(Zakharchuk/Shutterstock)

Funding advisors are increasing their use of other information due to generative AI and the aggressive benefits they plan to acquire via it, in response to the newest report on different information from Lowenstein Sandler.

Various information is the funding enviornment refers to something that doesn’t seem in firm filings, press releases, analyst stories, and different conventional sources. Traders need to different information like firm bank card transactions, geolocation, cellular system information, and social media to be able to acquire a probably profitable sign that may be exploited for aggressive benefit.

Lowenstein Sandler is a legislation agency that has been surveying funding advisors in hedge funds, personal fairness companies, and enterprise capital funds about their use of other information since 2019. The corporate detected a surge in using different information in 2023, when the variety of individuals in its survey affirming using different information doubled from the earlier 12 months, going from 31% to 62%.

The corporate just lately shipped its 2024 report, titled “Various Information Poised for Extra Progress within the Age of AI,” and the development has continued. Sixty-seven % of the 103 individuals surveyed by Lowenstein Sandler (composed of 95% personal fairness companies, 2% hedge funds, and three% enterprise capital companies) affirmed that they use different information. The % of individuals saying they’re making “important use of other information” elevated from 43% in 2023 to 54% in 2024, whereas these making average use declined 9%.

Supply: Lowenstein Sandler report, ““Various Information Poised for Extra Progress within the Age of AI”

What’s extra, 94% of present different information customers say they’re rising their budgets for the information sort, whereas 87% say their agency now has a proper coverage round its use (and 68% have adopted insurance policies about utilizing different information with AI). These information factors signifies different information has achieved a foothold in these companies.

The emergence of generative AI is taking part in a job within the enlargement of other information. In keeping with the report, 61% of survey respondents say they use AI for funding analysis, portfolio optimization, or buying and selling, whereas 58% say they use it for summarizing analysis and supplies. Amongst respondents already utilizing AI for funding and buying and selling functions, 85% say they’re going to develop their use of it within the subsequent 12 months. Amongst these not utilizing AI, 43% plan to undertake it for subsequent 12 months, the report says.

“Various information is now not novel, however the mixture with AI creates the chance for authentic insights at a scale and velocity that was beforehand unattainable,” says Scott H. Moss co-chair of the funding administration group at Lowenstein Sandler. “We have now entered a brand new period of funding that will likely be formed largely by know-how’s exploitation of knowledge.”

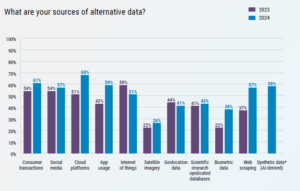

Various information can come from a spread of sources. The sources that noticed the largest share level will increase from earlier surveys got here from cloud platforms (17%), app utilization (17%), biometric information (16%), and Net scraping (20%), the corporate says.

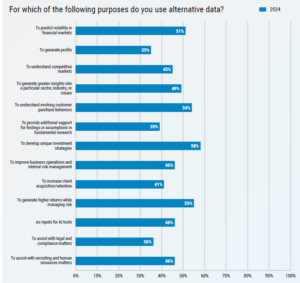

Funding companies are utilizing their different information for a wide range of use instances. The highest three use instances have been: growing distinctive funding methods, producing greater returns whereas managing danger, and understanding evolving buyer buy behaviors, in response to the report.

Supply: Lowenstein Sandler report, ““Various Information Poised for Extra Progress within the Age of AI”

Survey respondents say they acquire their different information comes from a wide range of sources, the highest three being cloud platforms, shopper transactions, and app utilization. Artificial information (which wasn’t an possibility in 2024) was quantity 4 on the listing, adopted by social media, with Fb, Instagram, and X being the main sources.

Whereas different information can generate alpha, it doesn’t come with out dangers. The highest concern that companies have in the case of different information are information possession and privateness points, cited by 36% of survey respondents. There was a three-way tie for second place at 33%, shared by information safety/breach, danger of buying materials private info, and elevated compliance burdens, the survey exhibits.

Among the many one-third of companies not utilizing different information, there have been a number of causes for why they don’t use it. Locked in a four-way tie at 35% have been lack of belief within the high quality of the information, too costly, regulatory/compliance danger, and technical difficulties working with the information.

Associated Gadgets:

Various Information Isn’t So Various Anymore

Bloomberg Makes Various Information Accessible Alongside Conventional Monetary Information

Various Information Goes Mainstream in Monetary Companies