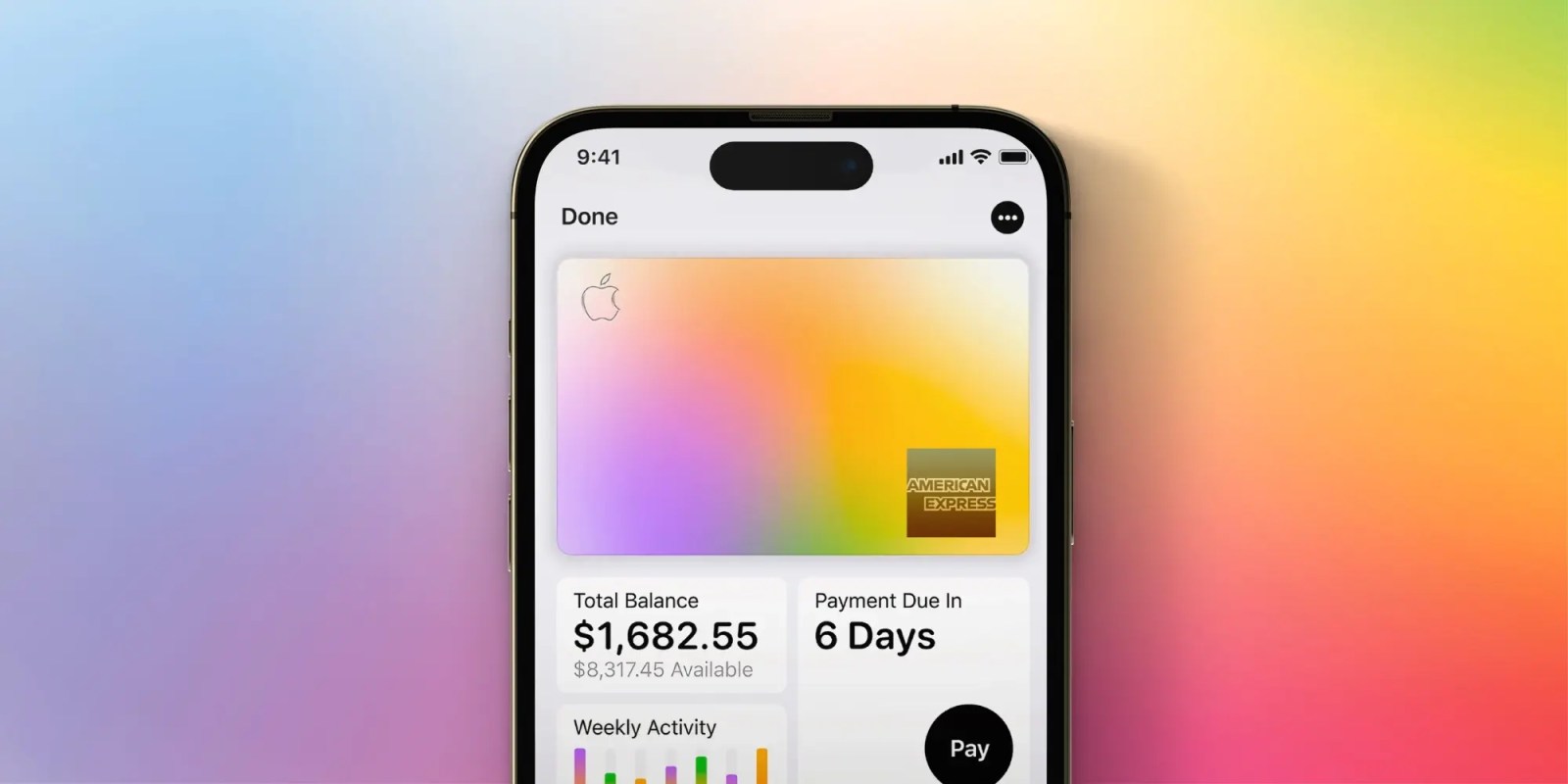

Recently, Apple Card launched, and I’ve been intrigued about what’s next for this innovative payment method. Considering Apple Card’s lukewarm reception and Apple’s desire to reposition itself as a services-driven company, it makes strategic sense for Apple to venture into offering its own comprehensive banking services.

What’s behind the sleek design of Apple Card?

Currently, the Apple Card is a simple, no-annual-fee credit card designed to provide a flat 2% cashback reward every time you use Apple Pay. The programme also features a premium tier of 3% cashback exclusively for Apple and select partner retailers, encouraging customers to make additional purchases at participating stores. It’s neither particularly unhealthy nor remarkable as a credit card experience.

Apple’s current iteration of the Apple Card not only benefits Goldman Sachs, but also creates value for the issuing bank, which plans to dissolve its partnership with Apple in the next 3-6 months. As two key concerns come into focus, I find it particularly compelling to envision a yearly pricing structure for the Apple Card, specifically tailored to travelers. Would this strategy effectively capture the hearts of frequent flyers?

The competitors

Within the general-purpose journey credit card category, options abound, including well-known players such as Chase, American Express, Citi, and Capital One. The text implies flexibility when stating: As a result of being a general-purpose playing card company, we are not tied to any specific airline or hotel chain. While many poker strategies do rely on a sufficient quantity of playing cards to optimize their value. Apple may well streamline complexities, rendering general-purpose travel credit cards more alluring to a broader audience.

A premier trio for financial flexibility is comprised of the Chase Freedom Unlimited, Chase Freedom Flex, and Chase Sapphire Preferred. The primary two cards are fee-free, while the third card carries an annual price of $95; however, all three cards share a common rewards ecosystem, enabling you to pool their points and transfer them to one of Chase’s numerous travel partners, such as Southwest Airlines or World of Hyatt.

The Chase Freedom Limitless prioritizes earning 1.5x points on all purchases, while the Freedom Flex excels with 5x rewards on specific rotating categories (including gas stations, grocery stores, etc.). Meanwhile, the Sapphire Preferred boasts 3x earnings on dining and 2x on travel. Sapphire offers a range of travel insurance options, solidifying its reputation as a top choice for travel-related expenses.

‘Apple Card Professional’ earnings

Will Apple create a highly successful travel-focused credit card, despite the complexity? Apple seeks to forge partnerships with various hotels and airlines to create an Apple-driven ecosystem, a feat that even major banks like Wells Fargo and Capital One have found challenging. Neither of these banks has a partnership with US Airways, nor are they affiliated with the airline in any way.

Apple’s Journey Card offers a seamless earning experience, where customers can earn 1x points on purchases made with the physical card, and 2x points when using Apple Pay – a reward structure that should remain in place. The revised text would be: It allows the cardboard to still serve as a useful catch-all. They would also retain around a threefold increase on Apple, but only if they were to abandon their other partnerships. To incentivize loyalty, substitutes should focus on rewarding customers with triple the points for every dining or travel transaction.

The proposed credit card would likely set its annual fee around $299, comparable to the American Express Gold card. Apple may offer customers a compelling reason to purchase their products by providing access to exclusive lounges as a key benefit.

Journey advantages

Apple is reportedly considering a collaboration with Precedance Go, which would grant Apple Card “Professional” users access to over 1,600 airport lounges globally. While offering an affordable alternative would indeed impose limitations on card use, potentially capping the number of transactions at 12 per year could still cater to the majority’s needs. The crucial aspect here is that if customers fail to fully leverage their visit opportunities, Apple and the relevant financial institution are ultimately rewarded through the annual fees collected.

Why not envision Apple creating a seamless redemption hub, integrating rewards from all its services, much like ? Transferring values requires tedious individual searches for each associate to find the optimal rate, a process that could be streamlined by Apple.

Might Apple’s recent pivot towards credit-building cards signal a shift from the original Apple Card concept, which primarily focused on everyday spending and rewards? Tell us within the feedback.