Environmental stewardship is crucial to driving long-term business and personal prosperity. As technological advancements accelerate, artificial intelligence is revolutionizing the accounting sector by offering innovative solutions to optimize workflows, minimize mistakes, and deliver actionable knowledge.

What cutting-edge innovations in artificial intelligence are revolutionizing financial management practices across organizations? These innovative platforms are engineered to streamline mundane tasks, provide instant insights, and fortify financial decision-making with enhanced precision, efficiency, and authority. Whether navigating the complexities of financial management as a small business owner, freelancer, or accounting professional, AI-powered tools offer a diverse range of innovative solutions to cater to distinct needs and revolutionize financial practices across various industries.

Vic.ai is a groundbreaking, AI-driven accounting solution that transforms the accounts payable process landscape. Vic.ai harnesses the power of sophisticated machine learning techniques to revolutionize financial processes, with a primary focus on simplifying and accelerating accounts payable operations. The platform’s sophisticated technology seamlessly ingests, categorises, and processes invoices with remarkable precision, significantly reducing the need for manual data entry and virtually eradicating human error throughout the process.

One of Vic.ai’s most notable strengths lies in its ability to simulate human decision-making, empowering it to manage the entire accounts payable process independently from start to finish. This functionality enables finance teams to redirect their attention from day-to-day tasks to more strategic initiatives such as financial analysis, cash flow forecasting, and vendor relationship management. Vic.ai’s adaptive learning mechanism enables the AI to continually refine its understanding of each group’s unique processes and requirements, ultimately yielding increasingly efficient and accurate operations.

- Streamlined autonomous bill processing boosts productivity by a remarkable 355%.

- AI-powered PO matching accurately identifies inconsistencies and verifies precise matching.

- Simplified and scalable approval workflows significantly reduce administrative burden and accelerate billing processes.

- Sophisticated cost management solutions that swiftly detect early cost savings opportunities and proactively mitigate potential fraud risks.

- Real-time analytics and actionable insights on invoices, workforce productivity, and business trends enable informed decision-making.

Invoice is a comprehensive, cloud-based accounting solution that streamlines accounts payable and accounts receivable workflows, accommodating the needs of businesses across various scales. The platform leverages advanced AI and machine learning capabilities to revolutionize bill management by simplifying administrative tasks, streamlining approval processes, and automating expense accounting with precision. By automating this process, Invoice significantly streamlines financial tasks, eliminating tedious administrative work and virtually eliminating potential errors associated with manual methods.

One of Invoice’s key advantages is its effortless integration with popular accounting software, ensuring seamless real-time data synchronisation and providing unparalleled transparency into financial activities. The platform’s user-centric design and adaptable features make it an attractive option for organizations seeking to streamline their financial operations. By implementing an effective invoice system, organizations can exert greater control over their cash flow, foster stronger vendor partnerships, and redirect resources towards high-impact projects rather than administrative tasks?

- Automated Bill Management: Streamlining Bill Processing, Entry, and Categorization

- Streamlined approval processes with customizable workflow templates, empowering users to configure complex, multi-tiered review sequences.

- Offering a range of payment options that cater to diverse needs, including automated clearing house (ACH), electronic funds transfer (EFT), digital gift cards, and traditional check payments.

- Global payment solutions facilitate seamless transactions across more than 130 countries worldwide.

- Seamless integration with popular accounting software programs, including QuickBooks, Xero, and NetSuite.

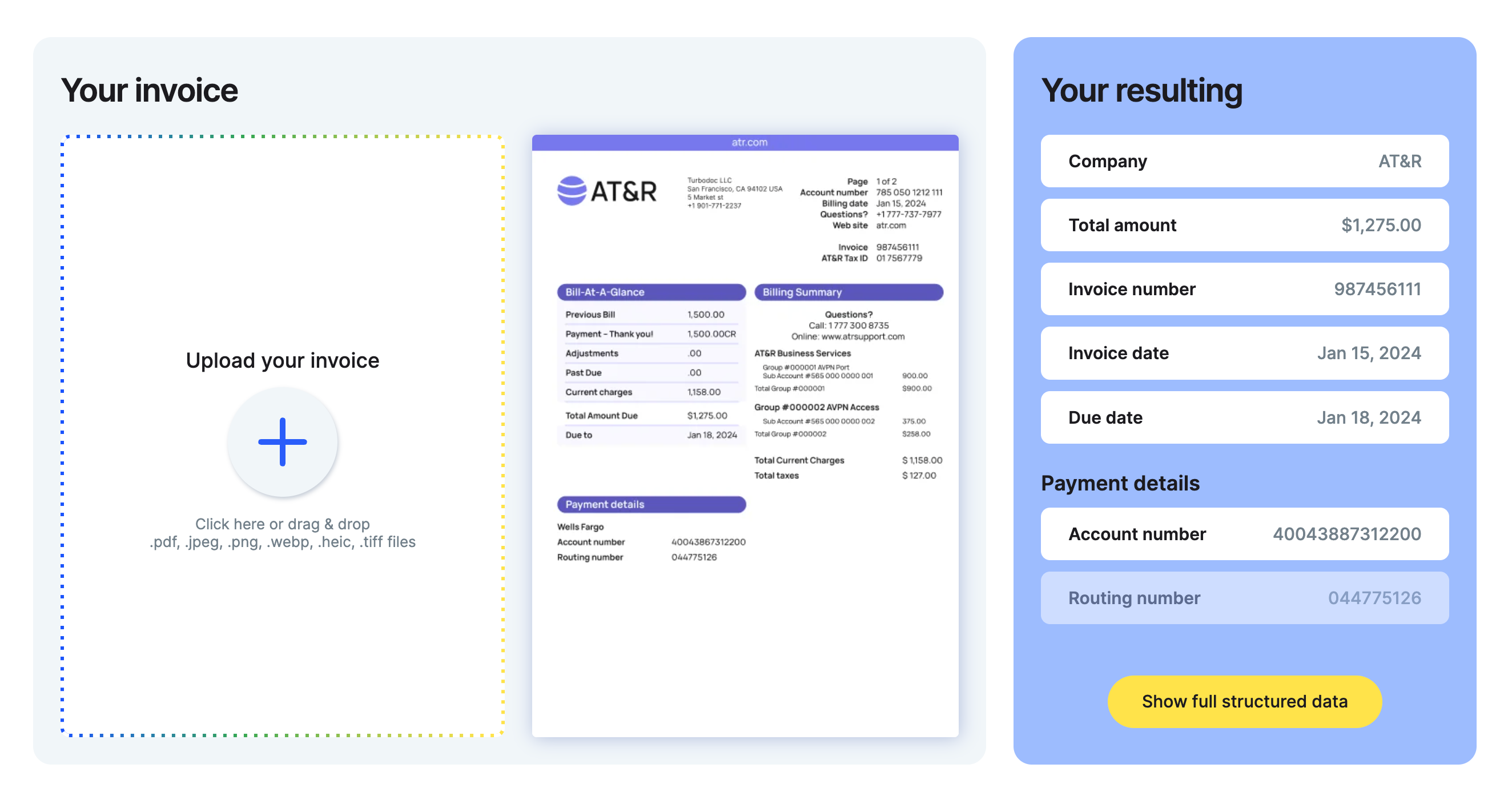

TurboDoc is a revolutionary AI-driven accounting tool that specializes in streamlining bill and receipt management through seamless automation. The platform employs state-of-the-art optical character recognition technology to accurately extract data from a variety of document formats. This cutting-edge feature obviates the need for manual guide input, significantly streamlining financial document processing while simultaneously reducing the likelihood of human error and associated costs.

TurboDoc’s OCR capabilities are bolstered by a user-centric interface that seamlessly structures extracted data for effortless access. This innovative function empowers organizations to seamlessly analyze data, aggregate reviews, and scrutinize financial insights across various timeframes or categories. TurboDoc prioritizes information security by utilizing cutting-edge encryption technologies at the enterprise level to safeguard sensitive financial data with utmost care. Moreover, the platform’s seamless integration with popular email services like Gmail enables customers to effortlessly automate document processing directly from their inboxes, thereby streamlining workflow and amplifying overall productivity.

- State-of-the-art OCR technology enables rapid processing of documents at an impressive rate of just 1.2 seconds per webpage.

- Extraction of High-Precision Information at 96% Accuracy: A Precise Solution

- Streamlined Gmail connectivity enables effortless automation of document workflows, directly sourcing files from inboxes.

- Streamlined Consumer Insights Platform for Seamless Data Analysis and Reporting.

- AES-256 compliant encryption ensures the utmost security of sensitive data stored on US-based servers, providing an enterprise-grade level of protection.

Indy is a comprehensive productivity platform meticulously crafted to meet the unique needs of freelancers and independent professionals. While not exclusively an accounting tool, Indy provides a robust set of financial management tools alongside other key business features. This comprehensive platform empowers freelancers to seamlessly manage various aspects of their business, including proposal creation, contract negotiation, invoicing, time tracking, project management, and client communication, within a streamlined and intuitive interface.

One of the key factors that make Indy stand out is its remarkable affordability, allowing freelancers at various stages of their career to consider it a viable option. The platform offers a complimentary plan featuring essential features, complemented by competitively priced paid tiers providing access to advanced tools. Indy’s user-friendly interface and effortless usability make it an attractive option for freelancers seeking to efficiently manage their business finances without requiring extensive training or a daunting learning curve. Through its unified platform, Indy streamlines multiple enterprise functions for freelancers, thereby freeing up valuable time and promoting organization, allowing them to concentrate more intensely on core business activities and client interactions.

- Proposals are crafted with precision using our customizable templates, ensuring seamless vetting by authorized professionals.

- Streamlined invoicing and cost processing via industry-standard payment gateways.

- Accurate time-tracking device for recording professional hours worked?

- Which administration options are available for a specific job group?

- Seamless customer engagement and collaborative document exchange functionalities.

Docyt is a cutting-edge AI-driven accounting automation platform engineered to revolutionize financial management for small businesses and accounting experts alike. By leveraging advanced generative AI technology, Docyt streamlines various accounting functions, including data capture, workflow management, and real-time reconciliation. This comprehensive methodology provides organizations with unparalleled transparency into their financial operations, empowering more informed decision-making through accurate and timely financial intelligence.

At the heart of Docyt’s success lies its innovative algorithmic framework, empowered by a unique ability to adapt and interpret invoices with an uncanny level of human understanding. With its advanced capabilities, this system accurately extracts relevant information from receipts and invoices, efficiently categorizing transactions with exceptional precision. Docyt’s innovative platform enables seamless real-time accounting, distinguishing it from traditional accounting solutions. Moreover, Docyt effortlessly synchronizes with existing accounting software, ensuring a smooth migration and negligible disruptions to your workflows. With its intuitive interface and potent automation tools, Docyt revolutionizes how businesses manage their financial operations, solidifying its status as a trailblazer in the industry.

- Data extraction from financial documents using AI-powered technology.

- Streamlined financial processes for seamless bill payment and approval workflows.

- Real-time financial data synchronization for current information recording.

- Monetary insights and comprehensive reporting capabilities fuel data-driven decision making.

- Tight interoperability with existing accounting software and comprehensive business systems.

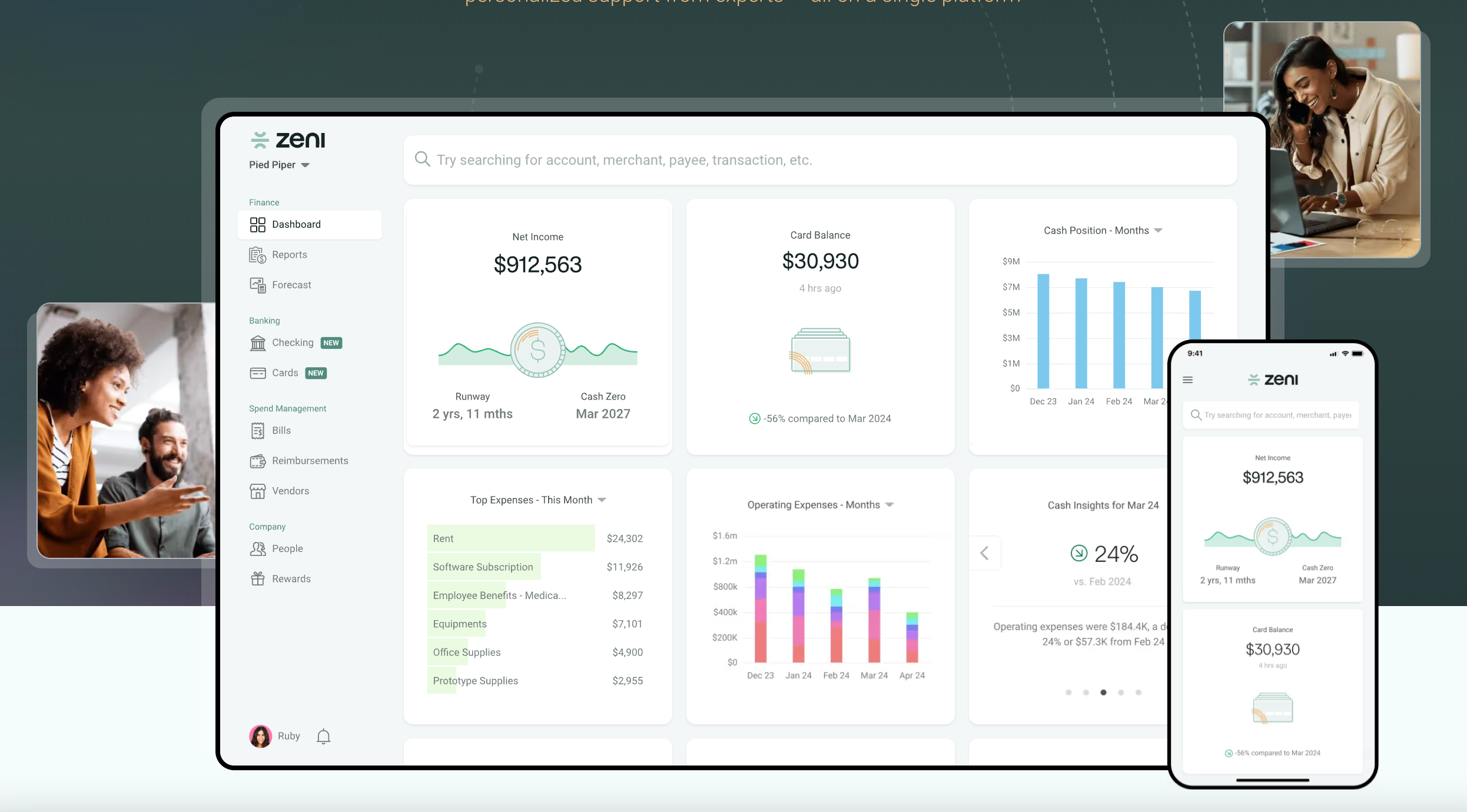

Zeni is a pioneering AI-driven financial platform that harmoniously integrates innovative bookkeeping, accounting, and Chief Financial Officer (CFO) services to simplify and optimize financial operations for early-stage startups and small businesses. Through its advanced AI capabilities, Zeni streamlines a vast array of administrative tasks, delivering instant analytics and personalized support from a dedicated team of expert financial advisors. This comprehensive methodology enables businesses to continuously update their records, receive real-time financial data, and inform strategic decisions with accurate, timely insights.

Zeni’s notable advantage stems from its capacity to provide a comprehensive financial solution on a unified platform. Zeni offers a comprehensive suite of solutions, encompassing invoice payment and invoicing, as well as expense management and financial planning, designed specifically to meet the diverse needs of growing businesses. The platform’s intuitive interface, bolstered by expert guidance from a dedicated team of financial specialists, presents a compelling option for entrepreneurs and business owners seeking to streamline their financial operations and focus on growth. Zeni streamlines financial management by consolidating key tools into a single solution, enabling businesses to reduce costs and simplify their technology infrastructure while providing an affordable option for comprehensive financial administration?

- AI-driven bookkeeping solutions that seamlessly categorize financial transactions, automate account reconciliations, and provide real-time insights.

- Professional financial organizations join forces to streamline processes for invoice payment, invoicing, and expense management.

- Real-time financial insights and tailored reporting functionality

- Entrance into a dedicated team of finance professionals, comprising experienced bookkeepers, skilled accountants, and certified public accountants.

- Sleek interoperability with other leading corporate tools and systems.

Blue Dot is a cutting-edge, artificial intelligence-powered tax compliance platform that effortlessly navigates the intricacies of modern worker expense management. As hybrid work patterns, decentralized commerce, and online consumerism continue to evolve, employee-initiated transactions are becoming increasingly widespread, presenting significant obstacles for financial teams struggling to manage unorganized financial data. By providing comprehensive coverage across both VAT and taxable worker profit sectors, Blue Dot’s platform effectively addresses these key concerns.

With a robust foundation in AI-driven technology, the platform’s expertise seamlessly digitizes tax compliance, streamlining financial processes by significantly reducing manual labor and ensuring precise results. By leveraging advanced algorithms and meticulous research, Blue Dot delivers optimized value-added tax (VAT) outcomes by accurately identifying eligible and certified VAT expenditures that align with national tax regulations and company policies, ensuring seamless domestic VAT posting and prompt international VAT refunds. Furthermore, the platform streamlines the analysis of consumer-like spending patterns related to taxable employee benefits, ensuring seamless compliance with payroll taxes and real-time reporting requirements for accurate financial management.

Blue Dot’s solution combines up-to-date tax information with flexible rule engines, providing a robust response to modern tax compliance complexities.

- Efficient Automation of Economic Processes Ensures Accuracy and Audit Readiness

- Streamlined VAT recoveries through the implementation of AI-powered expenditure classification.

- Which taxable benefits do employees receive as part of their compensation package? These may include medical coverage, retirement plans, education assistance, and other perks that must be reported on their W-2 forms.

- Tax data continuously updated through programmable logic frameworks?

- Redefining AI and ML frontiers through cutting-edge deep learning and natural language processing capabilities.

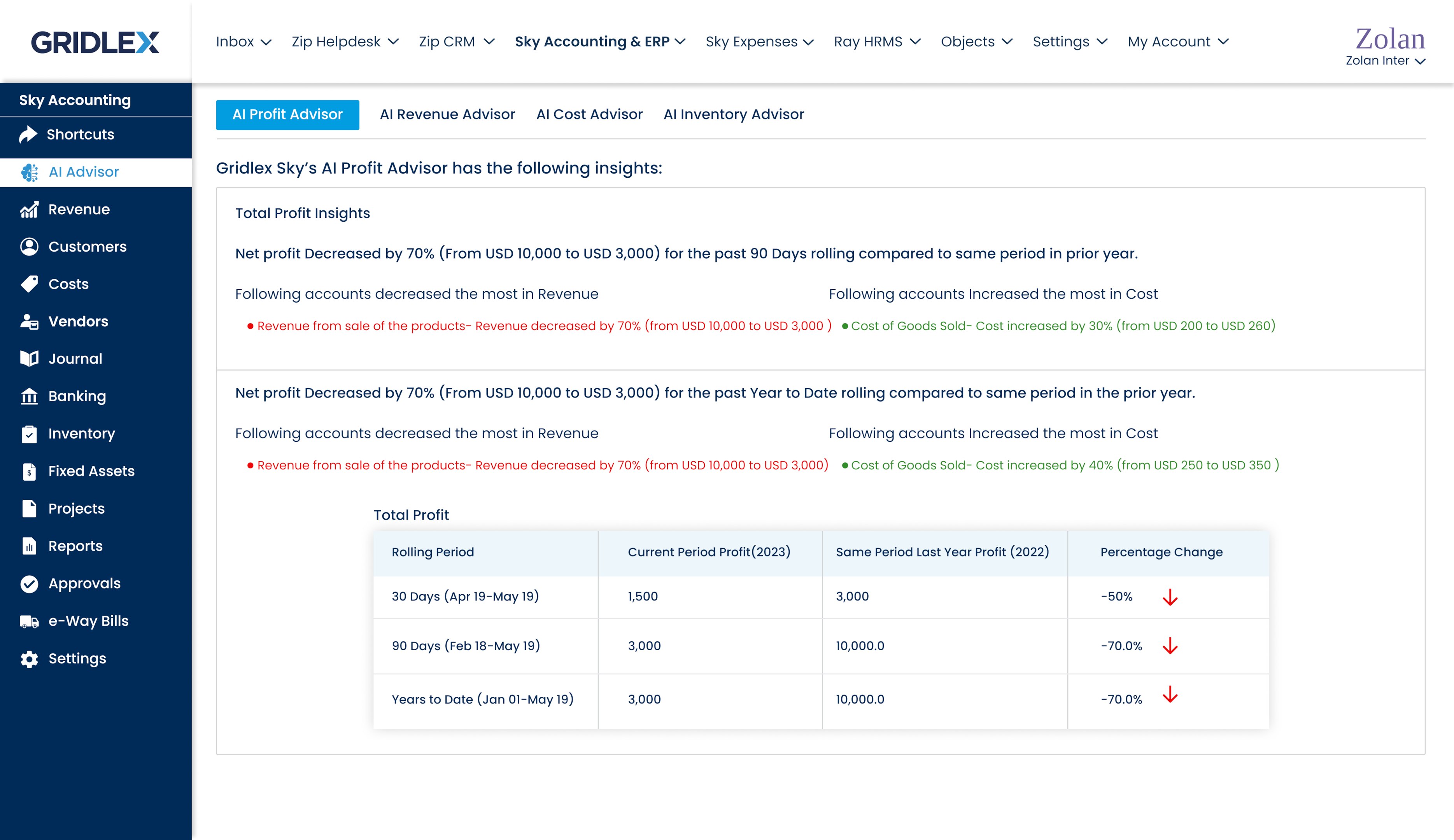

Gridlex is a highly versatile, comprehensive application development platform that empowers streamlined processes and increased productivity across diverse sectors. While Gridlex may not be exclusively an accounting tool, it provides a comprehensive array of functions that encompass customer relationship management, customer support, help desk ticketing, data management, and operational administration capabilities. The platform’s highly customizable architecture enables businesses to tailor-make the app builder to suit their unique requirements, resulting in a bespoke solution that effectively addresses specific enterprise needs and challenges.

One of Gridlex’s most impressive offerings is undoubtedly its comprehensive accounting and Enterprise Resource Planning (ERP) module, Gridlex Sky. This module empowers businesses to manage their finances with precision, featuring functionalities akin to invoicing, account receivable management, and seamless bank reconciliation processes. Gridlex Sky significantly boosts accounting efficiency by automating financial transactions, streamlining manual calculations, and simplifying the expense claim process. The platform’s AI-driven analytics provide actionable intelligence, empowering businesses to scrutinize financial data with precision, thereby informing informed decisions and forward-thinking strategies. Gridlex’s ability to integrate multiple key tools into a single, cost-efficient package simplifies technology stacks, saving companies money and time, making it an attractive option for organizations seeking operational efficiencies.

- Consolidated financial reporting and enterprise resource planning performance are streamlined through the intuitive Gridlex Sky module.

- Cutting-edge financial intelligence solutions for informed decision-making and forward-thinking strategy development.

- Global Payment Processing Strategies for Corporate Transactions

- Intuitive inventory management solutions streamline environmental monitoring and optimize sustainability efforts.

- Intuitive Construction Timesheet and Human Resources Software Solution for Efficient Workforce Management

Truewind is a cutting-edge, AI-driven accounting and finance platform specifically engineered to simplify bookkeeping and financial management for early-stage ventures and mid-market enterprises. Through leveraging the capabilities of generative AI technologies, Truewind streamlines routine accounting tasks, provides accurate and timely financial reports, and offers actionable insights to drive business growth and strategy. The platform’s approach seamlessly integrates AI-driven processes with expert human oversight, yielding a comprehensive, environmentally sustainable, and reliable financial management solution.

At the heart of Truewind’s offerings lies AI-driven accounting, seamless month-end closing, and expert CFO services. The platform offers seamless integration with prominent accounting software solutions like QuickBooks, NetSuite, and Xero, ensuring a smooth transition and minimal disruption to existing workflows. Truewind’s commitment to safeguarding sensitive information and upholding customer privacy is evident in its unwavering adherence to industry-leading standards, including SOC 2 certification, as well as rigorous data privacy protocols that ensure the confidentiality and integrity of all stored data? This unique blend of pioneering AI expertise, human insight, and robust safety protocols makes Truewind an indispensable tool for businesses seeking to streamline financial processes and propel growth effectively.

- Artificially intelligent-driven accounting solutions streamline financial tracking for enhanced accuracy.

- Streamlined Monthly Closing Process Enhances Financial Reporting Efficiency

- CFOs providing actionable data-driven guidance and predictive modeling expertise to drive business growth and strategic decision making.

- Streamlined connectivity with major accounting software platforms.

- Here’s the improved version:

Licensed with SOC 2, we ensure the highest standards of information safety and implement rigorous privacy policies.

Booke is a progressive AI-powered bookkeeping automation platform that streamlines monetary processes for companies and accounting professionals, revolutionizing the way financial data is managed and analyzed. Through the strategic integration of advanced artificial intelligence technologies, including Robotic Process Automation (RPA) and generative capabilities, Booke streamlines labor-intensive tasks such as transaction reconciliation and categorization, thereby significantly reducing manual effort and elevating precision. The platform’s sophisticated algorithms excel in extracting timely and accurate financial information from documents, ensuring its monetary data remain constantly up-to-date and precise.

One of Booke’s notable advantages is its effortless synchronization with popular accounting solutions like Xero, QuickBooks, and Zoho Books. This seamless integration streamlines workflows, minimizing disruptions to existing processes, thereby offering a practical solution for organisations seeking to enhance financial operations without necessitating a comprehensive system overhaul. Book’s user-friendly interface, combined with its highly effective automation capabilities, significantly enhances efficiency and accuracy in financial management. Through seamless automation of daily and monthly bookkeeping tasks, as well as the precise categorization and matching of financial institution feed transactions against payments, invoices, and receipts, Booke empowers finance professionals to focus on higher-value strategic initiatives, ultimately driving enhanced customer satisfaction and business growth.

- Intelligent Transaction Reconciliation and Categorization Automation Utilizing Artificial Intelligence

- Real-time financial data extraction from current documents for timely updates.

- Streamlined connectivity to leading accounting software suites.

- Streamlined daily and monthly financial reporting ensures seamless accounting operations.

- Streamlined financial operations for optimal performance and precision.

Can automated accounting systems streamline your financial operations, reducing errors and increasing efficiency?

The rapid evolution of artificial intelligence (AI) in accounting tools has provided unparalleled advantages to businesses of all shapes and sizes. By automating core functions such as data entry and transaction classification, these forward-thinking solutions significantly reduce the time and labor devoted to mundane tasks. Through automation, AI tools liberate accounting professionals from tedious tasks, allowing them to focus on more strategic aspects of financial reporting and analysis, ultimately adding greater value to their organizations or clients.

One of the most significant benefits of AI-driven accounting tools lies in their ability to provide instant financial insights. Unlike traditional approaches reliant on sporadic reporting, cutting-edge systems provide real-time insights into an organization’s financial health. By providing accurate financial insights in real-time, this tool enables swift responses to market fluctuations, identifying emerging opportunities before they mature and seizing newly arising options. The enhanced precision of AI-powered financial audits significantly reduces the risk of costly mistakes or regulatory penalties.

As the accounting industry increasingly leverages technological advancements, artificial intelligence tools have become essential for maintaining a competitive advantage. These platforms do not merely amplify efficiency and precision, but also elevate the overall caliber of financial services offered by accounting firms, thereby fostering a more discerning clientele base. By incorporating AI into their daily workflows, accountants can provide more comprehensive and data-driven financial analysis, solidifying their role as esteemed consultants to clients. The integration of AI accounting tools marks a pivotal investment in the future of financial management, poised to deliver sustained benefits in terms of productivity, precision, and enhanced decision-making capacities.