas Spark is a robust instrument, it may be troublesome to run effectively, so who higher than the creators of Spark to run it in your behalf?

Through the years, Databricks has morphed into one thing far greater than Spark and Spark-related initiatives like Spark SQL, Spark Streaming, graph-based Spark (GraphX), and machine studying Spark (MLlib). The corporate has launched a number of instruments for serving to prospects handle their knowledge, such because the Databricks Delta Lake and Unity Catalog.

Because the introduction of generative AI in late 2022, the corporate has invested closely to make it a frontrunner within the nascent area. It purchased an AI manufacturing unit within the acquisition of MosaicML for $1.3 billion in 2023, and since then it has launched AI merchandise like AI/BI Genie, Agent Bricks, and the Databrick Assistant.

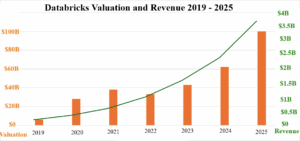

The strikes would seem like resonating with prospects. The corporate has added 5,000 prospects over the previous two years, which has corresponded with income greater than doubling, from $1.6 billion in 2023 to an estimated $3.7 billion for 2025. The corporate at present has about 9,000 workers, and will end the yr with 3,000 new hires, CEO and co-founder Ghodsi informed the Wall Avenue Journal.

That progress has put a highlight on the San Francisco firm. In his interview with the WSJ, Ghodsi mentioned the corporate wasn’t in search of cash, however so many potential buyers have been calling on him that it was robust to say no. The corporate, which raised $10 billion with a Collection J spherical in 2024, didn’t disclose precisely how a lot it’s on tempo to boost with its Collection Okay spherical, which it expects to shut quickly. However with the tempo of buyer progress and inside hiring, it could be shocking if it was a lot smaller than the 2024 spherical.

What we do know is that this: the discussions Databricks is having with buyers pegs the corporate valuation at $100 billion. That’s a whopping 61% improve from the Collection J spherical, which closed simply eight months in the past.

With a lot personal capital flowing in to Databricks’ coffers, it has put a damper on the necessity to go to the general public markets to boost cash for progress. An IPO has been anticipated from Databricks for years, but it surely doesn’t seem like imminent.

Whether or not or not Databricks goes public quickly, the corporate is ramping up enterprise. On the present fee of progress, the sky seems to be the restrict for Databricks. In reality, in line with Ghodsi, the corporate may attain the 12-digit mark in valuation, changing into a part of an elite group of corporations value $1 trillion or extra.

“The finance group tells me to not use this time period, however I believe Databricks has a shot to be a trillion-dollar firm,” Ghodsi informed the WSJ. “However we’ve got lots of work forward of us to get there.”

Solely 13 corporations at present have valuations in extra of $1 trillion. Hitting that mark will nearly definitely require being a public firm. If that’s the purpose, then the dimensions of the corporate might want to develop dramatically.

Associated Objects:

Databricks to Elevate $5B at $55B Valuation: Report

What Is MosaicML, and Why Is Databricks Shopping for It For $1.3B?

Databricks Needs to Take the Ache Out of Constructing, Deploying AI Brokers with Bricks